FactCheck Q A: are 'almost 60%' of small business owners paid '$50,000 or less'?

- Written by Janine Dixon, Economist at Centre of Policy Studies, Victoria University

The Conversation fact-checks claims made on Q&A, broadcast Mondays on the ABC at 9.35pm. Thank you to everyone who sent us quotes for checking via Twitter using hashtags #FactCheck and #QandA, on Facebook or by email.

Excerpt from Q&A, February 5, 2018.Almost 60% of small business owners in this country are paid $50,000 or less.

– Australian Chamber of Commerce and Industry chief executive James Pearson, speaking on Q&A, February 5, 2018

The Turnbull government is seeking parliamentary support to cut the company tax rate to 25% over the coming decade, arguing that cutting the rate will increase business investment, drive jobs growth and lift wages in Australia.

During an episode of Q&A, Australian Chamber of Commerce and Industry chief executive James Pearson said small business owners would benefit from a company tax cut in Australia. He said it would “help them be profitable”, allowing them to grow their businesses, employ more people and pay those workers more.

Pearson said “almost 60% of small business owners in this country are paid $50,000 or less”.

Is that right?

Checking the source

When asked for sources and comment to support James Pearson’s statement, a spokesperson for the Australian Chamber of Commerce and Industry provided The Conversation with the following graph.

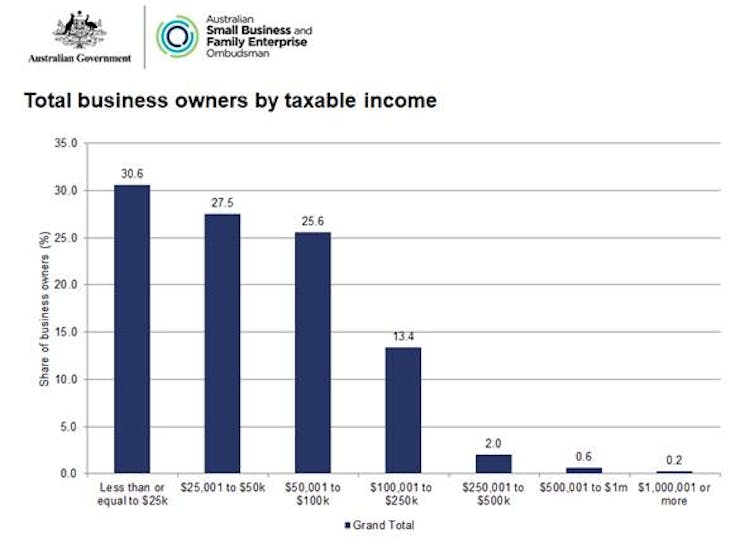

It draws on unpublished Australian Taxation Office data and relates to the 2014-15 income year:

Checking the source

When asked for sources and comment to support James Pearson’s statement, a spokesperson for the Australian Chamber of Commerce and Industry provided The Conversation with the following graph.

It draws on unpublished Australian Taxation Office data and relates to the 2014-15 income year:

Chart from the Australian Small Business and Family Enterprise Ombudsman using unpublished Australia Taxation Office data for the 2014-15 financial year. The data relate to individuals with a non-zero amount at any of the following labels on their 2014-15 tax return: distribution from a partnership or trusts (primary production or non-primary production) and/or net income or loss from business (primary production or non-primary production). The figures were produced to approximate the distribution of small business owners.

The spokesperson said:

We combined the data for those earning less than $25,000 and those earning $25,000 to $50,000, to come up with the under $50,000 assessment of 58.1% earning less than $50,000.

The spokesperson added “we understand the percentages we raised publicly are percentages of all business owners” – as opposed to small business owners. However:

We don’t think it makes much of a difference. The overwhelming majority of Australian businesses are clearly small and medium-sized enterprises, and the majority of business owners are small business owners.

Verdict

James Pearson’s statement that “almost 60% of small business owners in this country are paid $50,000 or less” is in the ballpark.

Based on Australia Taxation Office data from the 2014-15 financial year and Census 2016 data, it’s reasonable to say that between 50% to 60% of small business owners or managers earned less than $50,000 in those years.

However, Pearson used this information in the context of company tax rate cuts, arguing that small business owners “want a tax cut that will help them be profitable”.

In reality, due to the way Australia’s tax system works, it’s the small business owner’s personal income tax rate that is more relevant for the profitability of their business.

Calculating small business owner salaries

There’s more than one definition for ‘small business’ in Australia, and there’s no perfect data set against which to test Pearson’s statement.

But we can assess the Australian Taxation Office data Pearson’s office provided, and we can also look at Census 2016 data.

Pearson’s spokesperson provided The Conversation with a graph based on unpublished Australian Taxation Office data for the 2014-15 financial year. The Conversation verified the information in the graph with the Australian Taxation Office.

The graph shows that in 2014-15, 58.1% of the business owners listed earned less than $50,000. But the data aren’t specific to small business owners, and don’t include taxable income people received through companies – only through partnerships, trusts or as sole traders.

A spokesperson for the Australian Taxation Office told The Conversation the “figures were produced to approximate the distribution of small business owners”.

Now let’s look at Census 2016 data.

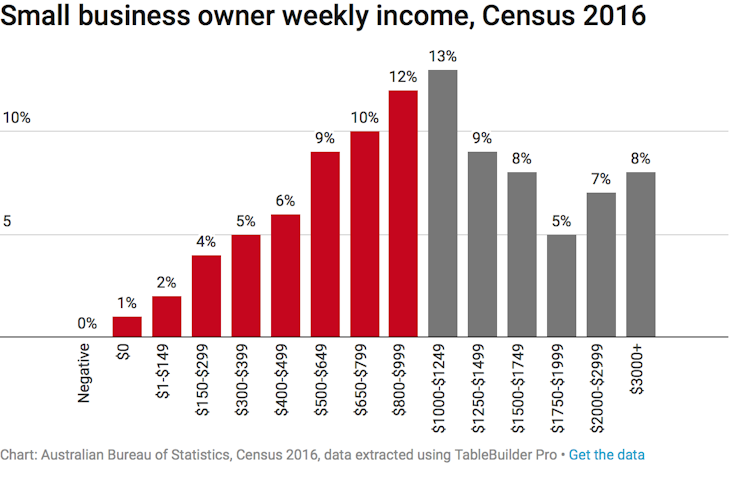

According to the Australian Securities and Investments Commission, “many regulators have informally adopted the definition of ‘small business’ used by the Australian Bureau of Statistics” – which is a business that employs fewer than 20 people.

If we look at Census 2016 data using that measure, then we see that 50% of small business owners were paid less than $1,000 per week in 2016 – or $52,000 per year or less.

Chart from the Australian Small Business and Family Enterprise Ombudsman using unpublished Australia Taxation Office data for the 2014-15 financial year. The data relate to individuals with a non-zero amount at any of the following labels on their 2014-15 tax return: distribution from a partnership or trusts (primary production or non-primary production) and/or net income or loss from business (primary production or non-primary production). The figures were produced to approximate the distribution of small business owners.

The spokesperson said:

We combined the data for those earning less than $25,000 and those earning $25,000 to $50,000, to come up with the under $50,000 assessment of 58.1% earning less than $50,000.

The spokesperson added “we understand the percentages we raised publicly are percentages of all business owners” – as opposed to small business owners. However:

We don’t think it makes much of a difference. The overwhelming majority of Australian businesses are clearly small and medium-sized enterprises, and the majority of business owners are small business owners.

Verdict

James Pearson’s statement that “almost 60% of small business owners in this country are paid $50,000 or less” is in the ballpark.

Based on Australia Taxation Office data from the 2014-15 financial year and Census 2016 data, it’s reasonable to say that between 50% to 60% of small business owners or managers earned less than $50,000 in those years.

However, Pearson used this information in the context of company tax rate cuts, arguing that small business owners “want a tax cut that will help them be profitable”.

In reality, due to the way Australia’s tax system works, it’s the small business owner’s personal income tax rate that is more relevant for the profitability of their business.

Calculating small business owner salaries

There’s more than one definition for ‘small business’ in Australia, and there’s no perfect data set against which to test Pearson’s statement.

But we can assess the Australian Taxation Office data Pearson’s office provided, and we can also look at Census 2016 data.

Pearson’s spokesperson provided The Conversation with a graph based on unpublished Australian Taxation Office data for the 2014-15 financial year. The Conversation verified the information in the graph with the Australian Taxation Office.

The graph shows that in 2014-15, 58.1% of the business owners listed earned less than $50,000. But the data aren’t specific to small business owners, and don’t include taxable income people received through companies – only through partnerships, trusts or as sole traders.

A spokesperson for the Australian Taxation Office told The Conversation the “figures were produced to approximate the distribution of small business owners”.

Now let’s look at Census 2016 data.

According to the Australian Securities and Investments Commission, “many regulators have informally adopted the definition of ‘small business’ used by the Australian Bureau of Statistics” – which is a business that employs fewer than 20 people.

If we look at Census 2016 data using that measure, then we see that 50% of small business owners were paid less than $1,000 per week in 2016 – or $52,000 per year or less.

Putting Pearson’s statement in context

In making his statement, Pearson described the financial struggles facing some small business owners. Pearson said these people “want a tax cut, they want a tax cut that will help them be profitable”.

They’ll employ more people, they’ll offer longer hours, more people will have jobs, more people will be paid more. That’s how it works.

Pearson added that when small business owners “see more productivity in their workforce, they can take the risk and grow their business”.

But the reality is, when an Australian resident is trying to decide whether to invest in their small business, it’s their personal income tax rate, not the company tax rate, that really matters.

Why?

Because company tax paid by Australian businesses on income earned in Australia acts as a ‘pre-payment’ of personal income tax when that income is distributed to shareholders in the company (or the owners of the company) via franked dividend payments.

Australian Taxation Office statistics show that in the 2014-15 financial year, more than 95% of dividends paid to Australian households were franked.

The fact that Australian business owners can claim back any tax paid by their businesses when they lodge their personal tax returns makes their personal income tax rate the more relevant concern to the potential profitability of their business.

In addition, Pearson argued that company tax cuts would lead to higher wages, a statement supported by the Australian Treasury. The Treasury modelling shows that the wage hike would be the result of greater foreign investment in Australia, leaving the owners of small businesses needing to pay higher wages to attract or retain workers.

Small business owners who receive their income via franked dividends won’t receive any tax relief to cover this expense. So it’s possible that cuts to the company tax rate could hinder small businesses, rather than benefit them. – Janine Dixon and Jason Nassios

Blind review

This verdict finds a reasonable level of support from the available data.

Research from the University of Western Sydney published in 2014, based on HILDA data and Australian Bureau of Statistics data, found that business owner households (as opposed to individuals) reported an average weekly income of $1,975 in 2010. That’s around $103,000 per household.

If there were two adults per household, this would equate to $51,500 per person.

Also, because the ‘average’ is skewed upwards by high income earners, 50% of earners would earn less than the average, which lends further support to Pearson’s statement.

Information published by an American company called PayScale suggests the average salary for a small business owner/operator in Australia is around $67,000 per year, and the median salary is $62,000.

If true, this would not be consistent with the claim that almost 60% of small business owners earn less than $50,000 per year. However, this information is based on a survey with a relatively small sample size. This source is a private sector consulting firm, and no other detail on their data source is provided. – Ross Guest

Putting Pearson’s statement in context

In making his statement, Pearson described the financial struggles facing some small business owners. Pearson said these people “want a tax cut, they want a tax cut that will help them be profitable”.

They’ll employ more people, they’ll offer longer hours, more people will have jobs, more people will be paid more. That’s how it works.

Pearson added that when small business owners “see more productivity in their workforce, they can take the risk and grow their business”.

But the reality is, when an Australian resident is trying to decide whether to invest in their small business, it’s their personal income tax rate, not the company tax rate, that really matters.

Why?

Because company tax paid by Australian businesses on income earned in Australia acts as a ‘pre-payment’ of personal income tax when that income is distributed to shareholders in the company (or the owners of the company) via franked dividend payments.

Australian Taxation Office statistics show that in the 2014-15 financial year, more than 95% of dividends paid to Australian households were franked.

The fact that Australian business owners can claim back any tax paid by their businesses when they lodge their personal tax returns makes their personal income tax rate the more relevant concern to the potential profitability of their business.

In addition, Pearson argued that company tax cuts would lead to higher wages, a statement supported by the Australian Treasury. The Treasury modelling shows that the wage hike would be the result of greater foreign investment in Australia, leaving the owners of small businesses needing to pay higher wages to attract or retain workers.

Small business owners who receive their income via franked dividends won’t receive any tax relief to cover this expense. So it’s possible that cuts to the company tax rate could hinder small businesses, rather than benefit them. – Janine Dixon and Jason Nassios

Blind review

This verdict finds a reasonable level of support from the available data.

Research from the University of Western Sydney published in 2014, based on HILDA data and Australian Bureau of Statistics data, found that business owner households (as opposed to individuals) reported an average weekly income of $1,975 in 2010. That’s around $103,000 per household.

If there were two adults per household, this would equate to $51,500 per person.

Also, because the ‘average’ is skewed upwards by high income earners, 50% of earners would earn less than the average, which lends further support to Pearson’s statement.

Information published by an American company called PayScale suggests the average salary for a small business owner/operator in Australia is around $67,000 per year, and the median salary is $62,000.

If true, this would not be consistent with the claim that almost 60% of small business owners earn less than $50,000 per year. However, this information is based on a survey with a relatively small sample size. This source is a private sector consulting firm, and no other detail on their data source is provided. – Ross Guest

The Conversation FactCheck is accredited by the International Fact-Checking Network.

The Conversation’s FactCheck unit is the first fact-checking team in Australia and one of the first worldwide to be accredited by the International Fact-Checking Network, an alliance of fact-checkers hosted at the Poynter Institute in the US. Read more here.

Have you seen a “fact” worth checking? The Conversation’s FactCheck asks academic experts to test claims and see how true they are. We then ask a second academic to review an anonymous copy of the article. You can request a check at checkit@theconversation.edu.au. Please include the statement you would like us to check, the date it was made, and a link if possible.

The Conversation FactCheck is accredited by the International Fact-Checking Network.

The Conversation’s FactCheck unit is the first fact-checking team in Australia and one of the first worldwide to be accredited by the International Fact-Checking Network, an alliance of fact-checkers hosted at the Poynter Institute in the US. Read more here.

Have you seen a “fact” worth checking? The Conversation’s FactCheck asks academic experts to test claims and see how true they are. We then ask a second academic to review an anonymous copy of the article. You can request a check at checkit@theconversation.edu.au. Please include the statement you would like us to check, the date it was made, and a link if possible.

Authors: Janine Dixon, Economist at Centre of Policy Studies, Victoria University