What we know suggests the economic impact of Wuhan coronavirus will be limited

- Written by Mark Humphery-Jenner, Associate Professor of Finance, UNSW

The Wuhan coronavirus has had a significant human toll. More than 100 people have died and nearly 3,000 are known to be infected, including some in Australia. The number actually infected will be higher. People experiencing only mild symptoms often don’t report them.

The economic cost is as hard to tease out as the health cost, but there are clues.

They suggest the coronavirus will have little impact on the global economy, quite a bit in China, and some in Australia, which will most likely be short-lived.

Confirmed cases of Wuhan coronavirus

Data included until January 27th 2019.

The Conversation

Data included until January 27th 2019.

The Conversation

China is bearing the immediate brunt

The impact in China is already apparent, with 35 million people under effective lockdown, air travel curtailed, and some tourist destinations closed. In a sign the virus might spread, five million people reportedly left Wuhan before the lockdown.

The Shenzhen and Shanghai composite stock market indexes fell 3.52% and 2.75% before they closed for what turned out to be an extended Lunar New Year break.

While China’s steps to contain the coronavirus will hurt its economy in the short term, in longer term they might contain the damage.

Previous pandemics suggest scale

The world has changed significantly since the the Spanish Flu pandemic of 1918, the Asian Flu pandemic of 1957-58 and even the Severe Acute Respiratory Syndrome (SARS) pandemic of 2001-02.

On one hand the world has become better at containment and treatment; on the other, it has become more connected. But previous pandemics can tell us a lot.

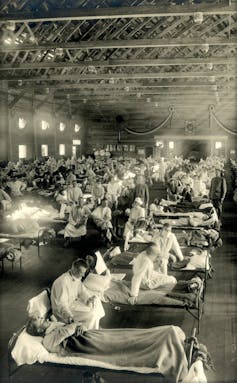

Emergency hospital during 1918 epidemic, Camp Funston, Kansas.

Otis Archives, National Museum of Health and Medicine

Emergency hospital during 1918 epidemic, Camp Funston, Kansas.

Otis Archives, National Museum of Health and Medicine

1918 Spanish Flu: According to the US Centers for Disease Control and Prevention, the Spanish Flu hit 500 million people worldwide, killing as many as 50 million worldwide, including 675,000 in the United States.

The US Congressional Budget Office believes such an event in 2006 would have cut US gross domestic product 4.25% below where it would have been.

World Bank calculations suggest a severe pandemic, killing 71 million people, would cut world GDP by about 5%.

1957-58 Asian Flu Pandemic: The 1957-58 pandemic killed about 1.1 million people worldwide. A follow-up 1968 pandemic had a similar effect.

The Congressional Budget Office believes a recurrence would cut United States GDP to about 1% below where it would have been. Similar countries would be affected in a similar way. The World Bank believes such a scenario would cut world GDP by between 1% and 2%.

2001-02 SARS pandemic: According to the US CDC, SARS infected around 8,100 people, with 774 dying, which was a 9.4% mortality rate. Its economic impact is open to debate. SARS mainly affected mainland China and Hong Kong, with one study estimating it cut their GDPs by 1.1% and 2.6%.

Read more: Should we be worried about the new Wuhan coronavirus?

But because the event coincided with the recovery from a global recession, the effect is hard to estimate. Other estimates are less pessimistic.

The economic impact was limited, with little impact outside of China and Hong Kong, as Australia’s Treasury noted at the time.

This one should be smaller

Here’s what we know.

It’s not yet severe. Fewer than 100 people have died so far. The mortality rate is just under 3%. China has moved aggressively to contain the virus meaning it should have have less impact on gross domestic product than earlier pandemics.

There’s been minimal global impact. There have been few cases outside China. The countries with few if any reported cases are likely to suffer little impact, as correctly predicted by a Treasury discussion paper on the impact of SARS.

China and Hong Kong are the worst hit. The impact is likely be less than SARS because the coronavirus is less severe, because of China’s forthright containment efforts and because the outbreak has coincided with the Lunar New Year break. However, the aggressive steps taken to contain the virus might have a significant short term impact. Travel has declined significantly. Tourist attractions, such as Disneyland in China have closed. Wuhan is likely to see a significant economic decline.

The impact should be short-lived. With SARS, the economies of both China and the rest of the world rebounded shortly afterwards. To some extent, this coincided with the world emerging from an economic downturn. But other estimates suggest that even the impact of the severe 1918 pandemic was short-lived.

Different industries will be impacted differently. In impacted regions, tourism and consumer spending are likely to be the most significantly hit, as was the case in 1918. China has already suffered a significant reduction in travel expenditure. Other industries, including medical industries, will experience positive impacts. But given that the coronavirus is relatively contained, the impact is unlikely to spread those industries in other countries.

Taken together these points suggest the coronavirus is unlikely to significantly affect the world economy.

Based on what we know so far, the impact on China is likely to be short-lived.

Read more: Are you in danger of catching the coronavirus? 5 questions answered

The flow-on effect to countries with a relationship with China such as Australia is likely to modest and and also short-lived.

Should infection or mortality rates spike, the impact could worsen.

Authors: Mark Humphery-Jenner, Associate Professor of Finance, UNSW