NATSEM: federal budget will widen gap between rich and poor

- Written by Robert Tanton, Professor, Institute for Governance & Policy Analysis, University of Canberra

The Morrison government’s pre-election budget has not been the bonanza some predicted. It is a fairly modest affair.

But calculations by the the National Centre for Social and Economic Modelling, based at the University of Canberra, show the budget will widen the gap between rich and poor. This is because changes to the tax and welfare system most benefit those paying tax. Those who don’t earn enough income to pay tax benefit least.

Read more: Infographic: Budget 2019 at a glance

The centre has calculated the impact of the the federal budget’s tax and welfare transfer changes by families, age groups and Commonwealth Electoral Division.

The most significant tax changes are the two stages of tax cuts in 2022-23 and 2024-25. In 2022-23 the point at which the marginal tax rate increases from 19% to 32.5% will lift from A$41,000 to A$45,000. In 2024-25 the marginal tax rate on incomes between A$45,000 and A$200,000 will be reduced to 30%. The top tax rate of 45% (which now kicks in at A$180,000) will apply to any income above A$200,000.

The threshold on which no income tax is paid remains the same, at A$18,200.

Other tax changes involve increases to the Low Income Tax Offset (LITO) and the Low and Middle Income Tax Offset (LMITO). The LMITO (available for those earning more than A$48,000) will increase from A$530 to A$1,090 from this financial year, while the LITO will increase from A$645 to A$700 in 2022-23.

More income, more benefit

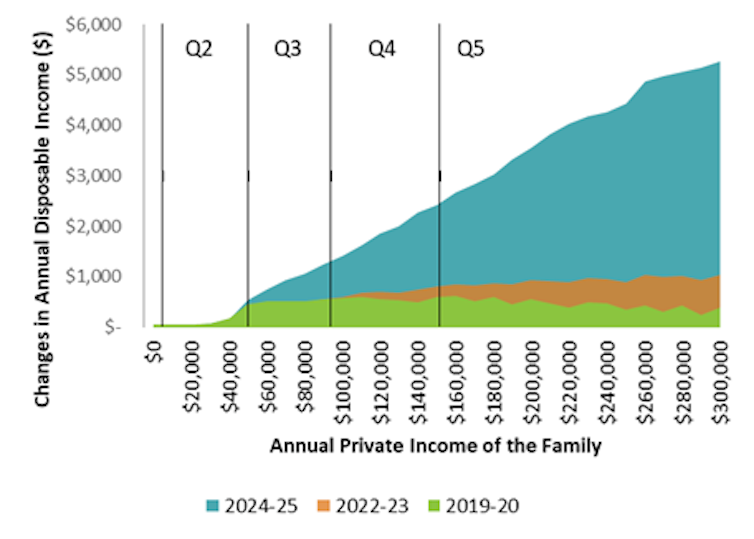

The benefit of the 2024/25 tax cuts on high-income families will be dramatic, as seen in Figure 1, which shows the effect of the changes over three years (2019-20, 2022-23 and 2024-25) by income.

Figure 1: Impact of 2019-20 tax and welfare system changes by income and year of impact.

NATSEM, Author provided (No reuse)

Figure 1: Impact of 2019-20 tax and welfare system changes by income and year of impact.

NATSEM, Author provided (No reuse)

The important point to note is that changes to marginal tax rates and the income tax offsets affect anyone paying tax. There is absolutely no benefit to anyone not paying tax. Which is why there is very little gain for those on incomes below $40,000 (the top of the second income quintile in Figure 1). The gain for those in the first income quintile (who mostly earn no private income) is even lower.

Demographic benefits

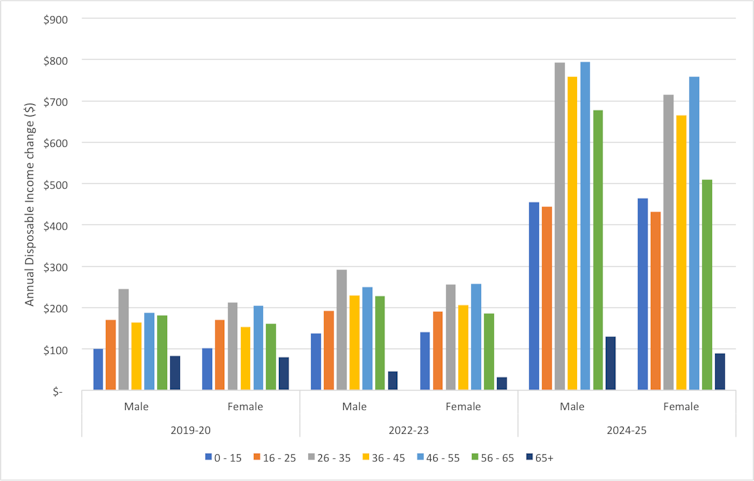

Figure 2 shows that the cohort that would gain the most in 2019-20 are those aged 26–35, by an average by A$245 a year for men and A$213 a year for women. This is mainly due to the change in the Low and Middle Income Tax Offset.

Figure 2: Impact of 2019-20 budget tax and welfare system changes by age group and year of impact.

Figure 2: Impact of 2019-20 budget tax and welfare system changes by age group and year of impact.

By 2024-25, the cohort gaining most are men aged 46–55, by A$795 a year, and women aged 46-55, by A$759 a year. This is mainly because the tax changes in 2024-25 provide greatest advantage to high-income earners, as shown above.

Family benefits

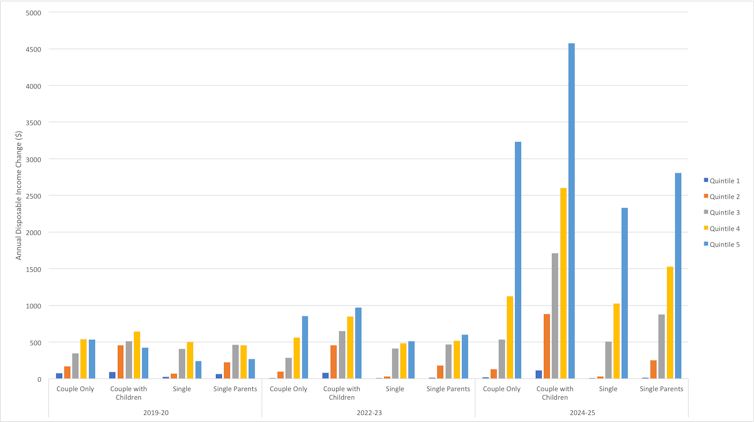

Figure 3 breaks down the impact by family type and income quintile. Couples with children gain the most for all years. By 2024-25, couples with children in the highest-income quintile gain an extra A$4,573 a year, while those in the lowest quintile get just A$114.

Figure 3: Impact of 2019-20 budget tax and welfare system changes by family type and income quintile.

NASTSEM, Author provided (No reuse)

Figure 3: Impact of 2019-20 budget tax and welfare system changes by family type and income quintile.

NASTSEM, Author provided (No reuse)

The main reason for this is that couples with children commonly have both parents working and paying tax, therefore tax changes benefit these families more.

In the first year (2019-20), the Low Income Tax Offset and Low and Middle Income Tax Offset mean middle-income earners gain the most (although it is still Quintile 4 gaining the most in this first year). By 2022-23 the tax cuts benefit higher-income households more.

Geographic gains

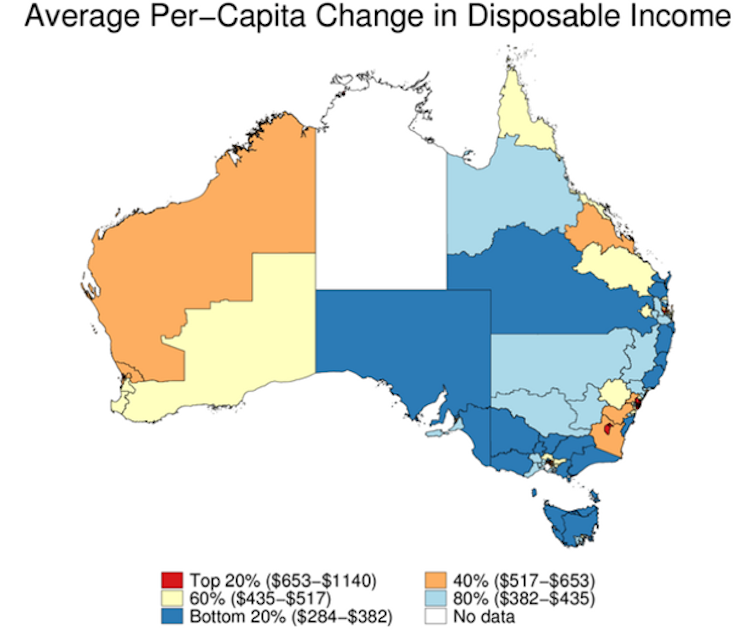

When it comes to the impact by Commonwealth Electoral Division (Figure 4), we can see that by 2024-25 urban areas gain the most, and regional areas the least.

Figure 4: Impact of 2024-25 tax and welfare system changes by Commonwealth Electoral Division.

NATSEM, Author provided (No reuse)

Figure 4: Impact of 2024-25 tax and welfare system changes by Commonwealth Electoral Division.

NATSEM, Author provided (No reuse)

This is because households in urban areas tend to have higher incomes, and the tax cuts in 2024-25 mean electoral divisions with higher income households will benefit the most.

Effect on poverty rate

The budget’s effect on the poverty rate – the proportion of households living on less than 50% of median income – is to reduce it by 0.2 percentage points by 2024-25. This is a fairly small reduction. But due to the tax cuts in 2024-25 raising the net incomes for high-income households, this means income inequality will be higher.

Read more: Future budgets are going to have to spend more on welfare, which is fine. It's spending on us

The 0.2 percentage point decrease compares to an 0.8% percentage point reduction that NATSEM’s modelling estimates would result from raising the Newstart allowance by A$75 a week from what it is now.

The message from this analysis is that the changes to the tax and welfare system in this budget benefits those with higher incomes and who are paying tax, with little to no gains in future years to some of those low income earners who aren’t paying tax.

Authors: Robert Tanton, Professor, Institute for Governance & Policy Analysis, University of Canberra

Read more http://theconversation.com/natsem-federal-budget-will-widen-gap-between-rich-and-poor-114728