Federal Budget 2018: a state-by-state spending analysis

- Written by Chris Salisbury, Research Associate, The University of Queensland

New South Wales and ACT

Anika Gauja, Associate Professor, Department of Government and International Relations, University of Sydney

With income tax cuts and a return to surplus earlier than expected, Treasurer Scott Morrison has certainly delivered a budget full of pre-election sweeteners. New South Wales itself isn’t a big winner, however, with only A$1.5 billion of the A$24 billion earmarked for infrastructure projects heading its way.

The projects that have been announced are strategically targeted: A$400 million will be spent on upgrading the Port Botany rail link, and A$50 million will go towards investigating the business case for the proposed Badgery’s Creek airport rail. The Pacific Highway will be upgraded with a new A$1 billion bypass at Coffs Harbour, bringing a windfall to the Nationals-held seat of Cowper. Scott Morrison’s own electorate will get A$25 million for a new monument commemorating the 250th anniversary of Captain Cook’s landing.

The “election budget” takes on even more significance in NSW, where voters will most likely go to the polls twice in the coming 12 months, with the next state election due in March 2019. By allocating only a modest proportion of infrastructure funding to NSW, the federal Coalition has made it hard for its NSW counterpart to capitalise on spending announcements during the state campaign.

If the state election is held before the next federal election, this might indicate confidence that Gladys Berejiklian’s government will be returned. Yet it might also signal a strategic focus away from NSW, where the state election could act as a buffer to absorb some of the disaffection that might otherwise be directed at the federal government.

Victoria

David Hayward, Professor of Public Policy and Director, VCOSS-RMIT Future Social Service Institute, RMIT University

Victoria is one of the big winners from the budget, through a mixture of luck and good political management.

First the luck. Mainly due to higher-than-expected population growth, Victoria will receive a bigger share of the national Goods and Services Tax pool, with revenue growing by a whopping A$1.4 billion, or almost 10% to A$17.3 billion. For the first time, Victoria’s share of GST revenues will be almost the same as its share of Australia’s population.

Also growing rapidly is the state’s share of federal infrastructure spending, which is tipped to rise from barely 8% to 15%. This is where the good political management part comes in. Over the last three years, Premier Daniel Andrews and Treasurer Tim Pallas have hit the airwaves to great effect, complaining bitterly about the state’s low levels of infrastructure investment under the Turnbull government.

With an election only six months away, the federal government has finally responded with a cool A$7.6 billion in total. Most of that investment will flow into a Melbourne Airport rail link (A$5 billion), a North East toll road that is yet to gain the support of the opposition (A$1.75 billion), and a rail link to Monash University’s Clayton Campus (A$500 million).

Much of this money won’t be seen for many years, with the spend next year being just A$900 million. The airport rail link is unlikely to start being built until 2026. There will also be some wrangling well before then, with the federal government determined to “equity” fund and the Victorian government looking for good old-fashioned capital grants.

Overall, though, this is a good-news budget for Victorians and the Victorian government. Just don’t expect opposition leader Matthew Guy to be smiling.

Western Australia

Ian Cook, Senior Lecturer in Australian Politics, Murdoch University

Today the budget confirmed that the West Australian government would get another A$2.8 billion to spend on transport infrastructure, and A$189 million to spend on hospitals. Low- to middle-income earners in WA, like everyone else in the country, can now expect around A$500 back by way of an increased tax rebate. West Australians were told last week that they would get around A$1 billion more through a revised GST carve-up.

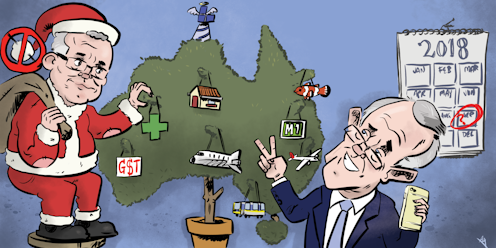

The crucial question now is whether Western Australians will see the federal government’s budget and the GST boost as a visit from Santa or Scrooge.

They had been wondering where the money would come from to pay for infrastructure projects, especially Perth’s Metronet, promised by State Labor during the last election campaign. Now they know. Well, most of it. A couple of billion dollars more will be needed to fund the projects.

Western Australians were expecting 45 cents back for every dollar in GST raised in the state (up from 34c) and they were told they would in fact get 47c. But Victorians will get A$1.8 billion more in funding, and 98c in the dollar back from their GST.

Many people in the West will be wondering whether another A$10 a week in their pocket is all that much, especially given Perth’s notorious coffee prices.

In a pre-election budget, and in a state in which the Liberal vote is falling, the Santa or Scrooge question is important – and the answer is still not really clear.

Queensland

Chris Salisbury, Research Associate, University of Queensland

As expected, Scott Morrison’s third federal budget is big on pleasure and light on pain for Queenslanders. With a federal election due within a year, and given Queensland’s status as a battleground state, the temptation to splash the cash in the Sunshine State is strong.

Committing almost A$536 million (A$478 million of it new) over five years to improve the health of the Great Barrier Reef has been welcomed widely, although criticised in some conservation circles for supporting programs that don’t directly address the impacts of climate change.

The biggest smiles are reserved for proponents of infrastructure spending, especially to relieve commuter congestion, with A$5.2 billion newly earmarked for projects in Queensland.

This includes a A$1 billion boost for expanding the M1 motorway between Brisbane and the Gold Coast, A$170 million for the Amberley interchange section of the Cunningham Highway near Ipswich, and A$3.3 billion for much-needed upgrades to the Bruce Highway. There is also A$390 millon for the Sunshine Coast rail line duplication, a project that has long been advocated by local Liberal National Party MPs.

Significantly, but not surprisingly, there is no federal funding for the Cross River Rail project in Brisbane, a longstanding bone of contention between the Labor state government and the federal Coalition. Instead, Morrison has pledged A$300 million for the LNP-controlled Brisbane City Council’s Metro transport project.

Regional Queensland hasn’t been ignored, with A$176 million promised for the long- proposed construction of Rockhampton’s Rookwood Weir, dependent on equivalent state funding. Federal Nationals MPs hope this will boost Coalition support in marginal central Queensland seats, where the popularity of One Nation looms large.

Northern Territory

Rolf Gerritsen, Professorial Research Fellow, Northern Institute, Charles Darwin University

The federal budget’s impact in the Northern Territory was determined before the territory’s own budget was released last week.

Two days before the NT budget came out, Treasurer Scott Morrison gave the territory a A$259 million top-up to compensate for its reduced GST revenue share. (A sweetener, perhaps, for approving fracking?).

Morrison also promised a A$550 million contribution to the territory’s indigenous housing budget. The Country Liberal Party candidate for the Labor seat of Lingiari also announced A$250 million to extend the indigenous Ranger program. And the NT received $280 million in roads funding, as well.

The NT has three problems in coming years. Its public service expenditure is overly large and top-heavy, meaning its cost is rising faster than inflation. Secondly, its population is growing relatively slowly compared with the rest of Australia. Finally, the territory’s Aboriginal population is decreasing as a proportion of the national Indigenous population, as more people in cities on the east coast have begun identifying as Indigenous in recent censuses.

These factors affect the territory’s relativities as calculated by the Commonwealth Grants Commission. The NT’s relativities have declined from 5.4% to 4.6% in the coming year. This means the NT received A$540 million less in its general purpose grant than if the 2010 relativities settings were still in place.

That will likely only get worse as the territory’s debt burden is expected to become intolerable within two decades.

South Australia

Rob Manwaring, Senior Lecturer, Politics and Public Policy, Flinders University

The twin focus of the 2018 budget was tax relief and a strong focus on support for older people.

This will have a mixed impact on South Australia. SA has a disproportionately older population compared with the rest of the country. In theory, the state should then benefit from a range of Scott Morrison’s measures to increase aged care places and support for in-home care.

The tax relief measures might also well offer some respite to residents, given concerns about cost-of-living prices.

Yet, the budget does little to directly tackle economic inequality in the state. SA has the highest youth unemployment in the nation. The lack of an increase to the state’s Newstart allowance will not help young people out of work. The treasurer also didn’t flag any specific measures to tackle other youth issues, including pathways into the housing market. Nor are there specific stimulus job measures, meaning any positive job growth effects might well take some time to kick in.

For Steven Marshall’s freshly minted Liberal government, however, there are opportunities in the budget, especially the 21st Century medical plan, which aligns well with his rejuvenation agenda to create medical precincts.

The government will also receive money to fund specific infrastructure measures, such as the North-South roads corridor. Whether this spending is proportionate to SA’s size and needs, however, remains unclear. The Marshall government will still likely need to be proactive to bring additional funding to the state for other infrastructure projects, such as solving traffic hot spots in Adelaide.

Tasmania

Maria Yanotti, Lecturer of Economics and Finance Tasmanian School of Business & Economics, University of Tasmania

Cuts to GST revenue and personal income tax will have the biggest impact for Tasmanians. Changes to the GST carve-up could deliver a A$29 million drop in state government revenue, which will restrict state expenditure as GST payments account for 40% of the state’s budget.

Conversely, the cut to personal income tax will mean more disposable income for many in Tasmania, where annual average earnings are A$53,357, but the median annual income is just A$29,796.

The measures to improve longer life choices for older Australians, as well as the fully funded roll-out of the National Disability Insurance Scheme, will also be welcomed in Tasmania. People aged 65 years and over represent almost 20% of the state’s population, the aged care residential services industry employs 2.8% of Tasmanians (relative to 2% of all Australians), and the health care and social assistance sector is the state’s biggest employer.

Investment in infrastructure, defence equipment, space industry, and research and development are arguably the way to go into the future. Most Tasmanians will support the Great Barrier Reef package and some will indirectly benefit from the Melbourne airport train link. However, the federal budget is again offering little that’s truly new for Tasmania, with most of the funding going to pre-existing commitments.

Investment in agricultural competitiveness and access to export markets, accompanied by cuts in business taxes and business support, will stimulate growth of businesses in an economy that receives a large share of Commonwealth income. Meanwhile, levelling the playing field for small business will benefit many emerging boutique businesses in the state.

Tasmania’s population, tourism industry, private businesses and economy have all been growing, which is always good for the incumbent government. Launceston and Hobart are progressing with “City Deals”, and the University of Tasmania is “transforming”. However, this progress has been accompanied by strong house price growth and housing pressure, while educational levels are still low.

Authors: Chris Salisbury, Research Associate, The University of Queensland

Read more http://theconversation.com/federal-budget-2018-a-state-by-state-spending-analysis-95928