Vital Signs: for the best election predictions, look to the betting markets, not the opinion polls

- Written by Richard Holden, Professor of Economics, UNSW

Opinion polls haven’t done too well in some important recent elections.

Polls failed to foresee the Brexit decision, and suggested Hillary Clinton would be elected president of the United States in 2016.

There’s good reason to think polls now have a harder time predicting election outcomes than in the past.

They rely on a representative sample of voters, since it is a basic fact that certain demographic groups are more likely to vote one way or the other.

For instance, if you are polling Australian voters and get a lot of 65-year-old self-funded retirees in your sample, you are going to overweight the Liberal Party vote. Get a lot of 20-year-old university students in your sample and the poll will tell you the Greens are set to become Australia’s largest political party.

The trouble is that technology has made it harder to poll.

It used to be the case that pretty much everyone had a landline phone and a fairly representative sample of folks would answer when the polling firm called at 6pm.

Not any more. The people who are not on the national do-not-call registry and willing to spend 10 minutes at 6pm answering the questions of a stranger about politics are not a representative cross-section of the electorate.

Lots of young people only have a mobile phone. Plenty of others are unwilling or unable to spend time answering a polling firm’s questions.

What pollsters do in response is weight the answers they do get. They know they’re getting a lot of older folks, for example, so they weight the responses of younger respondents to try to even things out.

This creates even more statistical problems because the legimitate margin of error of a poll goes up with this reweighting. Highly reputable pollsters adjust for this and report it, but not all do.

In money we trust

This is where another piece of internet-enabled magic enters the picture: prediction markets (aka online bookies).

Instead of just asking people what they are going to do, one can create a market where people can put their money where their opinions are. Economists like these sort of things because we are generally sceptical that people will just tell you the truth. We are generally confident about results when there’s money at stake.

The basic idea is as follows. Think of a “security” that you can buy or sell (it’s actually called an “Arrow Security” after the famous economist Kenneth Arrow). It pays $1 if an event occurs, and nothing if it does not. The event could, for example, be Donald Trump getting re-elected president of the United States in 2020.

Because this security is traded on a market, supply and demand will lead to an “equilibrium” price that balances different valuations of the security. At the extreme ends will be those that think it is worth a $1 and those who think it worthless. In between are people considering probabilities, some thinking the price should be higher and others lower.

If the security trades at 50 cents the market is saying there is a 50% chance Trump will be re-elected. If you have information that leads you to believe Trump has a higher chance than 50%, you could buy the security and make money in expectation.

The key is that if you buy it you help drive up the price. In doing so, your information is incorporated into the market price. Call it “the wisdom of crowds” – or, to really impress people at your next dinner party, “a fully revealing rational expectations equilibrium”.

For a more extended discussion of prediction markets and how they have been used in a wide range of contexts see this terrific paper.

The markets have spoken

What are betting markets saying about the May 18 Australian federal election? They’re saying Labor has a roughly 85% chance of winning, and the Coalition about 15%.

Some of the seat-by-seat markets are even more striking. Plenty of commentators think Wentworth, in which independent Kerryn Phelps is pitted against Liberal Dave Sharma, is a toss-up. The betting markets think Sharma has a 90% chance of winning.

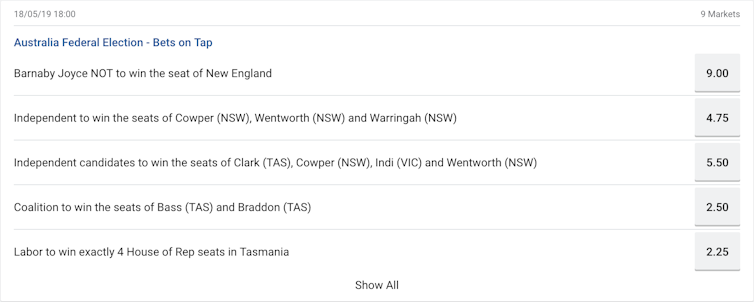

Odds from a well-known sports-betting website on Friday afternoon, May 17, 2019.

The Conversation

Odds from a well-known sports-betting website on Friday afternoon, May 17, 2019.

The Conversation

Now, markets aren’t always efficient and market prices don’t always perfectly reflect or “aggregate” all available information.

One particular concern is manipulation. If people use the market prices to make important decisions then unscrupulous actors might be prepared to lose money on the bet to influence the decision.

Another consideration is that there might not be much money at stake. Is anyone putting $1 million on the outcome of individual seats such as Capricornia or Corangamite? No. So-called “thin markets” tend not to be very informationally efficient.

In fact, when economists started getting all excited about these prediction markets I was pretty sceptical about their efficiency and concerned about their potential to be manipulated.

But the data have spoken.

It turns out these markets are really pretty good predictors on average. A security that trades at 70 cents pays out about 70% of the time on average. There is what financial economists call “excess volatility”, but if you want the best predictor of an election outcome, look at the markets, not the polls.

Authors: Richard Holden, Professor of Economics, UNSW