Small, but well-formed. The new home deposit scheme will help, and it's unlikely to push up prices

- Written by Rachel Ong ViforJ, Professor of Economics, School of Economics, Finance and Property, Curtin University

The new First Home Loan Deposit Scheme announced the Coalition, and instantly backed by Labor, is likely to be popular among those on the cusp of buying their first home.

It’ll be open to singles earning up to A$125,000 and couples earning up to A$200,000 who have saved at least 5% of the value of the home. The government-owned National Housing Finance and Investment Corporation will partner with private lenders to put up as much as another 15% of the value of the home to take the deposit to 20%.

However, the scheme is capped at 10,000 home buyers per year, roughly one tenth of the number of Australians who bought first homes in 2018.

It’ll help them - the latest survey shows that more than half of first homebuyers needed financial assistance outside of their own savings to get their deposit. The benefits of home ownership have been widely documented. But will it do enough?

Source of deposits

Authors' own calculations from ABS Survey of Income and Housing 2013-14

An often-expressed concern is that such a scheme will bid up house prices. However, it is means-tested, making it much less vunerable to this criticism than the non-means-tested First Home Owners’ Grant.

And is also capped at 10,000 loans per year, giving it little scope to price pressure.

However, it may not be means-tested enough.

Consider the population subgroup that broadly comprises aspiring homebuyers who qualify for the scheme: renters aged 25-34 years who meet the scheme’s income criteria and whose financial wealth is between 5% and 20% of the lowest-priced quarter of houses for sale in the borad area in which they live.

In the most-recent 2015 ABS Survey of Income and Housing there were 127,000 such potential eligible first home buyers, more than 12 times the 10,000 cap.

Read more:

That election promise. It will help first home buyers, but they better be cautious

The cap is a practical necessity of course, needed to limit impacts on prices and prevent a cost blowout. But the weakness of the scheme is that the cap will be filled on a “first come, first serve” basis, without distinguishing between those who actually need help and those who are likely to meet the deposit requirement anyway.

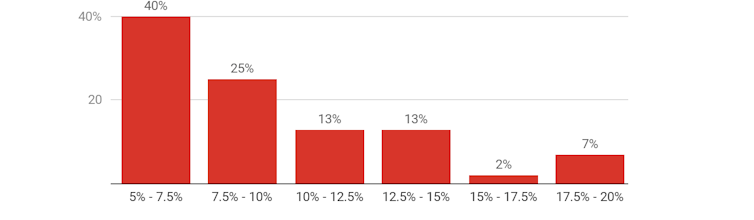

The graph shows that some 40% of potential first home buyers have managed to save a deposit amounting to not much more than 5% of the home value. Only 7% have a 20% deposit or something near it.

Potential users of the scheme, by amount of deposit saved

Authors' own calculations from ABS Survey of Income and Housing 2013-14

An often-expressed concern is that such a scheme will bid up house prices. However, it is means-tested, making it much less vunerable to this criticism than the non-means-tested First Home Owners’ Grant.

And is also capped at 10,000 loans per year, giving it little scope to price pressure.

However, it may not be means-tested enough.

Consider the population subgroup that broadly comprises aspiring homebuyers who qualify for the scheme: renters aged 25-34 years who meet the scheme’s income criteria and whose financial wealth is between 5% and 20% of the lowest-priced quarter of houses for sale in the borad area in which they live.

In the most-recent 2015 ABS Survey of Income and Housing there were 127,000 such potential eligible first home buyers, more than 12 times the 10,000 cap.

Read more:

That election promise. It will help first home buyers, but they better be cautious

The cap is a practical necessity of course, needed to limit impacts on prices and prevent a cost blowout. But the weakness of the scheme is that the cap will be filled on a “first come, first serve” basis, without distinguishing between those who actually need help and those who are likely to meet the deposit requirement anyway.

The graph shows that some 40% of potential first home buyers have managed to save a deposit amounting to not much more than 5% of the home value. Only 7% have a 20% deposit or something near it.

Potential users of the scheme, by amount of deposit saved

Deposit saved by renters aged 25-34 who meet the scheme’s eligibility criteria, per cent of lower quartile property prices in area of residence, 2015-16.

Authors' own calculations from the ABS Survey of Income and Housing 2015-16

The Coalition (or Labor) could get more bang for its buck within the cap by targeting those in greater need of assistance; for example by prioritising those who cannot access the so-called Bank of Mum and Dad. Not everyone has access to wealthy parents.

The Great Australian Dream of owning a home has been fading fast, and not just for young people. Naturally, the scheme’s details of the scheme require scrutiny. But overall, it provides a welcome acknowledgement (by both major parties) that the affordability crisis facing young people has not waned despite recent house price declines.

Read more:

The brutal truth on housing. Someone has to lose in order for first homebuyers to win

The scheme will restore the opportunity – at least to some – to accumulate wealth in property and enjoy the security and other benefits that home ownership brings.

But seriously addressing housing affordability will ultimately require a bigger intervention.

Deposit saved by renters aged 25-34 who meet the scheme’s eligibility criteria, per cent of lower quartile property prices in area of residence, 2015-16.

Authors' own calculations from the ABS Survey of Income and Housing 2015-16

The Coalition (or Labor) could get more bang for its buck within the cap by targeting those in greater need of assistance; for example by prioritising those who cannot access the so-called Bank of Mum and Dad. Not everyone has access to wealthy parents.

The Great Australian Dream of owning a home has been fading fast, and not just for young people. Naturally, the scheme’s details of the scheme require scrutiny. But overall, it provides a welcome acknowledgement (by both major parties) that the affordability crisis facing young people has not waned despite recent house price declines.

Read more:

The brutal truth on housing. Someone has to lose in order for first homebuyers to win

The scheme will restore the opportunity – at least to some – to accumulate wealth in property and enjoy the security and other benefits that home ownership brings.

But seriously addressing housing affordability will ultimately require a bigger intervention.

Authors: Rachel Ong ViforJ, Professor of Economics, School of Economics, Finance and Property, Curtin University