Lessons for Australia in the EU's algorithmic price war that ripped off consumers

- Written by Rob Nicholls, Senior lecturer in Business Law, UNSW

The European Commission imposed fines of more than €110 million (AU$170 million) on Asus, Denon & Marantz, Philips and Pioneer this month. These consumer electronics manufacturers had prevented online retailers from selling below the recommended retail price of their products, threatening to block supply if they did so.

This anti-competitive conduct is called “resale price maintenance”. It’s illegal in most countries that have competition law because it effectively rips off consumers.

Read more: Explainer: the good, the bad, and the ugly of algorithmic trading

What’s interesting about this case is the central role played by algorithms in the dispute. Manufacturers were using algorithmic price monitoring to figure out when retailers were discounting prices, while the same retailers were using algorithms to increase the competitiveness of their pricing.

So we have suppliers using algorithms (and threats) to increase prices, and retailers using algorithms to reduce prices. And it’s likely that both the retailers and the manufacturers were using the same application programming interface to monitor prices. The key thing is that the sales were all online.

Pricing algorithms operate via APIs

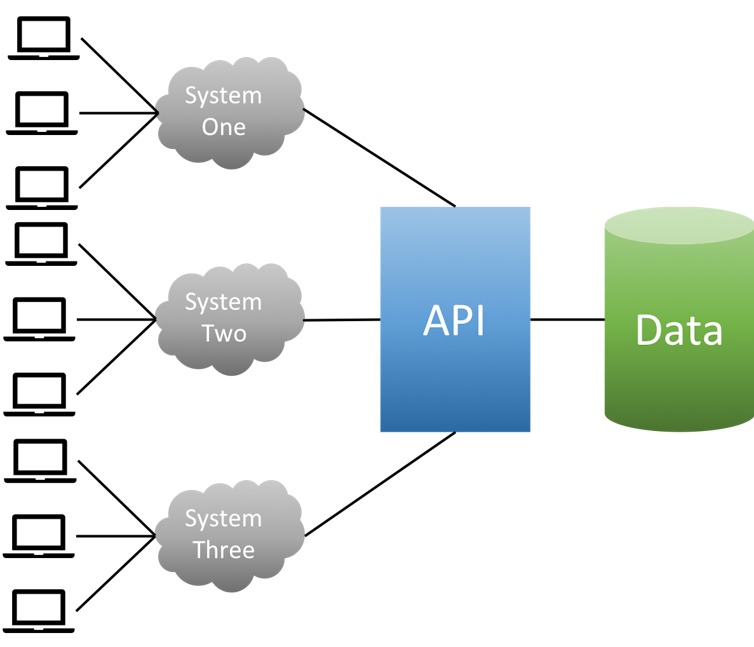

The purpose of an application programming interface or API is to provide “hooks” by which one application’s software can call for information from other software. The API means that the application’s software does not need to “look under the hood”.

Instead, a provider gives access to multiple systems that use the API for different applications. This is set out in the diagram below.

Application programming interface.

Rob Nicholls

Application programming interface.

Rob Nicholls

Traditionally, APIs have been used to allow one application to interface to another application – typically an operating system. For example, applications can be coded in a variety of programming languages but still operate on the Windows operating system.

This works because Microsoft specifies the API in such a way that multiple different programming language types can use that interface. A more recent approach to APIs is to provide access to large data sets. In many cases these data sets can be “live”.

In the online retail world, selling platform providers such as eBay and Amazon Marketplace provide application programming interfaces or APIs for their merchants.

Algorithms used by the retailers

In principle, a retailer or merchant could use the API provided by the platform to manage their pricing.

Research at Northeastern University has shown that merchants on Amazon Marketplace that use algorithmic pricing have greater sales. However, merchants may not have algorithm design as a core skill. This was illustrated when a biology textbook was advertised on Amazon Marketplace for over US$23 million.

As a result, there are a significant number of intermediary firms that offer “repricing” software designed to provide competitive pricing and ensure that their clients’ products are promoted by the platform.

For example, in the case of Amazon Marketplace, it’s important that the product is in the “BuyBox”. Although there are several such intermediaries, the practical effect is that only a very limited number of algorithms are used by many merchants on the most popular platforms.

Read more: Here's how we can protect ourselves from the hidden algorithms that influence our lives

The purpose of the repricing tools is to create a competitive offering from the merchant. Essentially it also acts as tool to discover rivals’ costs on the basis that the minimum acceptable margin for merchants is likely to be comparable.

The effect of the use of algorithms in a selling space where the products are identical is that the best consumer price is based on the private value of the second most competitive seller.

This results in that pricing that reflects both costs and acceptable margins.

Algorithms used by the manufacturers

In this case, the manufacturers were either using the same API as the retailers, or “screen scraping” the platform’s consumer website. Screen scraping is simply gathering data from a web page, rather than using the more efficient API.

Once the manufacturers had identified retailers that were selling below the recommended retail price, they asked them to change that price. If the change was not immediate, then the manufacturers threatened to cease supply.

The European Commission was particularly worried that if retailers followed the direction of the manufacturer, the algorithm-driven discounting would evaporate. This would leave consumers with a “take it or leave” recommended retail price.

Read more: Fear not, shoppers: Amazon's Australian geoblock won't cramp your style

For example, if you wanted to buy a Pioneer AVH-1300NEX car entertainment system on Amazon in the United States, you would find prices ranging from US$276 to US$494.95, including US shipping. The order of the offers from Amazon is “Prime” first.

Most of the Prime offers are at US$279.95. The merchant offering US$276 has algorithmically priced to encourage the buyers to ignore the Prime benefits as well as fulfilment by Amazon. The recommended retail price from Pioneer is US$400. If the resale price maintenance was still going on, you would have no offers lower than US$400.

What about Australia?

Resale price maintenance is prohibited in Australia.

The Australian Competition and Consumer Commission or ACCC summarises this as:

A supplier may recommend that resellers charge an appropriate price for particular goods or services but may not stop resellers charging or advertising below that price.

The ACCC also recommends that small businesses complain to the Commission if they receive threats about their pricing.

In a world where the technology is used to enforce regulation in the financial services sector (called RegTech), there is also an opportunity for the ACCC to use algorithmic-based tools detect anti-competitive conduct.

Perhaps the online call should be both “buyer beware” and “wholesaler beware”.

Authors: Rob Nicholls, Senior lecturer in Business Law, UNSW