a quick fix with hidden risks

- Written by Guy Dundas, Energy Fellow, Grattan Institute

Governments have got the message: Australians are angry about electricity prices. On Monday, Prime Minister Malcolm Turnbull announced a decisive shift away from reducing emissions to reducing prices.

This move means that both the federal government and the opposition have adopted an Australian Competition and Consumer Commission (ACCC) recommendation to cap electricity prices through a regulated “default offer”, although whether the states and territories will support this approach is unclear.

The good news is that price caps will probably work as advertised. That is, they will reduce prices for a relatively small number of customers who are currently on bad deals.

The bad news is that capping prices could also have unintended consequences.

Read more: A high price for policy failure: the ten-year story of spiralling electricity bills

Electricity prices have risen much faster than inflation for more than a decade. From around 2005 to 2014 the cost of the electricity network (the “poles and wires”) increased substantially, mainly through over-investment by various state government owners, and highly prescriptive (and expensive) reliability standards.

Since 2016, wholesale electricity prices have increased rapidly as gas prices have risen and as old coal-fired power stations were retired at the end of their life, reducing supply. During the same period governments required prices to rise to pay for renewable energy subsidies, particularly for rooftop solar systems.

Together, these three factors account for about 80% of the increase in household electricity prices over the past decade. Bashing big companies is the flavour of the month, but there was not a lot that energy companies such as AGL, Origin and EnergyAustralia could realistically have done to mitigate any of this.

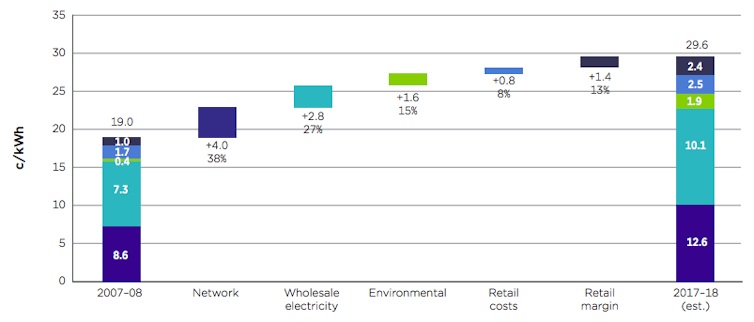

Change in average residential customer effective prices (c/kWh) from 2007–08 to 2017–18 across the National Electricity Market (prices in real 2016–17 dollars, excluding GST).

ACCC

Change in average residential customer effective prices (c/kWh) from 2007–08 to 2017–18 across the National Electricity Market (prices in real 2016–17 dollars, excluding GST).

ACCC

But several other factors have driven prices still higher, including the substantial profit margins charged by the big energy retailers. This prompted the ACCC’s recommendation of a “default offer”, to ensure that a customer who does not sign up to a market contract pays no more than a regulated price.

Household savings?

Both sides of politics say that this policy will save some households more than A$100 a year. But this is only true of the relatively small number of households who have not signed a contract with a retailer and so are on a “standing offer”.

In Victoria, the state with the most developed retail market, this is only 7% of households. That figure is higher where price controls have been removed more recently (around 19% in Southeast Queensland), but it is declining rapidly (see page 244 here).

So there will be large savings, but only for a small proportion of households. What’s more, the ACCC’s analysis suggests that the measure will not particularly benefit lower-income households, because those on hardship payment programs are less likely to be on a standing offer (see page 245 here). Think beach houses, not working families.

A quick fix

The danger is that politicians may be tempted to use price caps as a quick fix to reduce prices across the board. Given the many factors that have pushed up electricity prices in recent years, this approach is likely to be counterproductive.

It is likely to damage competition and inadvertently benefit the biggest power companies. An aggressively low price cap would make it impossible for many retailers to recover their genuine costs of supplying electricity. Fewer retailers would mean increased market concentration. And because most power companies are both retailers and generators, a small saving for consumers from lower retail margins could be more than offset by price increases resulting from a less competitive wholesale market.

Now is not the time to abandon market-based competition, given the rapid change in Australian and global energy markets. International companies such as Neoen, SIMEC ZEN, Total Eren and BayWa r.e. are investing in renewable generation and battery storage, and increasingly selling power directly to commercial and industrial customers. It is only a matter of time before these players begin to compete in the wider retail market.

What’s more, while product innovation in retailing has been limited to date (indeed, one of the critiques of a competitive electricity retail market is that they are all supplying the same electrons through the same wires), the prospects for future innovation are good. Rooftop solar panels and batteries provide a new way to supply power, and companies can increasingly use data from smart meters to inform and empower consumers.

Read more: The solar panel and battery revolution: how will your state measure up?

It is understandable that governments want to protect consumers from high electricity prices. A modest price cap through a default offer, implemented cautiously, might be analogous to existing measures under Australian consumer law that limit excessive credit card payment surcharges. But the ACCC does not directly regulate credit card fees, and nor should governments directly regulate electricity prices, the drivers of which are complex and constantly changing. Rather, the focus should be on helping consumers to navigate a competitive electricity market.

The ACCC’s default offer recommendation is not just about capping prices for a small number of disengaged customers. It is also intended to provide a clear benchmark against which all customers can compare offers and get a fair deal. Both major federal parties have indicated their support for a range of ACCC proposals to help consumers understand electricity prices. The government should implement the full package, with price caps playing a limited role, if any. Price caps are a seductive short-term solution with dangerous longer-term consequences.

Authors: Guy Dundas, Energy Fellow, Grattan Institute

Read more http://theconversation.com/capping-electricity-prices-a-quick-fix-with-hidden-risks-101981