Who is a broker and how to choose them

Instruction-comparison for beginners

What to pay attention to before you open an account with a broker online? We have collected the main points that are worth studying by every beginning investor.

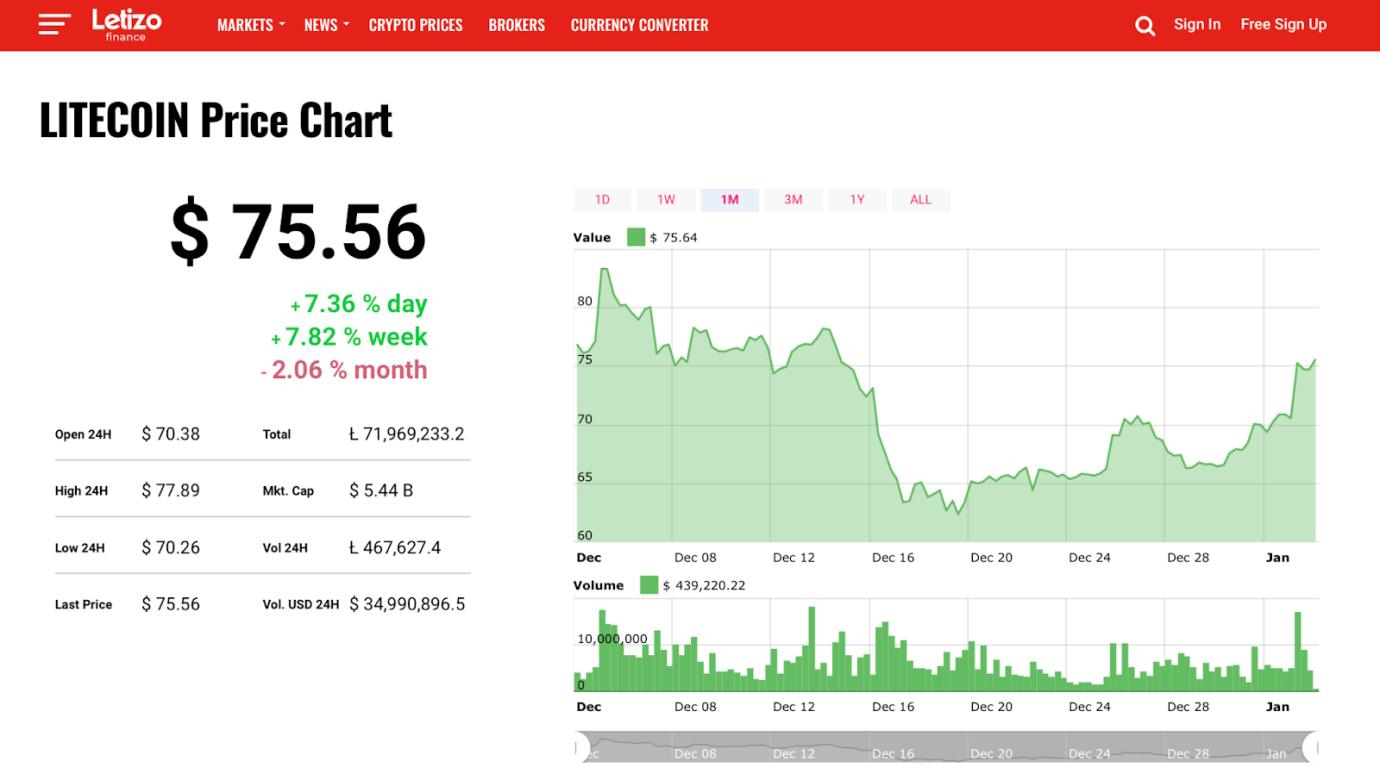

For sure, you have been reading, studying and absorbing various information about investments and the stock market and trading brokers lately. This means that it is time to choose a broker where you can make full use of your Litecoin price prediction analysis.

Who is a broker online, in simple words

According to the law in most countries, legal entities and individuals can not trade on exchanges directly, if they are not professional participants of the market. For this they need an intermediary - trading brokers.

An online broker is a professional securities market maker, an intermediary between investors and the stock exchange. To obtain this status, they need to follow certain legislative requirements. Brokers may be banks, investment, and brokerage companies.

What do trading brokers do?

After you have concluded an agreement, the broker opens for you a brokerage account and a depository account. With a broker, you can buy and sell securities, and trade currencies and other financial instruments. They execute clients' orders - transfers them to the exchange, gives money for the securities.

Besides, a broker draws up reports on cash flows and transactions, and transfers funds to a bank account. They can offer the services of a financial consultant, develop trade and investment strategies.

A broker also acts as a tax agent, calculates and withholds income tax from your profit from transactions and dividends, and transfers the money to the budget. If you have several accounts with the same broker, the taxes will be counted all together, not each account separately.

How to Choose a Broker

How not to go wrong in choosing your broker? Here are the main things an investor needs to consider before entering into a contract with a broker.

Licence

Usually, along with a brokerage license, a broker also gets a depository license, a dealer license, and an asset management license. The regulator checks brokers regularly. And if it finds violations, it can revoke the license. The regulator may also suspend the license for a period. If the broker corrects all violations, the license will be renewed.

Reputation and Reliability

A broker, like any financial institution, can go bankrupt. Or lose their license. To avoid problems, contact a trusted broker. How reliable the broker is, except for the presence of all licenses, can be determined with the help of the rating. Special organizations - rating agencies assign ratings.

In addition to dry numbers, you can read reviews to make money on Litecoin token price. Try to find information resources of real independent experts who make unbiased evaluations of various projects. Look online to see if the broker has had any financial difficulties or major scandals in the days before.

Fees

Every broker offers different rates. Before you open an account, decide which one suits you best. How often you want to make transactions.

Commissions

There are mandatory fees that a broker charges an investor regardless of the volume and number of transactions, and there are those that directly depend on how you behave in the market. But in this case you should pay attention to the rest of the conditions of such a tariff; the commission for another service is increased.

Here are the main commissions:

-

brokerage account maintenance fee;

-

fee for depositary services;

-

transaction fee;

-

commission for deposit and withdrawal of funds;

-

a fee for submitting orders over the phone;

-

leverage fees.

Availability of markets

Study the available markets and trading tools. Decide what you mainly intend to trade. You can choose the best trading tools with the help of the website letizo.com.