Beware the Sharemarket's 'Bear Market-Honey Trap'

- Written by Rod North

Respected sharemarket strategist, market analyst, best-selling author and survivor of ‘5 Booms and 5 Busts‘ Rod North offers his ‘Pearls of Wisdom’ in the current sharemarket.

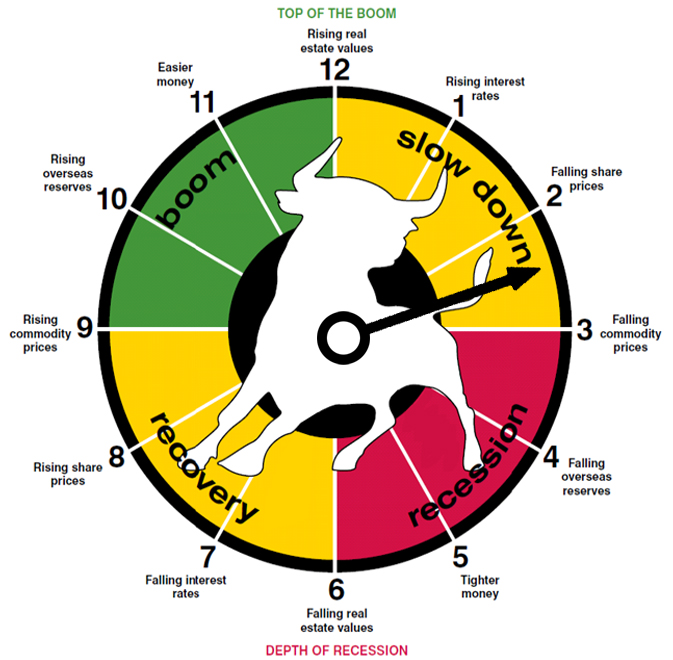

Where are we in the current ‘Bear Market Cycle’, what time is it on ‘The Investment Clock’ and what should investors do now to protect their investments and look for opportunities when the Sharemarket finally bottoms in coming months.

Long time sharemarket analyst and strategist, Rod North says:

“Don’t be lured into the ‘Bear Market Trap’ and perceived honey pot of gains to be had just because the market has risen like a soufflé in the past few weeks.”

The ill fated RMS Titanic after it hit the iceberg 108 years ago today on 14th April 1912 did this too, as the bow of the famous ship was heading down into the icy water, the stern of the ship rose one last time before it then unceremoniously followed the bow down to its final resting place on the seabed of the Atlantic Ocean.

Unlike the Titanic, the Australian sharemarket will rise again to meet another day and eventually get back to its all time high but not before we reach the final low point in the current ‘Bear Market Cycle’. In 145 years of sharemarket history, in every cycle the market has always risen and then surpassed its previous high.

Rod North also says:

“The Aussie sharemarket is in the middle of a brief Bear Market rally mirroring the gains made back in October 2008 before the GFC pulled shares down a further 25% before we finally reached the bottom of the market in March 2009.

“In our case, and in the context of today, expect that bottom and buy signal to be reached sometime by year end 2020 or early 2021.

“The Downward pressure from low inflation and a near-term recession stand to make the Coronavirus virus induced profit slump deeper than past declines.”

The unprecedented and massive Government stimulus packages pumped into the economy will help but they will likely not be enough to prevent a massive slump in company earnings in the months ahead as we deal with an economy in shutdown and people and consumers in lockdown.

Many top 200 Australian companies will not be able to maintain their dividends and may have to drop them in the light of the Coronavirus induced slump in earnings. Earnings, earnings, earnings is always the key driver of the sharemarket, sending it to higher levels and nobody wants to see company’s cut their dividends but this becomes inevitable when earnings totally disappear even for a short period.

The Australian sharemarket over recent days may have technically returned to Bull Market territory temporarily, Rod North said but he sees the uptick as a series of ‘dead cat’ market induced bounces being a precursor of much deeper lows ahead of us as the full impact of a declining and systemic economy heading into a COVID-19 induced recession fully kicks in and delivers more bad news and company profit declines in the months ahead.

After a career spanning four decades of sharemarket investing and commentary, Rod North says:

“Despite all the doom and gloom, there is always a silver lining in the sharemarket. The good news to be finally delivered, is that it will ultimately, in the months ahead, produce the ‘best buying opportunity’ in the sharemarket not seen since March 2009 when the index reached its lowest point of 3,109.

“The recent gains we have just witnessed over the past week followed nearly two months of sharp selling amid fears of a coronavirus fuelled recession. That market trajectory and pattern closely matches past trends.

“Many investors need to keep their investment fuel dry and in the tank for future, better selective buying opportunities in inevitable dips in the market ahead.

“At the moment in the cycle, the danger is, many novice or inexperienced investors will be poised to re-enter the market only to be crushed as history suggests is normal.

“Remember to keep your heads whilst all around you lose theirs.”

About the Author

Rod North has survived four market Booms and Busts, working in the financial services industry for 30 years. He is the founder and Managing Director of the award-winning investor relations, media and PR company, Bourse Communications, and a regular business and investment commentator. He is the author of three books, including the best-selling ‘Understanding the Investment Clock – Your Road to Recovery’.