As the Clean Energy Target fizzles, what might replace it?

- Written by Alan Pears, Senior Industry Fellow, RMIT University

Disclaimer: This article does not reflect my views about effective energy policy, which would ideally be comprehensive and deliver deep emissions reductions. Rather, this column explores what options might be attractive to our present prime minister and energy minister.

The energy melodrama continues to escalate. According to some interpretations, renewables are now so cheap that they don’t need any subsidy. Meanwhile, business concerns about energy policy uncertainty are reaching a crescendo, while voters see a government bumbling in the opposite direction to what much of the public actually wants.

Nevertheless, the existing Renewable Energy Target (RET) needs replacement, not least because it only runs until 2020 anyway. It is also too simple: it does not incentivise “dispatchable” renewable energy – that is, technologies that include energy storage to stabilise a grid that depends on intermittent renewables. To be fair, we need to remember that the current RET model was first proposed in 1997 and introduced by the Howard government, in a very different situation.

Read more: Coal and the Coalition: the policy knot that still won’t untie

So we do need a new energy target in some form. A well-designed target will decline in cost as competition and innovation do their work; it would be an effective policy tool to support emerging activities. We might think of it as a government endorsement that helps to focus both industry and consumers. Some degree of certainty is needed to underpin investment. And, as I explain later, a well-designed approach improves system reliability and stability.

So how does the government encourage reliable, affordable, cleanish electricity supply while also meeting its other apparent criteria of supporting coal and not boosting renewable energy “too much”? On top of that, how does it deal with high gas prices, which increase the cost of gas-fired generation? And support Snowy 2.0? It’s a wicked problem.

Read more: Baffled by baseload? Dumbfounded by dispatchables? Here’s a glossary of the energy debate

A dispatchable reliable energy target – a DRET – could be an attractive solution to a government in trouble. Superficially, it sounds like just a tweak of the popular RET. It mentions the right buzzwords. It could include incentives for “baseload coal”. It might even pass through the Senate.

Read more: Grattan on Friday: Turnbull close to finalising energy package but can he sell it?

The present Renewable Energy Target

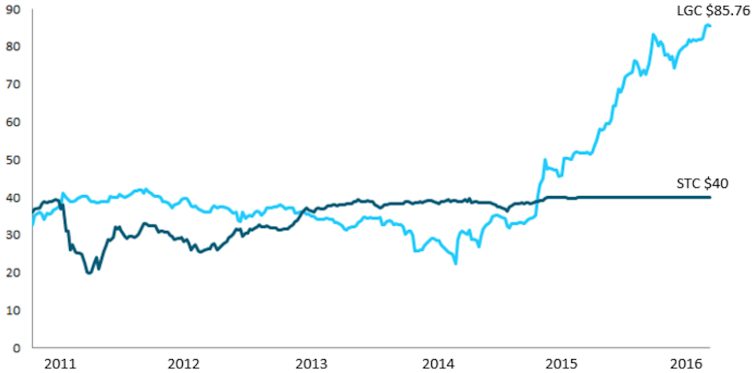

It’s worth noting that the present RET certificate price was trending down nicely towards zero – until the Abbott government tried to kill it off and investment collapsed. Renewable certificate prices (actually Large Generation Certificates, or LGCs) had fallen below A$30 due to competition. The Abbott government’s own review found that renewable energy was pushing down wholesale electricity prices by about as much as the cost of the certificates. The scheme was functioning effectively as a cheap net incentive for large-scale renewable energy.

Meanwhile, the price for Small Technology Certificates (STCs) that subsidise rooftop solar on voters’ homes has remained high, but has been politically untouchable.

The Large Generation Certificate price was trending down until investment stalled due to the uncertainty created by Abbott Government efforts to abolish the RET. Note: LGC=Large Generation Certificate STC=Small Technology Certificate.

Clean Energy Regulator

The Large Generation Certificate price was trending down until investment stalled due to the uncertainty created by Abbott Government efforts to abolish the RET. Note: LGC=Large Generation Certificate STC=Small Technology Certificate.

Clean Energy Regulator

DRET design options

Under a DRET, variable renewable energy projects would need to incorporate or partner with facilities that could store energy, stabilise voltage and frequency, and help restart after a blackout. As the present energy market provides weak signals for these, and they would cost extra, the rationale for a subsidy exists, even for coal-supporting MPs who want to be re-elected. So the subsidy would shift from the energy source, to the delivery of reliable supply.

It would make sense to include incentives for demand-side action, too, as reducing demand reduces pressure on the supply system and energy prices.

Another important question is how incentives can be delivered in ways that support efficient market operation. The present RET certificate approach sends a price signal, but leaves qualifying generators exposed to risk from varying wholesale electricity and certificate prices.

Alternatives such as reverse auctions linked to long-term contracts focus on competitive bidding as the “market” dimension of the subsidies. The successful bidders would also face market forces as they bid their output into the competitive wholesale market.

Reverse auctions potentially provide long term stability for service providers and consumers. These could be traditional Power Purchase Agreements, or the ACT government’s “contract for difference” approach. These approaches could be applied to energy efficiency measures and demand-side options.

Read more: The National Electricity Market has served its purpose – it’s time to move on

Extra features, such as local job creation and grid stabilisation, can be included in long-term contracts, as we have seen in state government programs in the ACT and, recently, Victoria.

An advantage of the reverse auction approach for a government is that it can be tweaked in response to changes in technologies, cost trends, demand and market rules, as we have seen with the Emission Reduction Fund.

Where to for coal?

As I look at the future of coal, I can’t help but be reminded of the famous comment by a Saudi sheikh in the 1970s: the stone age didn’t end because we ran out of stones.

In a DRET model, new coal plant proposals could bid like other generators. But they would confront their own challenges to provide comprehensive services and meet potential extra requirements built into auctions, such as employment in a wide range of sectors and across broad geographical areas.

Coal plant is not “fast response”, so it may also need storage to meet response requirements. Also, each coal generation unit is large, so a failure at a critical time might not meet dispatchability and reliability criteria without support from other generators, demand response, storage or other solutions.

The climate elephant

A DRET would not actively address climate policy: this exclusion seems to be necessary for any energy policy to survive the Coalition party room. However, it is still likely to help to cut emissions. Future auctions could incorporate a carbon intensity or other climate dimension. And it would provide some certainty for investors in energy solutions.

A DRET would operate in a complex environment, where state and local governments, businesses, communities and individuals, and even the Commonwealth government, will continue to act to achieve their own objectives, including climate response.

Authors: Alan Pears, Senior Industry Fellow, RMIT University

Read more http://theconversation.com/as-the-clean-energy-target-fizzles-what-might-replace-it-85598