priorities for the next government

- Written by John Daley, Chief Executive Officer, Grattan Institute

A federal election is an opportunity to take stock of how we are doing, where we are going, and what governments can do about it.

Grattan Institute’s latest report, Commonwealth Orange Book 2019, released today, is designed to help the next government set priorities for reform.

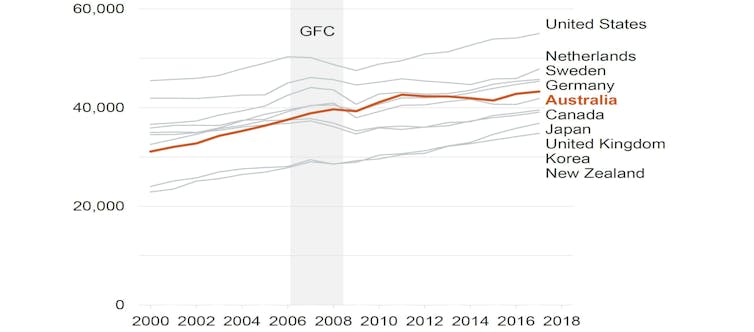

The problems aren’t hard to find. Our living standards have stagnated, mirroring trends across much of the developed world. Although we avoided the global malaise in the wake of the global financial crisis, other countries – most notably the United Kingdom and the United States – are starting to grow faster than us. Anxiety about our economic prospects is rising.

Australian incomes have flatlined in recent years

Gross national income per capita, purchasing power parity adjusted

Grattan Institute Commonwealth Orange Book 2019 Figure 2.1

The federal budget might be returning to surplus, but after a decade of deficits, Australia no longer enjoys the big financial buffers that gave the government the firepower to protect our economy through the global financial crisis. And the projected future surpluses assume spending restraint not achieved in 50 years.

Internationally, we’re slipping

On many social issues, Australia is not doing especially well when compared to its peers, as our International Scorecard shows.

Australia’s school results are behind. Home ownership has been sliding and housing costs and homelessness are relatively high. Australia’s electricity supply is more polluting, less reliable and more expensive than in comparable countries, and we are not on track to fulfil our promises to reduce greenhouse emissions. Trust in government is falling, and more people think the government is corrupt and policy making is being conducted behind closed doors.

There are bright spots. Our health system is delivering longer lives. Retirement incomes are generally sufficient, except for the increasing number of renters. Government is delivering results on health, education and retirement at relatively low cost.

Policy-wise, we’re drifting

But Australians pay more out of their own pockets for health and education than in most other countries. And Australians are paying much more to have their savings managed than in other countries.

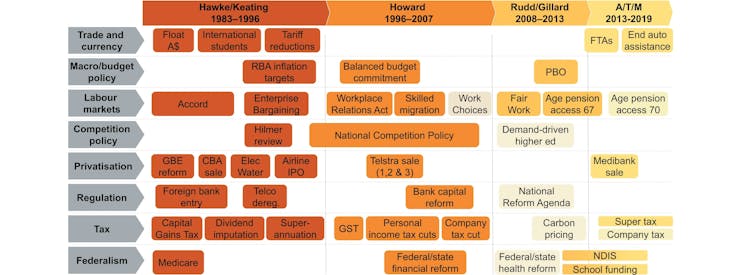

The overall pattern is that Australia is beginning to pay for well over a decade of policy drift and flip-flops. Governments of all political stripes have been less willing to put forward bold reforms in the public interest, and less able to make them stick.

Australia has made fewer tough economic choices this past decade, and reversed many

Grattan Institute Commonwealth Orange Book 2019 Figure 2.1

The federal budget might be returning to surplus, but after a decade of deficits, Australia no longer enjoys the big financial buffers that gave the government the firepower to protect our economy through the global financial crisis. And the projected future surpluses assume spending restraint not achieved in 50 years.

Internationally, we’re slipping

On many social issues, Australia is not doing especially well when compared to its peers, as our International Scorecard shows.

Australia’s school results are behind. Home ownership has been sliding and housing costs and homelessness are relatively high. Australia’s electricity supply is more polluting, less reliable and more expensive than in comparable countries, and we are not on track to fulfil our promises to reduce greenhouse emissions. Trust in government is falling, and more people think the government is corrupt and policy making is being conducted behind closed doors.

There are bright spots. Our health system is delivering longer lives. Retirement incomes are generally sufficient, except for the increasing number of renters. Government is delivering results on health, education and retirement at relatively low cost.

Policy-wise, we’re drifting

But Australians pay more out of their own pockets for health and education than in most other countries. And Australians are paying much more to have their savings managed than in other countries.

The overall pattern is that Australia is beginning to pay for well over a decade of policy drift and flip-flops. Governments of all political stripes have been less willing to put forward bold reforms in the public interest, and less able to make them stick.

Australia has made fewer tough economic choices this past decade, and reversed many

Grattan Institute Commonwealth Orange Book 2019 Figure 2.4

The next Commonwealth Government needs to choose to do less, but deliver more.

Recent Australian governments of all sides of politics have tried to fix too much at once, and have tended to achieve small things but mishandle big things. It takes time to design and implement important policies. Even for governments, resources are scarce and political capital is finite.

We should do less, and do it better

Some of the key policy reforms are primarily problems for state governments, such as planning reforms to permit more housing development, transport infrastructure project selection, electricity network costs, public hospital costs, and school teaching. In these areas, Commonwealth intervention gains headlines, but rarely achieves much.

Instead, the Commonwealth needs to focus where it has direct responsibility.

One such area is a clear, credible policy to tackle climate change that will win public support. Failure on this task destroyed the prime ministerships of Kevin Rudd and Malcolm Turnbull. The next government should implement the emissions and reliability obligations of the National Energy Guarantee for electricity, in cooperation with the states.

To support economic growth, the next Commonwealth government should put major tax reform back on the table. Australia needs to reform the combination of personal income tax, means-testing of welfare benefits, and childcare costs and subsidies, which discourage many second-income earners with children, primarily women, from working more.

Accelerated depreciation or investment allowances for large companies could attract more investment to Australia (and these are better reforms than simply cutting the company tax rate, which gives away tax revenue on investments already made).

These changes should be funded (and other tax increases avoided) by reducing the capital gains tax discount, winding back negative gearing, limiting superannuation tax concessions (particularly tax-free earnings in retirement), and broadening or increasing the rate of the goods and services tax.

Read more:

Stranger than fiction. Who Labor's capital gains tax changes will really hurt

In health, the Commonwealth needs to respond to the rapidly increasing pressures on private health insurance and out-of-pocket costs. It should start down the path of universal dental care.

The Commonwealth should finish the job on school funding and move on. It should reintroduce the demand-driven higher education system, while controlling costs by increasing the repayment requirements for Higher Education Loan Program debt.

On retirement incomes, the Commonwealth should abandon the planned increase in the Superannuation Guarantee from 9.5% to 12%, and instead drive down costs by adopting the Productivity Commission’s recommendations for “best-in-show” default superannuation funds.

Find things out…

In a range of other policy areas we know there are problems, but we don’t know the solutions.

The Commonwealth should commission work to determine how to deliver more integrated primary health care, improve the quality of initial teacher education, manage the balance between university and vocational education, ensure that natural gas producers pay a reasonable rate of royalty tax, and increase the age of access to the age pension and superannuation given rising life expectancy.

The politics of reform is never easy. Special interest groups, emboldened by success, are increasingly vocal in protecting their interests. The public interest has few friends.

…and protect the public interest

The next Commonwealth government should improve checks and balances on the influence of special interests by making political donations and lobbying more visible, in real time, and should ensure there are real penalties for people who do not comply. Election advertising expenditure should be capped to slow the “arms race” between the major parties for more campaign funds. And whoever wins the next federal election should establish a strong integrity commission.

Australia has a proud history of implementing substantial reform, which requires assembling the evidence, using it to defend the public interest, and staring down interest groups.

Recent reforms to school funding and the partial rollback of superannuation tax concessions show what is possible.

Many countries would be delighted to swap our problems for theirs. But we can do even better. And we must make our own luck.

Grattan Institute Commonwealth Orange Book 2019 Figure 2.4

The next Commonwealth Government needs to choose to do less, but deliver more.

Recent Australian governments of all sides of politics have tried to fix too much at once, and have tended to achieve small things but mishandle big things. It takes time to design and implement important policies. Even for governments, resources are scarce and political capital is finite.

We should do less, and do it better

Some of the key policy reforms are primarily problems for state governments, such as planning reforms to permit more housing development, transport infrastructure project selection, electricity network costs, public hospital costs, and school teaching. In these areas, Commonwealth intervention gains headlines, but rarely achieves much.

Instead, the Commonwealth needs to focus where it has direct responsibility.

One such area is a clear, credible policy to tackle climate change that will win public support. Failure on this task destroyed the prime ministerships of Kevin Rudd and Malcolm Turnbull. The next government should implement the emissions and reliability obligations of the National Energy Guarantee for electricity, in cooperation with the states.

To support economic growth, the next Commonwealth government should put major tax reform back on the table. Australia needs to reform the combination of personal income tax, means-testing of welfare benefits, and childcare costs and subsidies, which discourage many second-income earners with children, primarily women, from working more.

Accelerated depreciation or investment allowances for large companies could attract more investment to Australia (and these are better reforms than simply cutting the company tax rate, which gives away tax revenue on investments already made).

These changes should be funded (and other tax increases avoided) by reducing the capital gains tax discount, winding back negative gearing, limiting superannuation tax concessions (particularly tax-free earnings in retirement), and broadening or increasing the rate of the goods and services tax.

Read more:

Stranger than fiction. Who Labor's capital gains tax changes will really hurt

In health, the Commonwealth needs to respond to the rapidly increasing pressures on private health insurance and out-of-pocket costs. It should start down the path of universal dental care.

The Commonwealth should finish the job on school funding and move on. It should reintroduce the demand-driven higher education system, while controlling costs by increasing the repayment requirements for Higher Education Loan Program debt.

On retirement incomes, the Commonwealth should abandon the planned increase in the Superannuation Guarantee from 9.5% to 12%, and instead drive down costs by adopting the Productivity Commission’s recommendations for “best-in-show” default superannuation funds.

Find things out…

In a range of other policy areas we know there are problems, but we don’t know the solutions.

The Commonwealth should commission work to determine how to deliver more integrated primary health care, improve the quality of initial teacher education, manage the balance between university and vocational education, ensure that natural gas producers pay a reasonable rate of royalty tax, and increase the age of access to the age pension and superannuation given rising life expectancy.

The politics of reform is never easy. Special interest groups, emboldened by success, are increasingly vocal in protecting their interests. The public interest has few friends.

…and protect the public interest

The next Commonwealth government should improve checks and balances on the influence of special interests by making political donations and lobbying more visible, in real time, and should ensure there are real penalties for people who do not comply. Election advertising expenditure should be capped to slow the “arms race” between the major parties for more campaign funds. And whoever wins the next federal election should establish a strong integrity commission.

Australia has a proud history of implementing substantial reform, which requires assembling the evidence, using it to defend the public interest, and staring down interest groups.

Recent reforms to school funding and the partial rollback of superannuation tax concessions show what is possible.

Many countries would be delighted to swap our problems for theirs. But we can do even better. And we must make our own luck.

Authors: John Daley, Chief Executive Officer, Grattan Institute