we should legislate on Hayne recommendations before election

- Written by Michelle Grattan, Professorial Fellow, University of Canberra

As Labor seeks to get maximum political mileage from the banking royal commission report, Bill Shorten on Tuesday asked Scott Morrison for extra parliamentary sitting days to pass legislation to implement some of its recommendations.

In a letter to Morrison, Shorten said both houses should be recalled on March 5-7 and March 12-14. The sitting calendar has only 10 sitting days before the election.

“While there are many significant priorities facing the parliament, there is no more pressing priority than addressing the recommendations of the royal commission,” he said in his letter.

Shorten said it was “deeply regrettable” that the government had not given in-principle agreement to all the commission’s recommendations.

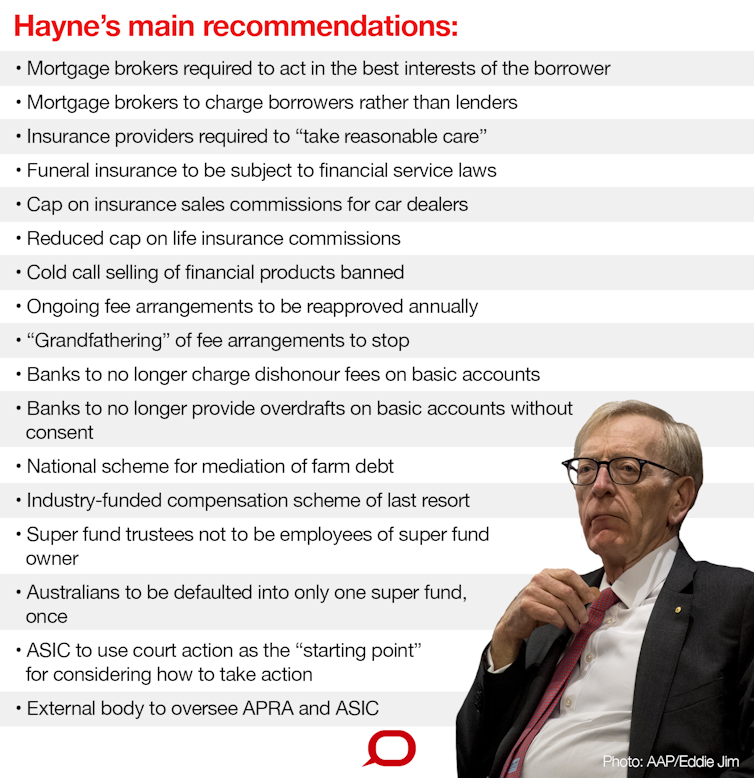

Both government and opposition have left themselves some wriggle room on the question of implementation, particularly on timing, while seeking to convey the message they are embracing everything commissioner Kenneth Hayne has recommended.

The government has said it will be “taking action” on all 76 recommendations. But it is not, for example, implementing for the time being the recommendation that the borrower, not the lender, should pay the mortgage broker fee for acting on home lending. It says this could reduce competition.

The opposition says it accepts all recommendations “in principle”.

In his letter Shorten said he noted that “the government has agreed to some important legislative changes” arising from the commission.

“After taking so long to recognise a royal commission was necessary, Australians will not accept any further delaying tactic from your government,” he said.

The Conversation

“Over the past 24 hours, Treasurer Josh Frydenberg has appeared to use the small number of remaining sitting days as an excuse to delay legislative changes. This should not be the case.”

Measures Labor nominates that should be legislated at once include

ending grandfathering commissions for financial advice; prohibiting

hawking of superannuation and insurance; application of unfair

contract terms provisions in the Australian Consumer Law to insurance; and the closing of loopholes to protect consumers, such as removing the exemptions for funeral expenses policies.

But the government, which is now in a minority in the House of

Representatives, is anxious to minimise its exposure in parliament.

Read more:

Compensation scheme to follow Hayne’s indictment of financial sector

Shorten received short shrift, with a government spokesman saying

there was already “legislation in the parliament that deals with a

number of the royal commission’s recommendations and even goes

further, but Bill Shorten and Labor have been fighting it tooth and

nail.”

The legislation the government is referring to includes increased

penalties for white collar crime, and the Protecting Your Super

legislation and increased powers for APRA.

“We won’t be lectured by Bill Shorten who still hasn’t outlined which recommendations Labor would implement,” the spokesman said.

Former prime minister Malcolm Turnbull, whose government finally

called the royal commission after continually rejecting pressure for one, said he regretted it had left it so long. “I think we should have got on with it earlier, ” he said on Tuesday.

Read more:

Six questions our banks need to answer to regain trust

He said “the reason I didn’t support a royal commission and the government didn’t - and that was a collective view of the government, not just mine - was because I could see what the problem was, a failure of responsibility and trust, and I wanted to get on and deal with it immediately.

"I didn’t want to have the delay of the royal commission”.

Frydenberg said he would be speaking to the banks directly “and my

message will be the same privately as it is publicly, that they must do better, that they need to reform, that they need to change the culture within their own organisations and that consumers must come first, second and third.”

The Conversation

“Over the past 24 hours, Treasurer Josh Frydenberg has appeared to use the small number of remaining sitting days as an excuse to delay legislative changes. This should not be the case.”

Measures Labor nominates that should be legislated at once include

ending grandfathering commissions for financial advice; prohibiting

hawking of superannuation and insurance; application of unfair

contract terms provisions in the Australian Consumer Law to insurance; and the closing of loopholes to protect consumers, such as removing the exemptions for funeral expenses policies.

But the government, which is now in a minority in the House of

Representatives, is anxious to minimise its exposure in parliament.

Read more:

Compensation scheme to follow Hayne’s indictment of financial sector

Shorten received short shrift, with a government spokesman saying

there was already “legislation in the parliament that deals with a

number of the royal commission’s recommendations and even goes

further, but Bill Shorten and Labor have been fighting it tooth and

nail.”

The legislation the government is referring to includes increased

penalties for white collar crime, and the Protecting Your Super

legislation and increased powers for APRA.

“We won’t be lectured by Bill Shorten who still hasn’t outlined which recommendations Labor would implement,” the spokesman said.

Former prime minister Malcolm Turnbull, whose government finally

called the royal commission after continually rejecting pressure for one, said he regretted it had left it so long. “I think we should have got on with it earlier, ” he said on Tuesday.

Read more:

Six questions our banks need to answer to regain trust

He said “the reason I didn’t support a royal commission and the government didn’t - and that was a collective view of the government, not just mine - was because I could see what the problem was, a failure of responsibility and trust, and I wanted to get on and deal with it immediately.

"I didn’t want to have the delay of the royal commission”.

Frydenberg said he would be speaking to the banks directly “and my

message will be the same privately as it is publicly, that they must do better, that they need to reform, that they need to change the culture within their own organisations and that consumers must come first, second and third.”

Authors: Michelle Grattan, Professorial Fellow, University of Canberra