Budget deficit to hit $184.5B this financial year, unemployment to peak at 9.25% in December: economic statement

- Written by Michelle Grattan, Professorial Fellow, University of Canberra

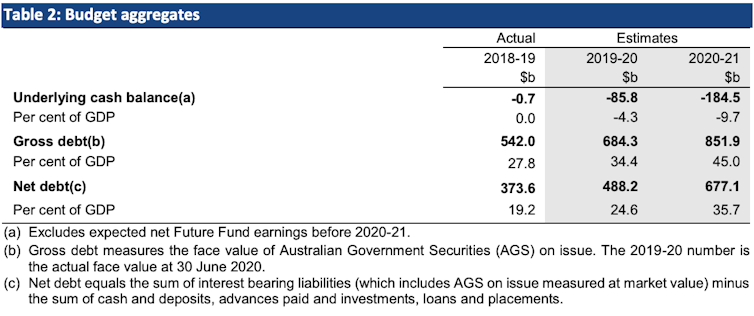

Treasurer Josh Frydenberg has announced massive budget deficits of $85.8 billion for the just-finished 2019-2020 financial year and $184.5 billion projected for 2020-2021.

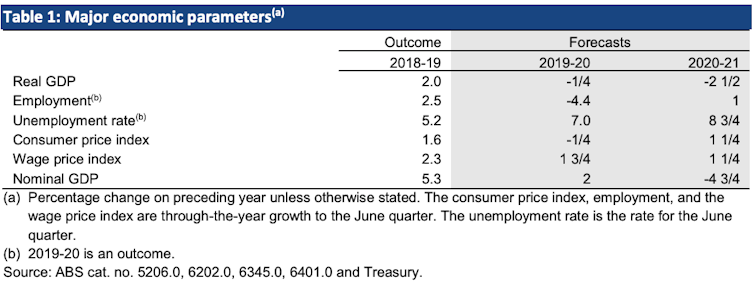

Growth is set to be negative for last financial year and the current one. The government’s economic statement forecasts cuts of 0.25% in GDP in 2019-20 and a reduction of 2.5% in the current financial year.

Unemployment is expected to peak at about 9.25% in the December quarter.

Employment is forecast to fall by 4.4% in 2019-20, but recover by 1% in 2020-21.

The unemployment rate averaged 7% in the June quarter 2020, and is forecast to be 8.75% for the June 2021.

Treasury

The statement shows debt levels rising markedly in the wake of the pandemic, although the government emphasises Australia still has a low level of government debt-to-GDP compared to other countries.

Net debt is estimated to be $488.2 billion in June this year. This 24.6% of GDP.

Debt is then forecast to increase to $677.1 billion at June 30 next year, which would be a rise to 35.7% of GDP.

As the government looks to the recovery, Treasurer Josh Frydenberg said: “Our economy has taken a big hit. And there are many challenges we confront. We can see the mountain ahead and Australia begins the climb. We must remain strong. We must draw strength from our resilience as a nation and a people.”

Finance Minister Mathias Cormann said “We are in a better, stronger, more resilient position than most of other countries around the world.”

Defending the high debt level, Cormann asked “what was the alternative?”

The government admits the outlook is unpredictable, and revised numbers will come in the October budget.

“The economic and fiscal outlook remains highly uncertain,” the statement says.

One massive uncertainty is what happens in Victoria. The statement takes into account the present six weeks lockdown but this could be extended if the state does not soon get on top of the second wave of the virus.

The Victorian government on Thursday reported 403 new cases, and five deaths including a man in his 50s. There were 19 new cases in NSW.

The statement says GDP is forecast to have fallen by 7% in the June quarter, but will grow in the September quarter by 1.5%. In the calendar year of 2020, GDP is expected to fall 3.75%, but grow in calendar year 2021 by 2.5%.

Earlier this week, the government announced an extension of JobKeeper and the Coronavirus Supplement that goes with JobSeeker, although both will be scaled back after September.

Despite the government announcing these increases in support, the statement stressed the goverment’s economic response to the crisis was “temporary and targeted” with measures designed to support the economy without undermining the structural integrity of the budget.

Treasury

The statement shows debt levels rising markedly in the wake of the pandemic, although the government emphasises Australia still has a low level of government debt-to-GDP compared to other countries.

Net debt is estimated to be $488.2 billion in June this year. This 24.6% of GDP.

Debt is then forecast to increase to $677.1 billion at June 30 next year, which would be a rise to 35.7% of GDP.

As the government looks to the recovery, Treasurer Josh Frydenberg said: “Our economy has taken a big hit. And there are many challenges we confront. We can see the mountain ahead and Australia begins the climb. We must remain strong. We must draw strength from our resilience as a nation and a people.”

Finance Minister Mathias Cormann said “We are in a better, stronger, more resilient position than most of other countries around the world.”

Defending the high debt level, Cormann asked “what was the alternative?”

The government admits the outlook is unpredictable, and revised numbers will come in the October budget.

“The economic and fiscal outlook remains highly uncertain,” the statement says.

One massive uncertainty is what happens in Victoria. The statement takes into account the present six weeks lockdown but this could be extended if the state does not soon get on top of the second wave of the virus.

The Victorian government on Thursday reported 403 new cases, and five deaths including a man in his 50s. There were 19 new cases in NSW.

The statement says GDP is forecast to have fallen by 7% in the June quarter, but will grow in the September quarter by 1.5%. In the calendar year of 2020, GDP is expected to fall 3.75%, but grow in calendar year 2021 by 2.5%.

Earlier this week, the government announced an extension of JobKeeper and the Coronavirus Supplement that goes with JobSeeker, although both will be scaled back after September.

Despite the government announcing these increases in support, the statement stressed the goverment’s economic response to the crisis was “temporary and targeted” with measures designed to support the economy without undermining the structural integrity of the budget.

Treasury

Revenue is taking a major knock from the fallout of the pandemic.

Total receipts, including earnings of the Future Fund, have fallen by $33 billion in 2019-20 and $61.1 billion in 2020-21 since the budget update last December.

Since that update, tax receipts have been revised down by $31.7 billion for the just completed financial year, and $63.9 billion for the current financial year.

Read more:

These budget numbers are shocking, and there are worse ones in store

“The outlook for tax receipts remains uncertain. This reflects both uncertainty around the economic outlook, and how this interacts with structural and administrative features of the tax system, such as the ability of taxpayers to carry forward losses to offset future income,” the statement says.

It says payments have increased by $187.5 billion over two years from the budget update.

They are expected to reach $550 billion for the 2019-20 year, which is 27.7% of GDP, and rise to $640 billion in the current financial year, representing 33.8% of GDP.

“This increase is as a result of the Government’s targeted responses to the COVID-19 pandemic to support Australia’s economy, as well as the impact of automatic stabilisers including the payment of unemployment benefits,” the statement says.

Treasury

Revenue is taking a major knock from the fallout of the pandemic.

Total receipts, including earnings of the Future Fund, have fallen by $33 billion in 2019-20 and $61.1 billion in 2020-21 since the budget update last December.

Since that update, tax receipts have been revised down by $31.7 billion for the just completed financial year, and $63.9 billion for the current financial year.

Read more:

These budget numbers are shocking, and there are worse ones in store

“The outlook for tax receipts remains uncertain. This reflects both uncertainty around the economic outlook, and how this interacts with structural and administrative features of the tax system, such as the ability of taxpayers to carry forward losses to offset future income,” the statement says.

It says payments have increased by $187.5 billion over two years from the budget update.

They are expected to reach $550 billion for the 2019-20 year, which is 27.7% of GDP, and rise to $640 billion in the current financial year, representing 33.8% of GDP.

“This increase is as a result of the Government’s targeted responses to the COVID-19 pandemic to support Australia’s economy, as well as the impact of automatic stabilisers including the payment of unemployment benefits,” the statement says.

Authors: Michelle Grattan, Professorial Fellow, University of Canberra