5 ways the Reserve Bank is going to bat for Australia like never before

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

The most important of the five measures the Reserve Bank announced on Tuesday is the one that won’t whirr into place for a very long time.

Others start immediately. On Thursday the bank will wade into the market and start buying up bonds issued by Australian governments.

It’ll buy Commonwealth government bonds with five to seven years left to run on Mondays, Commonwealth bonds with seven to ten years left to run on Thursdays, and bonds issued by state governments on Wednesdays.

It’ll spend about A$5 billion a week, every week for six months until it has unloaded $100 billion.

1. $5 billion per week, week in, week out

As before, when it did this on a more limited scale, it won’t be buying the bonds from the governments that issued them, but from third parties such as super funds and investment managers.

What’s (very) different is that it will be forcing a particular sum of money into their hands.

Its earlier bond buying program (which will continue) spent only as much as was needed to achieve an interest rate target.

The new program will spend a particular sum of created money (the Reserve Bank creates it out of nothing) every week for six months, whatever happens to rates.

Read more: The government has just sold $15 billion of 31-year bonds. But what actually is a bond?

It’ll be true “quantitative easing”, in that it’s the quantity of money that will matter, not the price.

Once in the hands of investors who would really rather own bonds, they’ll have to do something with it, such as investing in a business that employs people. That’s the theory.

As well, with bonds harder to find in Australia, fewer foreigners will move money here to buy them propping up the Australian dollar. That should allow the Australian dollar to fall, making local businesses more competitive against those from overseas. That’s the other part of the theory.

2. Cash rate near zero

And that’s just one of five measures Reserve Bank Governor Philip Lowe announced on Tuesday.

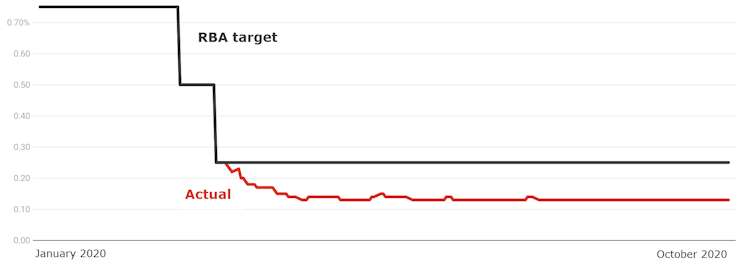

The once-watched cash rate which is the interest rate on unsecured overnight loans between banks, was cut to 0.25% in March amid hope that 0.25% was so low it wouldn’t need to be cut further.

Within days the actual cash rate at which banks transact business had fallen a good deal lower because, at 0.25%, many more of them wanted to lend than borrow.

Target cash rate versus actual

Reserve Bank of Australia

When it settled at about 0.14% the Reserve Bank didn’t bother to intervene to push it back up.

The new target of 0.10% will give banks almost no return for lending to each other and make borrowing from each other almost costless.

The separate rate for cash on deposit with the Reserve Bank will fall from 0.10% to as good as zero, 0.01%

Read more:

More than a rate cut: behind the Reserve Bank's three point plan

If the cuts were passed on in full to bank customers they would cut the standard variable mortgage rate from around 3.2% to 3%.

The rate on new mortgages would slide from 2.7% to 2.5%. The rates on customer’s deposits, already near zero, would fall further.

3. Bond rate to 0.10%

The Reserve Bank had been targeting a three-year bond rate of 0.25%, buying as many bonds as were needed to keep it there. It’ll cut that target to 0.10% in line with its cut in the cash rate, buying as many bonds as are needed to get and keep the rate at 0.10%.

Three-year bonds are used to fund fixed three-year mortgages and personal and business loans. All will become even cheaper.

This bond-buying program, which will target the rate, is completely separate from, and additional to, the $5 billion per week the bank will spend buying longer-term bonds week in, week out.

4. Near-free loans to banks

Since March the government has been advancing money to private banks for three years for just 0.25%.

The more they expand their lending to business (and especially to small and medium sized business) the more it will it will advance them in accordance with a formula.

The formula won’t change but the rate will. From Thursday new loans under the program will be offered to banks for just 0.10%.

5. A commitment with teeth

Until now, the bank has been fuzzy about the circumstances in which it will eventually change course and start pushing rates back up.

Its commitment was weaker than it sounded

the board will not increase the cash rate target until progress is being made towards full employment and it is confident that inflation will be sustainably within the 2–3 per cent target band

Whether or not “progress is being made” is subjective.

The commitment allowed the bank to assert that progress was being made and reverse course at its convenience.

Whether or not the bank was “confident” that inflation would be sustainably within its target band was even more subjective.

One word, big change

Reserve Bank of Australia

When it settled at about 0.14% the Reserve Bank didn’t bother to intervene to push it back up.

The new target of 0.10% will give banks almost no return for lending to each other and make borrowing from each other almost costless.

The separate rate for cash on deposit with the Reserve Bank will fall from 0.10% to as good as zero, 0.01%

Read more:

More than a rate cut: behind the Reserve Bank's three point plan

If the cuts were passed on in full to bank customers they would cut the standard variable mortgage rate from around 3.2% to 3%.

The rate on new mortgages would slide from 2.7% to 2.5%. The rates on customer’s deposits, already near zero, would fall further.

3. Bond rate to 0.10%

The Reserve Bank had been targeting a three-year bond rate of 0.25%, buying as many bonds as were needed to keep it there. It’ll cut that target to 0.10% in line with its cut in the cash rate, buying as many bonds as are needed to get and keep the rate at 0.10%.

Three-year bonds are used to fund fixed three-year mortgages and personal and business loans. All will become even cheaper.

This bond-buying program, which will target the rate, is completely separate from, and additional to, the $5 billion per week the bank will spend buying longer-term bonds week in, week out.

4. Near-free loans to banks

Since March the government has been advancing money to private banks for three years for just 0.25%.

The more they expand their lending to business (and especially to small and medium sized business) the more it will it will advance them in accordance with a formula.

The formula won’t change but the rate will. From Thursday new loans under the program will be offered to banks for just 0.10%.

5. A commitment with teeth

Until now, the bank has been fuzzy about the circumstances in which it will eventually change course and start pushing rates back up.

Its commitment was weaker than it sounded

the board will not increase the cash rate target until progress is being made towards full employment and it is confident that inflation will be sustainably within the 2–3 per cent target band

Whether or not “progress is being made” is subjective.

The commitment allowed the bank to assert that progress was being made and reverse course at its convenience.

Whether or not the bank was “confident” that inflation would be sustainably within its target band was even more subjective.

One word, big change

Reserve Bank Governor Lowe on Tuesday.

On Tuesday, Governor Philip Lowe ditched the fuzziness and replaced it with something measurable.

The board will not increase the cash rate until “actual inflation” is sustainably within the 2% to 3% target range.

“For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labour market.”

So prepared is the bank to bat for Australia that it won’t stop until there’s a “tight labour market”.

And it has used the word “actual”.

No longer will the bank need to merely see “progress towards” an inflation rate of 2% to 3%. It will have to be faced with an “actual” inflation rate of 2% to 3%.

Low rates for a long, long time

Australia’s inflation rate hasn’t been sustainably between 2% and 3% for more than half a decade, and it is likely to be at least that long again until it gets back there, if ever.

Governor Lowe said the bank’s forecasts, to be published this Friday, will put the inflation rate at 1%. It’ll put wage growth at the lowest on record, less than 2%.

By tying the future of the cash rate to an actual inflation rate rather than a feeling about the inflation rate, Governor Lowe is tying the bank to a cash rate of close to zero for as far anyone can see.

It means that not only will it be as cheap as it has ever been to borrow (for a mortgage, a business, for anything) it means there’s no risk of that suddenly changing because the bank gets rush of blood to the head.

It’s about the future, but it matters now.

Reserve Bank Governor Lowe on Tuesday.

On Tuesday, Governor Philip Lowe ditched the fuzziness and replaced it with something measurable.

The board will not increase the cash rate until “actual inflation” is sustainably within the 2% to 3% target range.

“For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labour market.”

So prepared is the bank to bat for Australia that it won’t stop until there’s a “tight labour market”.

And it has used the word “actual”.

No longer will the bank need to merely see “progress towards” an inflation rate of 2% to 3%. It will have to be faced with an “actual” inflation rate of 2% to 3%.

Low rates for a long, long time

Australia’s inflation rate hasn’t been sustainably between 2% and 3% for more than half a decade, and it is likely to be at least that long again until it gets back there, if ever.

Governor Lowe said the bank’s forecasts, to be published this Friday, will put the inflation rate at 1%. It’ll put wage growth at the lowest on record, less than 2%.

By tying the future of the cash rate to an actual inflation rate rather than a feeling about the inflation rate, Governor Lowe is tying the bank to a cash rate of close to zero for as far anyone can see.

It means that not only will it be as cheap as it has ever been to borrow (for a mortgage, a business, for anything) it means there’s no risk of that suddenly changing because the bank gets rush of blood to the head.

It’s about the future, but it matters now.

Authors: Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University