The oil and gas sector needs to diversify if it wants to prosper

- Written by Jerad A. Ford, Manager - Strategic Advisory, CSIRO Futures, CSIRO

One does not have to look far to see signs that the oil and gas industry has a bumpy road ahead. Demand might stay high for decades, but given the dizzying pace of technological change, who would bet on that?

Take the recent pledges by India, France, Britain, and China to phase out petrol and diesel vehicles. Or the plummeting costs of grid-scale solar power, rapidly becoming cheaper than fossil-fuelled electricity.

These developments should cause oil and gas companies to think very carefully about their next move. Big investments in natural gas globally, made on the assumption that gas is a bridge to a clean energy future, may fall flat because renewables are developing so swiftly.

The fact of the matter is that oil and gas companies need to start planning for a low-carbon future and embrace the opportunities it presents. One approach is to diversify their products and embrace renewable energy, one of four strategies that CSIRO has identified in its industry-led Oil and Gas Roadmap that outlines some of the future directions the industry might take.

Read more: Big oil’s offshore scramble is risky business all round

With 40% of companies involved in the exploration and production of petroleum likely to move away from oil and gas in 2017, solar photovoltaics and energy storage offer alternative avenues in which oil and gas companies can invest.

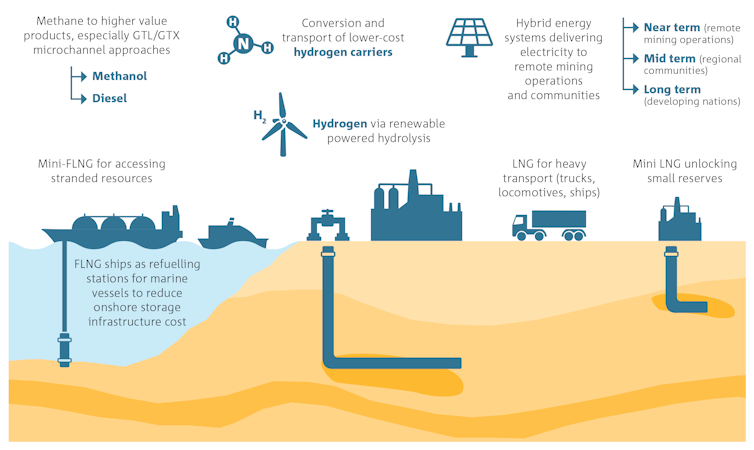

Renewables can be integrated into operations to reduce both the cost and the carbon intensity of operations. In the longer term, these technologies could help energy companies to develop more sophisticated offerings. For instance, hybrid solar and gas microgrids could be sold to developing nations, allowing them to leapfrog from energy poverty into clean, cheap distributed energy for all, effectively skipping expensive, centralised electricity grid infrastructure.

The Oil and Gas roadmap.Two more strategic opportunities focus on expanding the potential of the least carbon-intensive fossil fuel: natural gas.

For example, global demand for liquefied natural gas (LNG) for transport is expected to grow fourfold to 100 million tonnes a year by 2030, a prime target being maritime shipping. Meeting this LNG demand could open up a valuable market for Australia.

Another opportunity lies in the creation of higher-value products. Natural gas can be converted to many refined products that can fetch higher margins in the market, including diesel and other chemicals such as methanol and dimethyl ether.

More investment is needed to make conversion technology economically competitive, but it would be a wise investment, especially in light of Australia’s lack of domestic strategic fuel reserves.

Read more: Running on empty: Australia’s risky approach to oil supplies

Hydrogen fuel is another possibility for Australian resource companies. It can be produced from gas, but in the future hydrogen fuel could also be manufactured by solar-powered electrolysis of water. Both would be good options, given Australia’s abundance of gas and sunlight.

Investments will be needed to improve the production and transport economics of hydrogen, including the development of efficient technologies that can convert hydrogen carriers (like ammonia) to hydrogen at the point of use.

Smarter fuel options.

CSIRO, Author provided

Smarter fuel options.

CSIRO, Author provided

Our roadmap also suggests other ways for companies to get involved in the energy transition, by becoming more efficient, less wasteful, and more productive.

Advanced environmental solutions point to ways to improve water quality and reuse, reduce or eliminate greenhouse gas emissions (including sequestering carbon dioxide, controlling fugitive emissions, and finding alternatives to flaring), and finding the best ways to decommission assets like wells and offshore platforms after their useful life is over.

The industry needs to be much more efficient in exploring and producing oil and gas so that the life of existing assets can be lengthened, often using less environmentally damaging approaches such as waterless fracturing and reservoir rejuvenation using microbes. Robots and artificial intelligence could also help to improve efficiency and safety.

The oil and gas sector has an important role to play in the future of the energy sector, but that role is changing. Companies need to be proactive to remain relevant. If they pursue some of the opportunities outlined here, they will help ensure they stay viable into the future.

Authors: Jerad A. Ford, Manager - Strategic Advisory, CSIRO Futures, CSIRO

Read more http://theconversation.com/the-oil-and-gas-sector-needs-to-diversify-if-it-wants-to-prosper-85176