It is necessary to worry about health, but pessimism about the economy will hurt us

- Written by Gordon Menzies, Associate Professor of Economics, University of Technology Sydney

During this pandemic, our twin health and economic crises require two different types of concern, and they operate differently.

For the health crisis, a high level of concern is necessary. Saving lives demands nothing less than full compliance with unprecedented restrictions.

For the economic crisis, it is logical to be worried. Elsewhere, I have distinguished between economic wants and needs, and right now the provision of needs is under threat.

On the other hand, extreme pessimism about the economy is dangerous.

The #CoronaEconomy is different to the normal economy and interpreting it is subject to distortion from confirmation bias, which is the tendency for people to process information in a way that screens out things that don’t accord with the narrative they have adopted.

The world faces a crisis, and so it is entirely appropriate that many people have adopted a crisis narrative. But if confirmation bias turns it into a view that “nothing good can happen in the economy” it will have gone too far.

Read more: When a virus goes viral: pros and cons to the coronavirus spread on social media

As the pandemic spreads, the worldwide media will have up to 195 countries and more than a dozen major stock exchanges to confirm that view.

This is unfortunate. Just as panic buying can create a crisis in supply chains that needn’t be there, undue pessimism can create a needless crisis in the economy.

If those who remain relatively well off through the crisis decide not to spend merely because they are worried about a downturn – the financial equivalent of hoarding – it will make the downturn they are worried about even bigger.

In turn it will further threaten people’s employment, accommodation, and their ability to fulfil their basic needs.

Read more: Psychology can explain why coronavirus drives us to panic buy. It also provides tips on how to stop

There is genuine bad news. The pandemic has endangered access to health care, shut down industries, pushed people out of jobs and made it hard to spend. And Australia is taking a huge hit in external income as commodity prices fall.

Fortunately there’s also good news.

Voluntary transfer payments are emerging. People and groups are giving away money to meet the unfolding challenges. Some managers at firms such as Qantas are forgoing pay while others are giving up their jobs.

Some workers are taking fictional leave, which amounts to a gift to their employer, or sharing around reduced working hours, which amounts to a gift to the employee most likely to miss out otherwise.

Coles, Woolworths, and some other employers are expanding. Even “panic buying”, whether justifiable or not, can generate employment.

As in the global financial crisis, government stimulus payments can help cushion unemployment, even though not every initiative will operate perfectly.

The movement online of what used to be face-to-face activity will make some businesses more productive when the crisis is over, giving them room to grow and provide products and services more cheaply.

Best of all, our country’s exposure to commodity price downturns is limited by our floating exchange rate.

More than half our exports are resource-based or rural, meaning large falls in world demand could be expected to wreak havoc with employment.

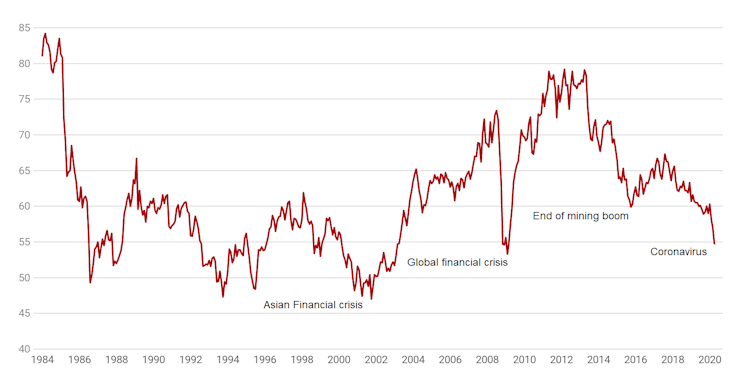

But our floating exchange rate cushions these shocks, as it did during the 1990s Asian financial Crisis, the 2000s global financial crisis and at the end of the mining boom.

The latest depreciation is a big one, and will help us.

Trade-weighted Australian dollar exchange rate since float

Index of Australian dollar exchange rates weighted by trade shares.

Source: RBA

Index of Australian dollar exchange rates weighted by trade shares.

Source: RBA

In 1948 the English author CS Lewis, wrote an essay, Living in the Atomic Age, about coping with an ever-present existential threat.

His context was different. It was about the atomic bomb. But the message was that the best way to deal with an overwhelming concern was simply to be the best of ourselves.

If we are all going to be destroyed by an atomic bomb, let that bomb when it comes find us doing sensible and human things — praying, working, teaching, reading, listening to music, bathing the children … not huddled together like frightened sheep and thinking about bombs.

It would help right now if we recognised that extreme concern, while entirely appropriate as a means to protect health, isn’t helpful as a means of protecting the economy.

There’s no point huddling together like economically-frightened sheep. It blinds us to the good that’s around us now, and the good that is to come.

Authors: Gordon Menzies, Associate Professor of Economics, University of Technology Sydney