The Cheapest Green Slips in NSW With The Best Value

- Written by NewsServices.com

The cheapest green slips in NSW can be accessed online. There are six licensed Compulsory Third Party (CTP) Insurance providers in NSW. These include AAMI, GIO, Allianz, NRMA, Youi and, our environmental partner insurer, QBE.

When choosing the cheapest green slips in NSW, it’s important to consider how much coverage it gives you and how fast the provider can help facilitate your vehicle registration and assist with claims. Keeping this in mind helps you get the best value for your money.

What We’ll Cover:

- Cost of Green Slips In 2021 And The Cheapest Green Slips In NSW

- What Should My CTP Insurance Cover?

- How Are Green Slip Prices Calculated?

- How To Register or Renew CTP Insurance

- Which Is More Efficient, 6-Month or 12-Month Cover?

Cost of Green Slips In 2021 And The Cheapest Green Slips In NSW

The cost of green slips differs according to the driver’s age, vehicle type and model, home or business address, and driving offences. Prices can vary by a hundred dollars or more.

A CTP insurance product doesn’t cover damage to your car, but you may opt for comprehensive car insurance if you want this benefit included.

Our partner insurer QBE has one of the cheapest green slips in NSW. Whenever NSW drivers purchase a green slip through our partner insurer, a tree will be planted to reduce the harmful effects of carbon emissions in the air.

What Should My CTP Insurance Cover?

Aside from purchasing CTP insurance within your budget, it’s essential to determine what benefits you require from your CTP insurer. Here they are:

1. At-fault Driver Protection

The 2017 CTP scheme has limited benefits for drivers at fault in a motor vehicle accident. The NSW Government has paid more than $73.7 million worth of benefits to at-fault drivers. An average of $16,196 per claim has been claimed by NSW drivers at fault from December 2017 to June 2020. The benefits under the policy usually last for six months. If you want additional (but limited) at-fault driver coverage, choose an insurer with at-fault-driver protection.

Standard CTP insurance doesn’t entitle the at-fault driver to:

- Attendant care

- Over $5000 expenses in a medical facility that’s not a public hospital connected to pharmaceuticals and the like

- Payments for change of residence

- Over $5,000 compensation for loss of income

- Costs for future loss of income

2. Lifetime Care For Serious Injuries

Serious injuries by third-party individuals that lead to permanent disability and income loss are entitled to Lifetime Care and Support which is another scheme that is funded through the CTP insurance scheme levies.

3. Special Children’s Benefits

Children below 16 years old can be compensated even if they caused the accident.

4. Blameless Accidents Benefits

Blameless accidents include collision with animals, sudden medical issue like stroke or heart attack, and unanticipated mechanical problems with the vehicle.

How Are Green Slip Prices Calculated?

You can use the green slip calculator on our website to calculate the cost of your CTP insurance. For instance, if you happen to be born in 1985 with a 2016 Ford Falcon model with an average driving distance of 15,000 km per year and live in postcode 2153, The figures below are the yearly cost per insurer effective 15 November 2020. Please note that GIO, Allianz, and NRMA provide at-fault driver protection, which is why their prices are higher.

AAMI - $732.86

GIO -$732.55

Allianz - $732.00

NRMA - $481.62

QBE - $431.03

How To Register or Renew CTP Insurance

To Register:

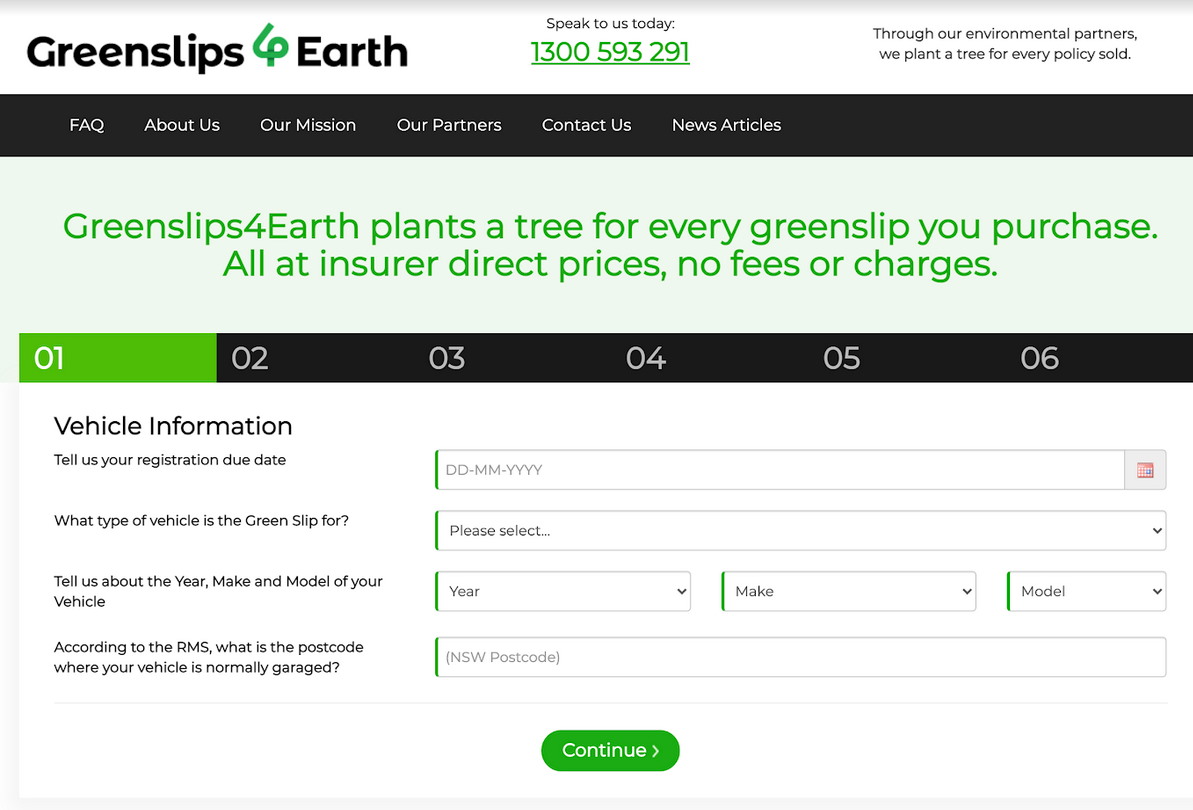

Go to our online green slip calculator. (The State Insurance Regulatory Authority regulates our calculator.) Please provide your Vehicle Identification Number or Drivers Licence or Billing Number. It’s advisable to use the green slip calculator for vehicles weighing 4.5 tonnes or less. For heavier vehicles, contact us directly on 1300 593 291 to determine the exact value of your CTP insurance. Once you receive your quote, you can choose the cheapest green slip in NSW and either proceed with the purchase directly or go back at a later time to our website and submit your quote.

To Renew:

Your chosen insurer usually sends you a renewal notice four weeks before your CTP insurance expires. You can automatically renew by clicking on the link they provide via email. Automatic renewal isn’t applicable for CTP insurance policies that have expired over 21 days. You’ll need to go to the Transport for NSW office to process your renewal manually.

Which Is More Efficient, 6-Month or 12-Month Cover?

Prices can change in six months, but only NSW drivers who renew on time can choose a six-month CTP insurance cover. If it’s your first time registering, try a six-month CTP insurance policy and see how prices change halfway through the year. Having 12-month coverage saves you time and energy in renewing your CTP insurance.

Find out which CTP insurance works for your budget. Compare green slip prices using our online calculator, and get the cheapest green slips in NSW today.