Travel bans and event cancellations: how the art market is suffering from COVID-19

- Written by Anita Archer, Research Coordinator, ERCC Research Unit, University of Melbourne

The recently released The Art Market 2020 report provides a timely insight into how COVID-19-related disruptions are likely to impact growth and sales in the global art market.

The report estimates global art market sales in 2019 were worth US$64.1 billion (A$97 billion), down 5% on 2018.

This drop reflects the decline in global economic growth driven by increasing geopolitical tensions and the trend toward trade protectionism led by the United States.

In 2020, measures to control the spread of coronavirus through government restrictions on travel and large social events are already having a dramatic impact on the international art market.

In the last six weeks, multiple art fairs have announced either postponement or cancellation, including Jingart Beijing, Art Basel Hong Kong, Miaart Milan, Art Paris, Art Berlin and Art Dubai.

The European Fine Art Fair in Maastricht went ahead, but reported a 27% drop in attendance of VIPs at the opening, when many major sales are traditionally made.

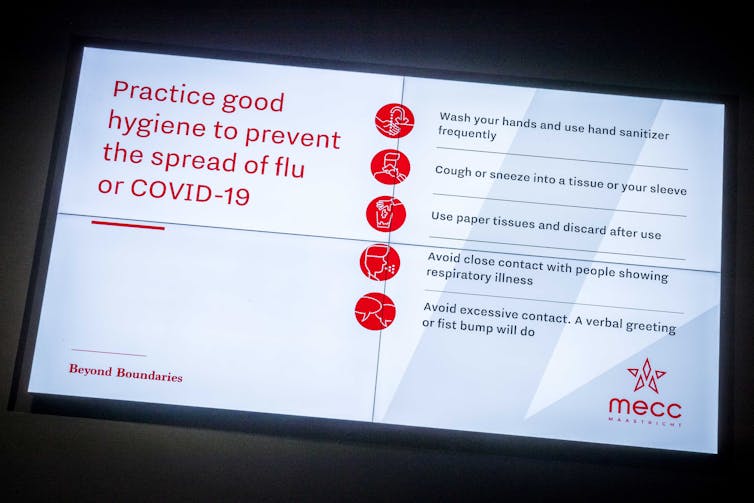

While the European Fine Art Fair (TEFAF) went ahead, good hygiene guides were prominently placed.

Marcel van Hoorn/EAP

While the European Fine Art Fair (TEFAF) went ahead, good hygiene guides were prominently placed.

Marcel van Hoorn/EAP

The growing art fair market

As in previous years, 2019 art market sales were highly concentrated in three major hubs. The United States, the United Kingdom and China collectively accounted for 82% of the total value of sales.

The Art Market report identified a growing shift away from public auctions toward private sales. The overall auction sector (including public auctions and private sales by auction houses, online and offline) represented 42% of total market sales in 2019.

The overall dealer sector (including dealer, gallery and online retail sales) represented 58% of total art market sales in 2019, with the value of sales increasing by 2%.

Read more: Friday essay: The Australian art market has flatlined. What can be done to revive it?

Within this sector, dealers with turnover of more than US$1 million (A$1.5 million) experienced a much larger growth of 20%. These dealers are the fastest-growing sector and the most reliant on art fair sales.

Almost half of all sales in the dealer sector were made at art fairs in 2019, amounting to US$16.5 billion (A$25 billion) – 26% of all sales made in the global art market.

This concentration of sales at the top end of the dealer market is perhaps the art market’s Achilles heel when considering potential fallout from the impending COVID-19 pandemic.

Dealers in this turnover bracket attended twice as many art fairs as smaller dealers, with international fairs (as opposed to local fairs) contributing to more than half their total art fair sales.

For dealers with turnover of more than US$10 million (A$15.1 million), international art fairs represented a staggering 70% of their art fair sales.

An unwelcome ‘distraction’

Besides the sales generated at art fairs, dealers have become increasingly dependent on fairs for expanding client lists and developing their businesses.

The unfolding COVID-19 pandemic represents an immediate threat to this business model. One dealer quoted in The Art Market report noted the undesirable impact disruptions from outside the art world can have on art market demand:

2020 will be a challenging year, but rather than major political dramas having a direct financial impact, their main danger for us is to distract people’s attention. Distractions and anxieties can take people away from buying art, even if the economy is booming and they’re still in a position to spend.

While this dealer was more likely referring to topical political issues, such as Brexit or trade sanctions, the COVID-19 outbreak has the potential to provide a far greater “distraction” for art buyers.

The impact of COVID-19 on the long-term health of the art market remains to be seen.

Art fairs had already been struggling due to multiple economic headwinds in the latter part of 2019, with increasing numbers of retractions and cancellations worldwide.

Art Basel Hong Kong attracted 88,000 visitors in 2019.

Jerome Favre/EPA

Art Basel Hong Kong attracted 88,000 visitors in 2019.

Jerome Favre/EPA

In 2019, Art Basel Hong Kong featured 242 galleries from 35 countries and was attended by 88,000 visitors over five days. This was a pivotal event on the regional calendar and its loss to the 2020 art market will be sorely felt.

The global footprints and nimble business structures of international auction houses may help these businesses weather this storm, as they have done in the past. But the picture is worrying for commercial galleries.

Artists and galleries prepare for months in advance of fairs and exhibitions.

In a survey of the impact of the coronavirus on the art market in China, 73.8% of respondents in the visual arts industry reported their businesses will not survive for longer than three months if the current containment situation continues.

Creative initiatives are emerging, such as Art Basel Hong Kong’s online viewing platform. But with uncertainty about how long it will be until this pandemic is under control, the future health of the global art industry is yet to be determined.

Authors: Anita Archer, Research Coordinator, ERCC Research Unit, University of Melbourne