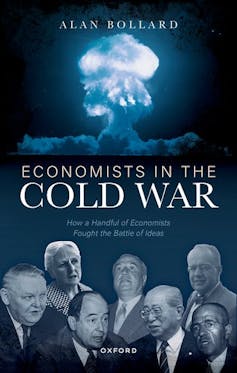

From Oppenheimer to Milton Friedman: how the Cold War battle of economic ideas shaped our world

- Written by Alan Bollard, Professor of Economics, Te Herenga Waka — Victoria University of Wellington

Is Oppenheimer a movie for our time, reminding us of the tensions, dangers and conflicts of the old Cold War while a new one threatens to break out?

The film certainly chimes with today’s big power conflicts (the US and China), renewed concern about nuclear weapons (Russia’s threats over Ukraine), and current ideological tensions between democratic and autocratic systems.

But the Cold War did not just rest on the threat of the bomb. Behind the scientists and generals were many other players, among them the economists, who clashed just as vigorously in their views about how to run postwar economies.

Without their allocation systems, funding mechanisms, technological advances, economic mapping and fiscal policies, neither the big powers nor the minor players could have afforded their defence expenditures or operated their economies.

One of J. Robert Oppenheimer’s colleagues, genius Hungarian mathematician John von Neumann, not only worked on the Nagasaki bomb at Los Alamos, but also turned his mind to economics. He developed game theory for economists – which the RAND Corporation used to test first-strike nuclear attacks against second-phase reprisals.

Von Neumann also developed the computer architecture on the EDVAC machine that allowed simulations of these nuclear and economic “games”. He went on to build the famous expanding economy model that showed the possibilities of dynamic growth through investment.

Spies and ideologies

The US had a huge financial advantage in this game, but it did not have everything its own way. Von Neumann’s nemesis was a Russian prodigy named Leonid Kantorovich. He survived the siege of Leningrad and invented linear programming to help Soviet factories build wartime planes more efficiently.

When he proposed extending these techniques to the whole planned Soviet economy, he was knocked back by the Marxist ideologues because he used prices to indicate scarcity. Kantorovich escaped incarceration and execution, unlike some of his colleagues. But he found himself assigned to the ENORMOZ project, the desperate Soviet race to build their own atomic bomb.

Kantorovich was helped in this contest by information leaked by Soviet spy Klaus Fuchs from von Neumann’s laboratory at Los Alamos. Such espionage was endemic in the period.

Read more: How the Soviets stole nuclear secrets and targeted Oppenheimer, the 'father of the atomic bomb'

US Treasury Assistant Secretary Harry Dexter White, a principal architect of the 1944 Bretton Woods agreements (which established the IMF and the World Bank), was feeding US secrets to the Soviets. More than 20 of his New Deal colleagues in the US administration belonged to Soviet spy rings.

In economics as well as the military, there were defining ideological differences: those like Austrian economist Friedrich Hayek who saw market allocation and price signals as the only way to allocate resources efficiently in a modern economy; and those like Polish Marxist economist Oskar Lange, who argued that planned socialist economies could also be efficient – at least theoretically – by using frequent data on shortages and gluts.

The Soviet Union used this latter system tolerably well to meet the military needs of the second world war. But it failed when faced with the more sophisticated civilian demands later in the Cold War.

Academic warfare

Such arguments were fought out on the Washington beltway and in the Kremlin. But some of the most brutal arguments took place in the hallowed halls of academia.

For example, Joan Robinson, the brilliant yet erratic upper-class Cambridge economist, tried to rewrite Marxian economics but ended up with something closer to dynamic Keynesianism – an interpretation of how John Maynard Keynes’ 1935 General Theory of Employment, Money and Interest might be extended to lead to growth.

Read more: John Maynard Keynes: unusually for an economist, he did not think people were very rational

And for the next 30 years she argued this with Paul Samuelson of the Massachusetts Institute of Technology, himself from a tough steel town, about whether the reinvestment of profits or the surplus value of labour was the key to dynamic growth.