Fewer episodes, more foreign owners: the incredible shrinking of Australian TV drama

- Written by Anna Potter, Associate Professor, University of the Sunshine Coast

Long running Australian television dramas like Packed to the Rafters, All Saints, McLeod’s Daughters and Blue Heelers are no longer being made. Blue Heelers racked up 510 episodes and 25 Logies during its 12 year run; 122 episodes of Packed to the Rafters aired between 2008 and 2013.

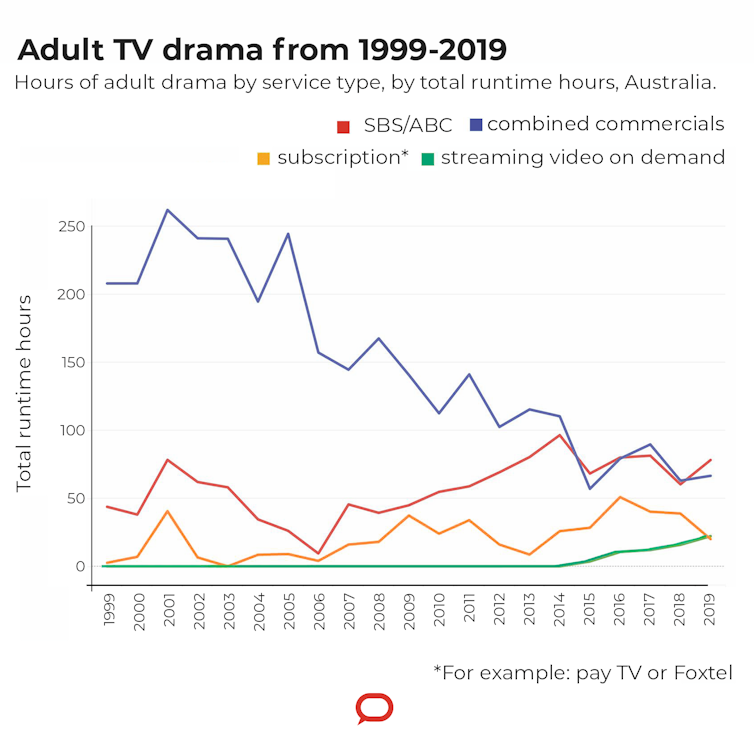

These shows provided an ongoing slice of Australian life to viewers here and overseas. But a lot has changed. From 1999 to 2019, the total hours of adult TV drama produced by all TV services (including the commercial broadcasters, ABC and SBS, Foxtel and the streamers) dropped by 20%.

And since 2015, Australian adult TV dramas have averaged just seven episodes a year. This represents a stunning fall in production levels from the early 2000s, when series of more than 20 episodes were common.

The shrinking length of the average Australian TV drama reflects other substantial changes in production over the last two decades. Our research explores how new technologies enabling multichannels and streaming services, combined with changes in the global TV business, have impacted homegrown drama.

As a first step, we assembled a database of all the Australian TV drama series produced since 1999. Our analysis of that data, published in the Australian Drama Index, found hours of adult, prime-time drama produced by commercial broadcasters Seven, Nine, and Ten fell by 68% between 1999 and 2019.

We excluded long-running soap operas such as Neighbours or Home and Away from this count because soaps account for so many hours of Australian drama they obscure the changes elsewhere. Still, even with the inclusion of soap operas, hours of adult drama on commercial channels fell by 45% over this time.

In contrast, national broadcasters, mostly the ABC, increased their drama hours. From 44 hours in 1999, the ABC’s annual local drama output had fallen to just five hours in 2006. But by 2019, it had reached 72 hours. This trend was especially pronounced after 2009 when the ABC received significant extra funding for drama and children’s programs for three years.

The introduction of streaming services in 2015 provided minimal additional Australian drama hours, with 22 hours commissioned by all providers in 2019. Still, these hours of Australian-made drama matched Foxtel’s that year.

Author provided, Author provided

Read more:

Crunching the numbers on streaming services' local content: static growth, but more original productions

Who produces?

Our study shows twice as many production companies made Australian drama in 2019 than in 1999. So more companies made fewer hours of drama — more of them foreign owned.

Several formerly Australian production companies such as Matchbox Pictures, Southern Star, and Screentime are now owned by foreign media conglomerates. In the first decade of our study, foreign-owned companies accounted for only 12% of Australian adult drama hours produced.

This figure grew to 38% of hours in the decade since 2009, with such companies making series including The Family Law, Offspring and Love Child.

Our concern here regarding foreign ownership isn’t one of foreign influence (as might be the case when considering news). Rather, there are implications for Australian-owned companies that might lack the resources (money to develop new ideas, international sales networks) to go head to head with foreign-owned firms.

And with 38% of Australian drama now made by foreign-owned companies, this means taxpayer supports, such as the proposed 30% tax rebate for producers of Australian films and TV shows, are going to overseas firms.

What is commissioned?

Interestingly, the number of titles produced yearly has not changed much. Rather, the number of episodes for each title has dropped significantly across all commissioners — commercial broadcasters, national broadcasters, Foxtel and the streamers.

Another trend is the shift in children’s drama production from live-action drama to animation. This has largely been caused by Seven, Nine and Ten increasingly using animation to fill their children’s drama quotas from the mid-2000s. These quotas were removed entirely in 2021, with big implications for animation producers.

Read more:

The slow death of Australian children's TV drama

An uncertain future

Although many might assume the challenges facing Australian TV drama are a result of the 2015 arrival of streaming services, our data illustrates the disruption began much earlier. The introduction of multi-channels from 2009, like 7mate, 9Life and Eleven, challenged the business of commercial broadcasters, incurring new costs but with no increase in television advertising spending.

Since then, search engines (Google, Amazon) and social media have drawn advertising dollars away from television, resulting in less funds going towards the making of Australian drama.

Australia is not unusual in this regard. The fall in advertising has hurt commercial broadcasters all over the world, making it harder for them to fund drama production. The rise of transnational streaming services such as Netflix, Disney+, and Paramount+ is also challenging the development of stories about Australian life.

Even when these services produce shows in Australia, they are designed to be watched by subscribers around the globe.

Well-crafted policy in the 1970s and 80s supported Australian television when foreign-produced dramas dominated our TV screens. Given commercial broadcasters’ withdrawal from drama commissioning, we need 21st century policies that will support Australian drama, particularly children’s.

Increasing financial support for the national broadcaster is an efficient and effective way to safeguard supplies of drama made first and foremost for Australian audiences. Our new drama index confirms the urgent need for such policy solutions.

Author provided, Author provided

Read more:

Crunching the numbers on streaming services' local content: static growth, but more original productions

Who produces?

Our study shows twice as many production companies made Australian drama in 2019 than in 1999. So more companies made fewer hours of drama — more of them foreign owned.

Several formerly Australian production companies such as Matchbox Pictures, Southern Star, and Screentime are now owned by foreign media conglomerates. In the first decade of our study, foreign-owned companies accounted for only 12% of Australian adult drama hours produced.

This figure grew to 38% of hours in the decade since 2009, with such companies making series including The Family Law, Offspring and Love Child.

Our concern here regarding foreign ownership isn’t one of foreign influence (as might be the case when considering news). Rather, there are implications for Australian-owned companies that might lack the resources (money to develop new ideas, international sales networks) to go head to head with foreign-owned firms.

And with 38% of Australian drama now made by foreign-owned companies, this means taxpayer supports, such as the proposed 30% tax rebate for producers of Australian films and TV shows, are going to overseas firms.

What is commissioned?

Interestingly, the number of titles produced yearly has not changed much. Rather, the number of episodes for each title has dropped significantly across all commissioners — commercial broadcasters, national broadcasters, Foxtel and the streamers.

Another trend is the shift in children’s drama production from live-action drama to animation. This has largely been caused by Seven, Nine and Ten increasingly using animation to fill their children’s drama quotas from the mid-2000s. These quotas were removed entirely in 2021, with big implications for animation producers.

Read more:

The slow death of Australian children's TV drama

An uncertain future

Although many might assume the challenges facing Australian TV drama are a result of the 2015 arrival of streaming services, our data illustrates the disruption began much earlier. The introduction of multi-channels from 2009, like 7mate, 9Life and Eleven, challenged the business of commercial broadcasters, incurring new costs but with no increase in television advertising spending.

Since then, search engines (Google, Amazon) and social media have drawn advertising dollars away from television, resulting in less funds going towards the making of Australian drama.

Australia is not unusual in this regard. The fall in advertising has hurt commercial broadcasters all over the world, making it harder for them to fund drama production. The rise of transnational streaming services such as Netflix, Disney+, and Paramount+ is also challenging the development of stories about Australian life.

Even when these services produce shows in Australia, they are designed to be watched by subscribers around the globe.

Well-crafted policy in the 1970s and 80s supported Australian television when foreign-produced dramas dominated our TV screens. Given commercial broadcasters’ withdrawal from drama commissioning, we need 21st century policies that will support Australian drama, particularly children’s.

Increasing financial support for the national broadcaster is an efficient and effective way to safeguard supplies of drama made first and foremost for Australian audiences. Our new drama index confirms the urgent need for such policy solutions.

Authors: Anna Potter, Associate Professor, University of the Sunshine Coast