China’s crackdown on cryptocurrency trading – a sign of things to come

- Written by Andrew Godwin, DIRECTOR OF STUDIES, BANKING AND FINANCE LAW, University of Melbourne

The Chinese government’s decision to order several Bitcoin and other cryptocurrencies exchanges to close shows how much of a threat they are perceived to be to financial stability and social order in China.

The decision to also ban initial coin offerings altogether (the unregulated means by which funds are raised for a new cryptocurrency venture) has taken traders and analysts by surprise. China is the world’s largest cryptocurrency market with around 80% of Bitcoin transactions taking place in yuan.

The blockchain (a digital ledger in which digital currency transactions are publicly recorded) is poised to have a massive impact on the future of finance. This recent crackdown suggests the Chinese government is determined to cement its place as a leading rule maker and power-broker in the quickly emerging area of cryptocurrency transactions and exchange.

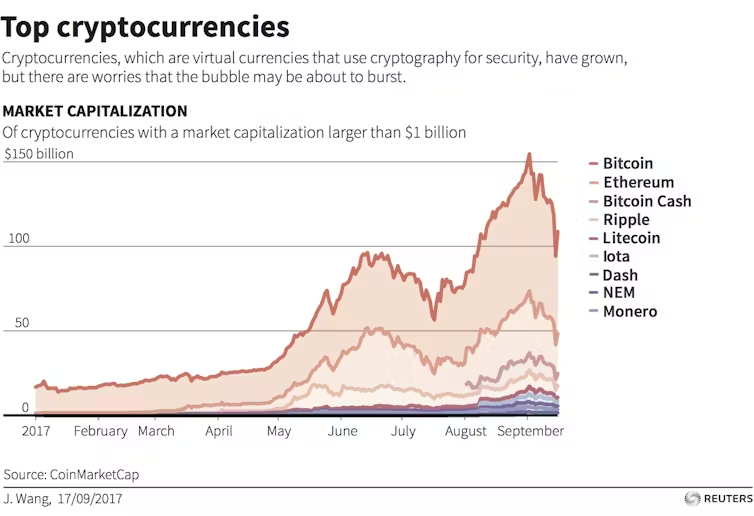

Top Cryptocurrencies internationally.

Reuters

Top Cryptocurrencies internationally.

Reuters

Chinese relationship with bitcoin

The Chinese government released a list of 60 initial coin offering trading platforms and instructed local agencies to make sure all platforms were listed and closed down. The delayed crackdown is in line with previous practice in China.

The Chinese government often adopts a wait-and-see approach to activities that are largely unregulated until the magnitude of the activity becomes clear. The extent of speculative investment and the risk of losses to investors if the bubble bursts motivated the government to intervene in cryptocurrency trading.

Read more: Can cryptocurrencies like Bitcoin survive scrutiny from central banks?

In China, the popularity of cryptocurrencies has been boosted by the tightening of controls on money moving out of the country over the past two years. This has lowered the value of the China’s currency, the renminbi, as investors seek assets in different denominations and chase higher yields. Cryptocurrencies are also popular because they can be used to transfer funds offshore and circumvent foreign exchange controls.

The government is particularly concerned with the use of cryptocurrencies and initial coin offerings to perpetrate and disguise fraudulent activity, including money laundering and ponzi type investment schemes.

Chinese authorities are anxious to avoid any social unrest in the lead-up to the 19th Party Congress. The effects of the 2015 stock market collapse, where the A-share market lost one-third of its value over a period of one month, are still being felt.

In some respects, the regulatory intervention in China is mirrored in other countries that have been dragging their heels in coming to terms with cryptocurrencies. It was only in July this year that the US Securities Commission issued a report determining that DAO tokens were “securities” and must be regulated accordingly.

China’s own cryptocurrency

In January last year, the People’s Bank of China issued a notice announcing it would be issuing its own digital version of the renminbi. The notice highlighted the benefits of a government backed digital currency in terms of cost, coverage, convenience and security.

Read more: The big business revolution: why the future is blockchain

In the initial phase, it’s likely that trading in this digital currency will be limited to regulated entities such as banks along similar lines to trading on the conventional foreign exchange markets.

By launching its own digital currency, the Chinese government avoids the risks associated with privately-issued cryptocurrencies and ensuring they are not used as a means of circumventing China’s strict capital and currency controls.

When China introduces its own digital currency (no formal date has yet been announced), the impact on the global economy will be significant. Not only will it challenge the existing global payment systems and establish China as a leading rule maker in this area, it will also enhance the importance of the renminbi as a global reserve currency.

Authors: Andrew Godwin, DIRECTOR OF STUDIES, BANKING AND FINANCE LAW, University of Melbourne

Read more http://theconversation.com/chinas-crackdown-on-cryptocurrency-trading-a-sign-of-things-to-come-84014