Australia's system of taxing alcohol is 'incoherent', but our research suggests a single tax rate isn't the answer

- Written by Ou Yang, Research Fellow, The University of Melbourne

The best word to describe the way Australia taxes alcoholic drinks is “incoherent”.

It was the word used by the 2010 Henry Tax Review to describe a system in which some wine effectively faces no alcohol tax, expensive wine is taxed heavily and cask wine lightly, beer (but not wine) is taxed by alcohol content, brandy is taxed less than other spirits, and cider is taxed differently to beer.

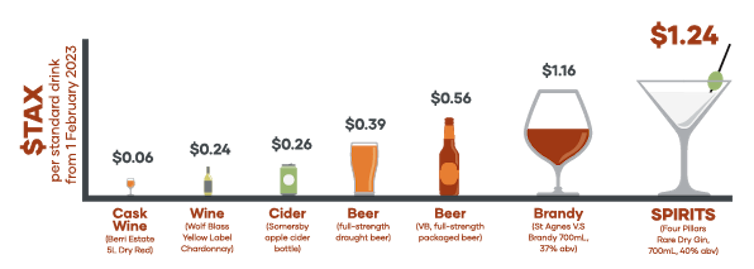

Industry calculations suggest cask wine is taxed at as little as six cents per standard drink, mid-price wine at 26 cents, bottled beer at 56 cents, and spirits at $1.24.