Don't bank on Dollarmites to teach financial literacy: here are our alternatives

- Written by Catherine Attard, Associate Professor, Mathematics Education, Western Sydney University

The recent royal commission into banking has revealed rampant wrongdoing by the big banks. As a result, there is renewed public interest in school banking schemes. The Commonwealth Bank’s Dollarmites program has once again come into the spotlight.

Dollarmites was awarded a 2018 Choice Magazine Shonky award. The program has over 300,000 active participants, and although it’s not the only school banking program, it’s the largest by far.

Read more: Should banks play a role in teaching kids about how to manage money effectively?

According to the Commonwealth Bank, the motive behind the Dollarmites program is to teach good savings habits and develop financial literacy. But I could find little independent research evidence it actually does.

On the surface, the Commonwealth Bank’s intentions are good. But research has found 40% of people develop loyalty to their banks and continue banking with them into adulthood.

We need to consider other options. Here are some research-backed alternatives.

Alternatives to school banking

Financial literacy can be taught both at home and at school, in practical and meaningful ways. If we consider the core business of schools to be learning, then our classrooms are not an appropriate place for the distractions of corporate marketing. There is definitely no time to be wasted on the logistics of organising school banking.

Read more: Financial literacy is a public policy problem

In fact, schools have several options when it comes to teaching financial literacy. There are a number of free resources already aligned to the curriculum.

Parents should have conversations about budgeting with their children.

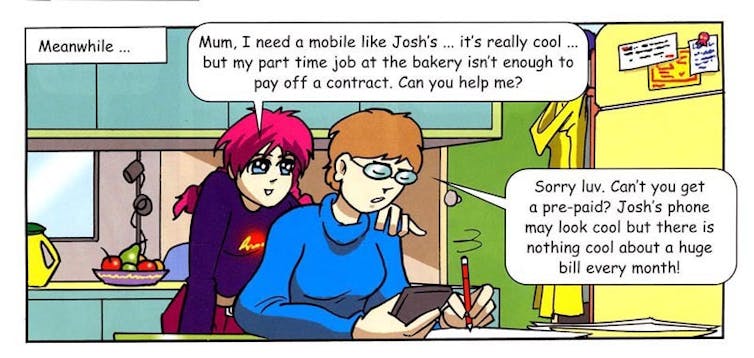

ASIC comic To the Max/AAP

Parents should have conversations about budgeting with their children.

ASIC comic To the Max/AAP

In my research, using ASIC’s MoneySmart resources, financial literacy was combined with maths. Students did activities that allowed them to deal with real money while applying maths skills.

For example, some students borrowed money from the school principal to set up small businesses. They then ran their business at a school market day, and used their profits to buy Christmas gifts for underprivileged children.

Simple activities such as setting up classroom economies or allowing children to help plan events (such as class excursions) are also excellent at engaging children in financial literacy in a fun, realistic and interactive way.

Findings from my study showed learning about money and maths improved engagement, understanding of mathematical concepts and knowledge of financial concepts such as budgeting, profit and loss, lending and interest.

There are also resources such as Banqer, a free subscription-based app that allows students to manage fictitious money to budget and cover expenses (such as “renting” a desk). In my professional opinion, apps such as this are high quality. They may have corporate sponsorships, but are offered brand-free, which is preferable.

Parents can teach financial literacy too

Parents are one of the biggest influences on the financial habits of children. Parents have a responsibility to model good financial behaviours.

Involving children in shopping, having discussions about family budgeting and encouraging children to save some of their pocket money using a bank account of their choice all contribute to the development of financial literacy. These are really simple, everyday things parents can do to help their children learn financial literacy.

Read more: Teaching kids about maths using money can set them up for financial security

Authors: Catherine Attard, Associate Professor, Mathematics Education, Western Sydney University