When falling home ownership and ageing baby boomers collide

- Written by Rachel Ong ViforJ, Professor of Economics, School of Economics, Finance and Property, Curtin University

Until now, the majority of older people in Australia have achieved the goal of owning their own home outright. Hence, policymakers have typically shown little concern about the size and budget costs of rental housing assistance programs for seniors. However, two major societal shifts are set to propel such programs into the spotlight as a prominent government subsidy for older Australians.

The first trend is population ageing. We anticipate that baby boomers will place growing pressure on housing assistance programs as they age.

This is simply because of their larger numbers compared to earlier generations. Applying ABS population projections to data from the 2011 Household, Income and Labour Dynamics in Australia (HILDA) Survey, we project the population of Australians aged 55 years and over will increase from 5.1 million to 7.9 million between 2011 and 2031 – a 55% increase.

A second shift – falling rates of home ownership – could further increase the demands on the housing system. The HILDA Survey reveals rates of home ownership have fallen from 72% in 2001 to 66% in 2016.

This decline is in part due to younger Australians finding it more difficult to become owner-occupiers. It is also due to growing numbers of Australians dropping out of home ownership.

Estimates from the ABS Surveys of Income and Housing show that from 1982 to 2013 the home ownership rate fell 7.3 percentage points among the 45-54 age group. It fell by 5.1 percentage points for the 55-64 age group.

These trends are likely to continue.

A growing divide among older Australians

To analyse the implications of these shifts, we forecast the changing profile of Australians aged 55 and over by housing tenure. We apply demographic projections to the 2011 HILDA Survey and describe tenure profiles based on hypothetical declines of 5 and 15 percentage points in home ownership rates by 2031, as well as a stagnant stock of public housing.

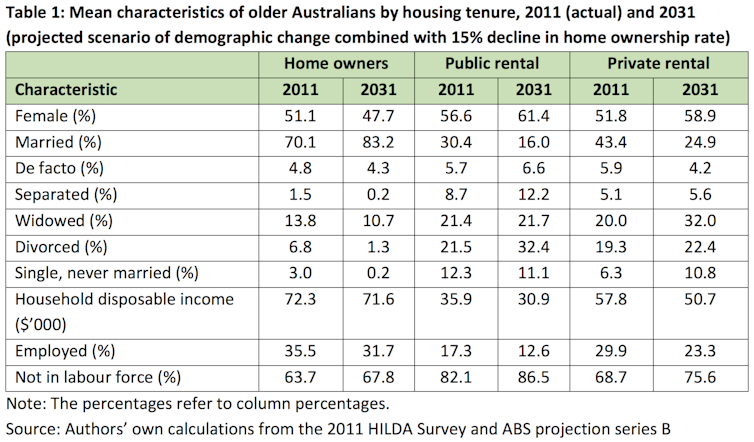

Our findings point to a growing divide among older Australians. For older Australians, home ownership will increasingly become the preserve of higher-income married couples (see table 1). Older people on lower incomes – especially women and those affected by marital breakdown or bereavement – will rent.

The divide is especially stark if the home ownership rate falls by 15 percentage points. In this scenario, 27.4% of people aged 55 and over will be private renters by 2031.

Budget impacts of housing assistance

Older Australians’ demand for housing assistance could spike as a result of population ageing and falling home ownership rates.

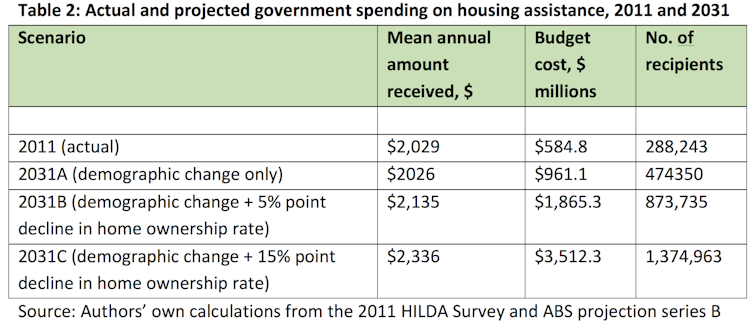

Even demographic change on its own would lift real government spending on housing assistance for Australians aged 55 and over by 64% by 2031 (see table 2).

If home ownership rates also decline by 5 percentage points, then real government spending is projected to blow out to three times its 2011 level.

A steep fall in the home ownership rate of 15 percentage points would send real government spending on housing assistance soaring to around six times the 2011 level. That would increase real spending on housing assistance for older Australians from a tiny 0.043% of real GDP in 2011 to 0.16% of forecast real GDP in 2031.

Budget impacts of housing assistance

Older Australians’ demand for housing assistance could spike as a result of population ageing and falling home ownership rates.

Even demographic change on its own would lift real government spending on housing assistance for Australians aged 55 and over by 64% by 2031 (see table 2).

If home ownership rates also decline by 5 percentage points, then real government spending is projected to blow out to three times its 2011 level.

A steep fall in the home ownership rate of 15 percentage points would send real government spending on housing assistance soaring to around six times the 2011 level. That would increase real spending on housing assistance for older Australians from a tiny 0.043% of real GDP in 2011 to 0.16% of forecast real GDP in 2031.

The implications of demographic change coupled with falling home ownership rates are obvious for the housing sector:

the private rental tenure is set to expand

demand for housing assistance will grow

spending on housing assistance programs will increase the strain on government budgets.

Challenges beyond housing policy

There are also important ramifications for retirement incomes policy. The age pension system assumes most Australians will retire as outright home owners with no mortgage payments to meet. They can therefore get by on low age pensions. But growing numbers of older renters struggling to meet rental payments will call into question the adequacy of our age pension benefits.

There is an alternative scenario. By 2031, the superannuation system will have matured. Growing numbers of older renters – especially those with steady employment records – could accumulate big enough balances in defined contribution schemes to become home buyers in later life.

Dipping into superannuation savings to finance a home purchase is attractive on various fronts:

it offers the prospect of secure and affordable housing in old age

it helps with access to the age pension as owner-occupied housing assets are exempt from the age pension assets test and are not deemed to generate an income return under the income test

under aged care assets test rules, the equity stored in what was an aged care client’s family home is either exempt from the assets test (if a spouse or dependent children is still living in the home), or subject to a cap ($165,271.20 as at March 20 2018), and is not assessed for age care deeming purposes.

On the other hand, superannuation balances are an assessable asset under age pension and aged care assets test provisions, as well as for age pension and aged care deeming purposes.

Should growing numbers of Australians approach retirement as renters these anomalies offer them potentially powerful motives to substitute assets away from superannuation and into owner-occupied housing in later life. But, in doing so, they could undermine a key objective of Australia’s superannuation guarantee – that of promoting financial independence and reducing reliance on public pensions in old age.

The implications of demographic change coupled with falling home ownership rates are obvious for the housing sector:

the private rental tenure is set to expand

demand for housing assistance will grow

spending on housing assistance programs will increase the strain on government budgets.

Challenges beyond housing policy

There are also important ramifications for retirement incomes policy. The age pension system assumes most Australians will retire as outright home owners with no mortgage payments to meet. They can therefore get by on low age pensions. But growing numbers of older renters struggling to meet rental payments will call into question the adequacy of our age pension benefits.

There is an alternative scenario. By 2031, the superannuation system will have matured. Growing numbers of older renters – especially those with steady employment records – could accumulate big enough balances in defined contribution schemes to become home buyers in later life.

Dipping into superannuation savings to finance a home purchase is attractive on various fronts:

it offers the prospect of secure and affordable housing in old age

it helps with access to the age pension as owner-occupied housing assets are exempt from the age pension assets test and are not deemed to generate an income return under the income test

under aged care assets test rules, the equity stored in what was an aged care client’s family home is either exempt from the assets test (if a spouse or dependent children is still living in the home), or subject to a cap ($165,271.20 as at March 20 2018), and is not assessed for age care deeming purposes.

On the other hand, superannuation balances are an assessable asset under age pension and aged care assets test provisions, as well as for age pension and aged care deeming purposes.

Should growing numbers of Australians approach retirement as renters these anomalies offer them potentially powerful motives to substitute assets away from superannuation and into owner-occupied housing in later life. But, in doing so, they could undermine a key objective of Australia’s superannuation guarantee – that of promoting financial independence and reducing reliance on public pensions in old age.

Authors: Rachel Ong ViforJ, Professor of Economics, School of Economics, Finance and Property, Curtin University

Read more http://theconversation.com/when-falling-home-ownership-and-ageing-baby-boomers-collide-102846