Labor would quash tax cuts for businesses with $10-$50 million turnover

- Written by Michelle Grattan, Professorial Fellow, University of Canberra

Bill Shorten has said a Labor government would repeal already-legislated tax cuts for companies with an annual turnover between A$10 million and $50 million, but left its position up in the air for those between $2 million-$10 million.

The decision, announced in response to questions at a news conference on Tuesday, does not appear to have gone through shadow cabinet. Nor did Shorten mention it when he addressed caucus on Tuesday morning.

It opened the opposition leader to immediate attack from the government and business.

Finance Minister Mathias Cormann said it was Shorten’s “captain’s call”.

Treasurer Scott Morrison said there were 20,000 businesses between $10-50 million turnover, with an average of 75 employees in those businesses.

“This is terrible news for 1.5 million Australians who work in those businesses that will have to face higher taxes under Labor if Labor is elected,” Morrison said. Shorten had turned former leader Mark Latham’s “ladder of opportunity” into “the snake of envy”, Morrison said.

The Australian Chamber of Commerce and Industry CEO, James Pearson said Labor had sent a “very bad signal to business today”.

The opposition has had a long-standing policy of leaving the cuts in place for the smallest businesses – with turnovers less than $2 million. But by failing to clarify its position for companies up to $10 million, Shorten has left uncertainty for many smallish businesses.

A spokesperson for Shorten said: “We’ve never supported these tax cuts for big businesses - we voted against them and we haven’t changed our position.

"We’ve always supported tax cuts for small businesses.

"As Bill said, we’re considering a threshold of $2 million or $10 million turnover. That will be decided by the shadow cabinet, in the normal way.”

Shorten’s announcement comes days after the speech by frontbencher Anthony Albanese in which he advocated the Labor strike a better relationship with business. The speech was seen as Albanese differentiating himself from Shorten on a number of fronts and positioning on leadership ahead of the Super Saturday byelections.

Read more: Anthony Albanese sets out his blueprint for Labor

Asked about the decision apparently not having gone to shadow cabinet, ALP sources argued it had been generally known that a Labor government would not leave in place company tax cuts above the $10 million threshold.

But shadow treasurer, Chris Bowen, asked in May how long Labor was going to wait to give certainty to middle-level companies, said for companies above $2 million turnover “it is right and proper that we take some time to carefully work that through. We will be announcing our position, which will be crystal clear, not only to the voters but to the businesses of Australia,” Bowen said.

Labor earlier committed to repealing the tax cuts for big business, now before the Senate, in the event the government manages to legislate them. There is still no indication it can do so.

Whether a Labor government could get any repeals through would depend on the attitude of the Senate of the day.

Shorten’s announcement also comes as he faces criticism over Labor’s controversial advertisement, running in the byelections, that targets Malcolm Turnbull’s personal wealth and how he would benefit from the tax cuts for large companies.

Read more: Labor makes company tax fight all about Malcolm Turnbull's money

Shorten doubled down on the attack in the caucus meeting, saying that Turnbull “has no clue about how people actually live, and I do believe his wealth is connected to that”.

He also told caucus that the Longman byelection was very close and Braddon was “very difficult”.

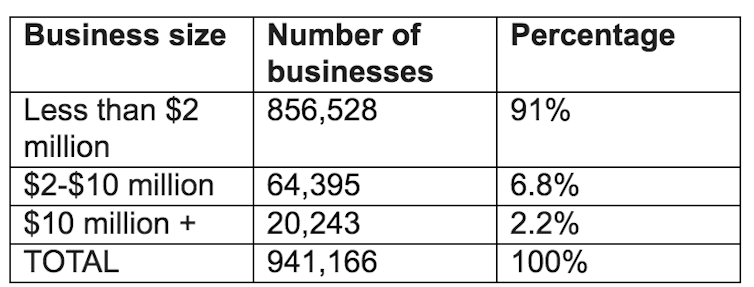

Business size in Australia.

Australian Taxation Office, Taxation statistics 2015/16

Business size in Australia.

Australian Taxation Office, Taxation statistics 2015/16

Authors: Michelle Grattan, Professorial Fellow, University of Canberra