Medicare needs to change with the times, but rushing this could leave patients with higher gap fees

- Written by Stephen Duckett, Director, Health Program, Grattan Institute

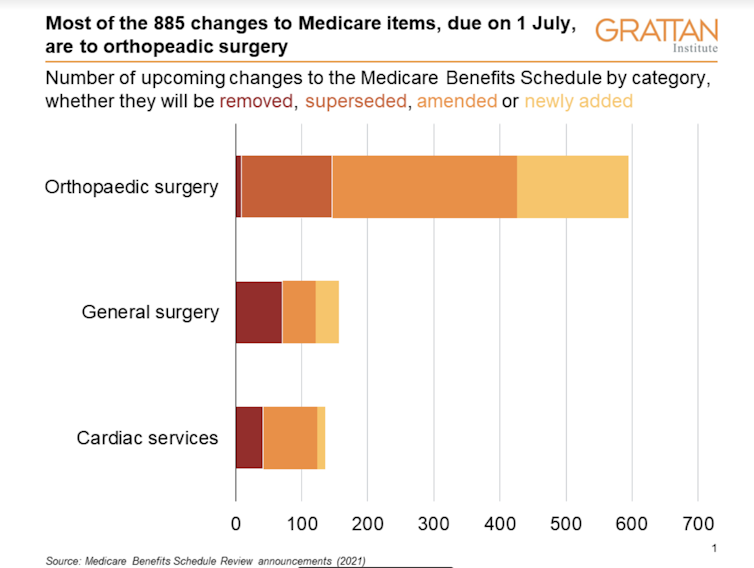

The federal government has announced more than 850 changes to the Medicare Benefits Schedule (MBS) will take effect from July 1.

This has prompted concerns the changes could lead to greater out of pocket costs for consumers.

While changes to the Medicare schedule are needed, three weeks isn’t enough time for the system to adapt. Surgeons and private health insurers need time to work through the changes and adjust their fees.

With hasty implementation, patients may face higher gap fees. The government should delay the changes so patients aren’t left in the lurch.

Remind me, what’s the MBS?

The Medicare Benefits Schedule is the list of tests, treatments, procedures and “attendance items” for (mostly) doctors’ and some other clinicians’ services. It sets out the government-determined fee and the associated Medicare rebate for each item.

Doctors in Australia can and do set their own fees, resulting in patients often facing significant out-of-pocket payments.

Read more: Explainer: what is Medicare and how does it work?

Changes to the MBS Schedule have to be implemented carefully – balancing the need for the MBS to reflect contemporary practice and ensuring value for tax-payers’ money, but avoiding patients being left further out of pocket.

For item numbers when patients are in private hospitals, the Medicare rebate is 75% of the fee. Private insurers must pay the 25% balance, and generally pay more on top of that, as part of a “known gap” agreement – where the insurer has entered into an agreement with the surgeon so that the patient’s out-of-pocket payment is fixed and known in advance, say $1000 – or a “no gap” agreement.

If the insurer hasn’t entered into an agreement with a surgeon, the patient may have to pay the full gap between the MBS fee and what the specialist charges.

Each item in the MBS has a “descriptor” which defines precisely what the item means.

The MBS needs to change with the times

Medicine changes with new technology, new anaesthetic techniques and new surgical procedures.

Laparoscopic (key hole) procedures may take longer than open procedures but have better outcomes and reduced length of hospital stay.

New approaches to aneasthesia for other procedures may reduce the time needed for operations, again with better outcomes.

The MBS needs to recognise and adapt to these changes. This means the prices for procedures should be updated regularly.

The process so far

Historically, Australia hasn’t had a good track record of regularly updating the schedule.

Then in 2015, health minister Sussan Ley launched a complete overhaul of the MBS. Every section was to be reviewed to ensure the item numbers were still relevant and the descriptors were appropriate and reflected contemporary practice.

The review examined whether some MBS descriptors were no longer reflective of contemporary practice, or didn’t properly describe contemporary procedures.

The review was also to look at problematic billing practices, where some doctors used ambiguity in the MBS to claim multiple items for a procedure, while others only claimed for one item.

Read more: Dodgy treatment: it's not us, it's the other lot, say the experts. So who do we believe?

The review process involved separate committees for each area of the MBS. The reports of each area were published in dribs and drabs, with the final tranche published late last year.

The changes to the MBS

The government has been slowly responding to the recommendations.

Last year it announced changes to intensive care, diagnostic imaging (including breast imaging and nuclear), chemotherapy, blood products and several specialist areas.

In last month’s budget, it announced changes to varicose veins, gynaecology, pain management and some types of surgery.

The latest round of announcements include:

Almost half involve amending existing items (see the chart below).

Grattan Institute

The process of getting to these recommendations has involved extensive consultation, and the changes have generally been supported by the relevant parts of the profession.

The proposed changes are consistent with those widely consulted recommendations. The MBS Review recommendations say what should happen and the government announcement brings that to reality both with a date for the changes to be implemented and the precise wording of the new item descriptor in the MBS.

The unwelcome surprise is not necessarily the changes themselves but the process of implementation. The general direction of reform was known, but the precise wording wasn’t. The timing of all the proposed changes also came as a surprise.

Will patients have to pay more?

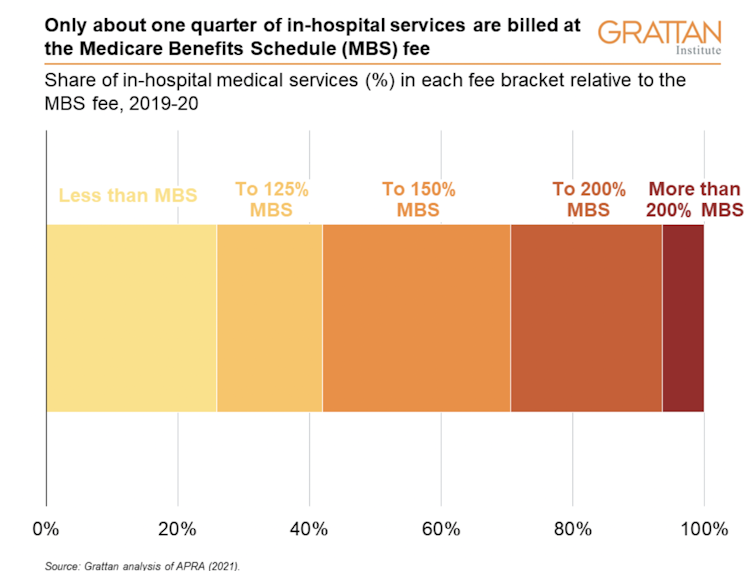

Most of the changes are to hospital-based procedures, where the MBS only covers part of the fee, with much of the rest covered by private health insurance, and the remainder as out-of-pocket payments for patients. Our recent Grattan Institute report shows only about one-quarter of in-hospital services are billed at the MBS fee:

Grattan Institute

The process of getting to these recommendations has involved extensive consultation, and the changes have generally been supported by the relevant parts of the profession.

The proposed changes are consistent with those widely consulted recommendations. The MBS Review recommendations say what should happen and the government announcement brings that to reality both with a date for the changes to be implemented and the precise wording of the new item descriptor in the MBS.

The unwelcome surprise is not necessarily the changes themselves but the process of implementation. The general direction of reform was known, but the precise wording wasn’t. The timing of all the proposed changes also came as a surprise.

Will patients have to pay more?

Most of the changes are to hospital-based procedures, where the MBS only covers part of the fee, with much of the rest covered by private health insurance, and the remainder as out-of-pocket payments for patients. Our recent Grattan Institute report shows only about one-quarter of in-hospital services are billed at the MBS fee:

Grattan Institute

The MBS rebate is, on average, just less than half (48%) the fee charged; private insurers pay about 40% and the balance is the patient out-of-pocket fee.

What private health insurers are prepared to pay determines the size of any gap a patient has to pay.

The response of private health insurers to the new MBS items is crucial. Insurers will have “no-gap” and “known-gap” arrangements with surgeons, and all of these will need to be reviewed as a result of the MBS restructure in the three specialties.

Insurers should negotiate with specialists to ensure they recognise the MBS umpire has decided what the base MBS fee is – and that specialists don’t respond by increasing patients’ out-of-pocket expenses.

Indeed, insurers might use this opportunity to bring down excess fees, which is a core part of making the insurance product more attractive.

Read more:

4 ways to fix private health insurance so it can sustain a growing, ageing population

Each insurer will have their own separate process for doing this, and each will do it on their own timeline.

Although it appears insurers may have been given more notice than doctors, it’s almost certain that some insurers will not have updated their view about what is a reasonable fee, nor finalised new contracts with surgeons about no-gap or known-gap arrangements by the current implementation date of July 1.

This will almost inevitably mean that patients will face increased out-of-pocket costs.

The remedy is simple: the government should defer the changes to allow adequate time for implementation. But it should stress that the delay is about implementation, not about reopening the debate about what is included in the revisions to the MBS.

Grattan Institute

The MBS rebate is, on average, just less than half (48%) the fee charged; private insurers pay about 40% and the balance is the patient out-of-pocket fee.

What private health insurers are prepared to pay determines the size of any gap a patient has to pay.

The response of private health insurers to the new MBS items is crucial. Insurers will have “no-gap” and “known-gap” arrangements with surgeons, and all of these will need to be reviewed as a result of the MBS restructure in the three specialties.

Insurers should negotiate with specialists to ensure they recognise the MBS umpire has decided what the base MBS fee is – and that specialists don’t respond by increasing patients’ out-of-pocket expenses.

Indeed, insurers might use this opportunity to bring down excess fees, which is a core part of making the insurance product more attractive.

Read more:

4 ways to fix private health insurance so it can sustain a growing, ageing population

Each insurer will have their own separate process for doing this, and each will do it on their own timeline.

Although it appears insurers may have been given more notice than doctors, it’s almost certain that some insurers will not have updated their view about what is a reasonable fee, nor finalised new contracts with surgeons about no-gap or known-gap arrangements by the current implementation date of July 1.

This will almost inevitably mean that patients will face increased out-of-pocket costs.

The remedy is simple: the government should defer the changes to allow adequate time for implementation. But it should stress that the delay is about implementation, not about reopening the debate about what is included in the revisions to the MBS.

Authors: Stephen Duckett, Director, Health Program, Grattan Institute