A high price for policy failure: the ten-year story of spiralling electricity bills

- Written by David Blowers, Energy Fellow, Grattan Institute

Politicians are told never to waste a good crisis. Australia’s electricity sector is in crisis, or something close to it. The nation’s first-ever statewide blackout, in South Australia in September 2016, was followed by electricity shortages in several states last summer. More shortages are anticipated over coming summers.

But for most Australians, the most visible impact of this crisis has been their ever-increasing electricity bills. Electricity prices have become a political hot potato, and the blame game has been running unchecked for more than a year.

Read more: A year since the SA blackout, who’s winning the high-wattage power play?

Electricity retailers find fault with governments, and renewable energy advocates point the finger at the nasty old fossil-fuel generators. The right-wing commentariat blames renewables, while the federal government blames everyone but itself.

The truth is there is no silver bullet. No single factor or decision is responsible for the electricity prices we endure today. Rather, it is the confluence of many different policies and pressures at every step of the electricity supply chain.

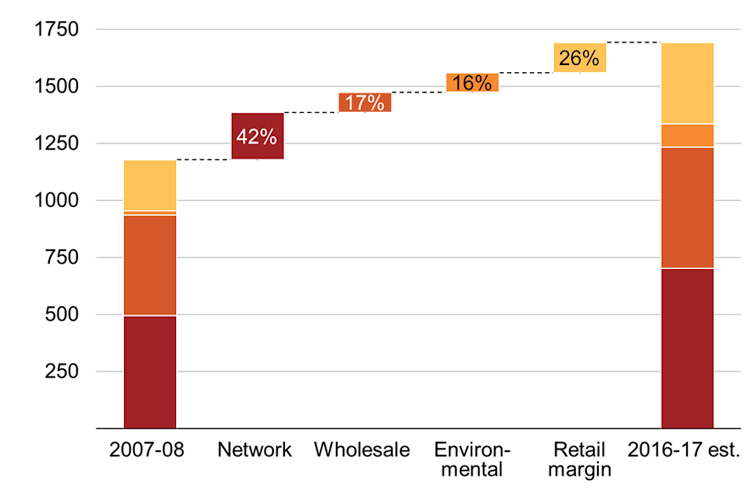

According to the Australian Competition and Consumer Commission (ACCC), retail customers in the National Electricity Market (which excludes Western Australia and the Northern Territory) now pay 44% more in real terms for electricity than we did ten years ago.

Four components make up your electricity bill. Each has contributed to this increase.

How your rising power bills stack up.

ACCC, Author provided

How your rising power bills stack up.

ACCC, Author provided

The biggest culprit has been the network component – the cost of transporting the electricity. Next comes the retail component – the cost of billing and servicing the customer. Then there is the wholesale component – the cost of generating the electricity. And finally, the government policy component – the cost of environmental schemes that we pay for through our electricity bills.

Each component has a different tale, told differently in every state. But ultimately, this is a story about a decade of policy failure.

Network news

Network costs form the biggest part of your electricity bill. Australia is a big country, and moving electricity around it is expensive. As the graph above shows, network costs have contributed 40% of the total price increase over the past decade.

The reason we now pay so much for the network is simply that we have built an awful lot more stuff over the past decade. It’s also because it was agreed – through the industry regulator – that network businesses could build more network infrastructure and that we all have to pay for it, regardless of whether it is really needed.

Network businesses are heavily regulated. Their costs, charges and profits all have to be ticked off. This is supposed to keep costs down and prevent consumers being charged too much.

That’s the theory. But the fact is costs have spiralled. Between 2005 and 2016 the total value of the National Electricity Market (NEM) distribution network increased from A$42 billion to A$72 billion – a whopping 70%. During that time there has been little change in the number of customers using the network or the amount of electricity they used. The result: every unit of electricity we consume costs much more than it used to.

There are several reasons for this expensive overbuild. First, forecasts of electricity demand were wrong – badly wrong. Instead of ever-increasing consumption, the amount of electricity we used started to decline in 2009. A whole lot of network infrastructure was built to meet demand that never eventuated.

Second, governments in New South Wales and Queensland imposed strict reliability settings – designed to avoid blackouts – on the networks in the mid-2000s. To meet these reliability settings, the network businesses had to spend a lot more money reinforcing their networks than they otherwise would have.

Third, the way in which network businesses are regulated encourages extra spending on infrastructure. In an industry where you are guaranteed a 10% return on investment, virtually risk-free – as network businesses were between 2009 and 2014 – you are inclined to build, build, build.

The blame for this “gold-plating” of network assets is spread widely. Governments have been accused of panicking and setting reliability standards too high. The regulator has copped its share for allowing businesses too much capital spend and too high a return. Privatisation has also been criticised, which is slightly bizarre given that the worst offenders have been state-owned businesses.

Retail rollercoaster

The second biggest increase in your bill has been the amount we pay for the services provided to us by retailers. Across the NEM, 26% of the price increase over the past decade has been due to retail margins.

This increase in the retail component was never supposed to happen. To understand why, you must go back to the rationale for opening the retail sector to competition. Back in the 1990s, it was felt that retail energy was ripe for competition, which would deliver lower prices and more innovative products for consumers.

In theory, where competition exists, firms seek to reduce their costs to maximise their profits, in turn allowing them to reduce prices so as to grab as many customers as possible. The more they cut their costs, the more they can cut prices. Theoretically, costs are minimised and profits are squeezed. If competition works as it’s supposed to, the retail component should go down, not up.

But the exact opposite has happened in the electricity sector. In Victoria, the state that in 2009 became the first to completely deregulate its retail electricity market, the retail component of the bill has contributed to 36% of the price increase over the past decade.

On average, Victorians pay almost A$400 a year to retailers, more than any other mainland state in the NEM. This is consistent with the Grattan Institute’s Price Shock report, which showed that rising profits are causing pain for Victorian electricity consumers. Many customers remain on expensive deals, and do not switch to cheaper offers because the market is so complicated. These “sticky” customers have been cited as the cause of “excessive” profits to retailers.

But the new figures provided by the ACCC, which come directly from retailers, paint a different picture. The ACCC finds that the increase in margins in Victoria is wholly down to the increasing costs of retailers doing business.

There are reasons why competition might drive prices up, not down. Retailers now spend money on marketing to recruit and retain customers. And the existence of multiple retailers leads to duplications in costs that would not exist if a single retailer ran the market.

But these increases should be offset by retailers finding savings elsewhere, and this doesn’t seem to have happened. History may judge the introduction of competition to the retail electricity market as an expensive mistake.

Generational problems

So far, we have accounted for 65% of the bill increase of the past decade, and neither renewables nor coal have been mentioned once. Nor were they ever likely to be. The actual generation of electricity has only ever formed a minor portion of your electricity bill – the ACCC report shows that in 2015-16 the wholesale component constituted only 22% of the typical bill.

In the past year, however, wholesale prices have really increased. In 2015-16, households paid on average A$341 a year for the generation of electricity – far less than they were paying in 2006-07. But in the past year, that is estimated to have increased to A$530 a year.

Generators, particularly in Queensland, have been engaging in questionable behaviour, but it is the fundamental change in the supply and demand balance that means higher prices are here to stay for at least the next few years.

The truth is the cost of generating electricity has been exceptionally low in most parts of Australia for most of the past two decades. When the NEM was created in 1998, there was arguably more generation capacity in the system than was needed to meet demand. And in economics, more supply than demand equals low prices.

Over the years our politicians have been particularly good at ensuring overcapacity in the system. Most of the investment in generation in the NEM since its creation has been driven by either taxpayers’ money, or government schemes and incentives – not by market forces. The result has been oversupply.

Up until the late 2000s the market kept chugging along. Then two things happened. First, consumers started using less electricity. And second, the Renewable Energy Target (RET) was ramped up, pushing more supply into the market.

Demand down and supply up meant even more oversupply, and continued low prices. But the combination of low prices and low demand put pressure on the finances of existing fossil fuel generators. Old generators were being asked to produce less electricity than before, for lower prices. Smaller power stations began to be mothballed or retired.

Something had to give, and it did when both Alinta and Engie decided it was no longer financially viable to keep their power stations running. Far from being oversupplied, the market is now struggling to meet demand on hot days when people use the most electricity. The result is very high prices.

A tight demand and supply balance with less coal-fired generation has meant that Australia increasingly relies on gas-fired generation, at a time when gas prices are astronomical, leading to accusations of price-gouging.

Put simply, Australia has failed to build enough new generation over recent years to reliably replace ageing coal plants when they leave the market.

Is it renewable energy’s fault that coal-fired power stations have closed? Yes, but this is what needs to happen if we are to reduce greenhouse emissions. Is it renewables’ fault that replacement generation has not been built? No. It’s the government’s fault for failing to provide the right environment for new investment.

The right investment climate is crucial.

Marcella Cheng/The Conversation, CC BY

The right investment climate is crucial.

Marcella Cheng/The Conversation, CC BY

The current predicament could have been avoided if we had a credible and comprehensive emissions reduction policy to drive investment in the sector. Such a policy would give investors the confidence to build generation with the knowledge about what carbon liabilities they may face in the future. But the carbon price was repealed in 2014 and replaced with nothing.

We’re still waiting for an alternative policy. We’re still waiting for enough generation capacity to be built. And we’re still paying sky-high wholesale prices for electricity.

Green and gold

Finally, we have the direct cost of government green schemes over the past decade: the RET; the household solar panel subsidies; and the energy-efficiency incentives for homes and businesses.

They represent 16% of the price increase over the past 10 years – but they are still only 6% of the average bill.

If the aim of these schemes has been to reduce emissions, they have not done a very good job. Rooftop solar panel subsidies have been expensive and inequitable. The RET is more effective as an industry subsidy than an emissions reduction or energy transition policy. And energy efficiency schemes have produced questionable results.

It hasn’t been a total waste of money, but far deeper emissions cuts could have been delivered if those funds had been channelled into a coherent policy.

_Read more: One day we won’t need a Renewable Energy Target, because we’ll have good climate policy

The story of Australia’s high electricity prices is not really one of private companies ripping off consumers. Nor is it a tale about the privatisation of an essential service. Rather, this is the story of a decade of policy drift and political failure.

Governments have been repeatedly warned about the need to tackle these problems, but have done very little.

Instead they have focused their energy on squabbling over climate policy. State governments have introduced inefficient schemes, scrapped them, and then introduced them again, while the federal government has discarded policies without even trying them.

There is a huge void where our sensible energy policy should be. Network overbuild and ballooning retailer margins both dwarf the impact of the carbon price, yet if you listen only to our politicians you’d be forgiven for thinking the opposite.

And still it goes on. The underlying causes of Australia’s electricity price headaches – the regulation of networks, ineffective retail market competition, and our barely coping generators – need immediate attention. But still the petty politicking prevails.

The Coalition has rejected the Clean Energy Target recommended by Chief Scientist Alan Finkel. Labor will give no guarantee of support for the government’s alternative policy, the National Energy Guarantee. Some politicians doubt the very idea that we need to act on climate change. Some states have given up on Canberra and are going it alone.

We’ve been here before and we know how this story ends. Crisis wasted.

Authors: David Blowers, Energy Fellow, Grattan Institute