Leading Brokerage Moomoo Offers CHESS-sponsored Trades to Australian Investors

- Written by PR Newswire Asia - Daily Bulletin Au RSS

|

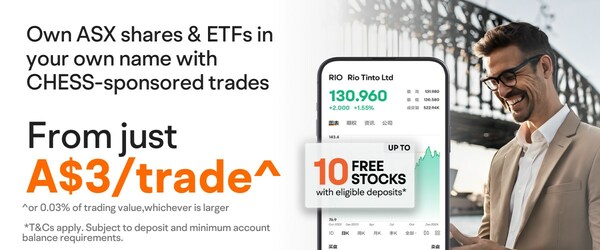

SYDNEY, April 9, 2024 /PRNewswire/ -- Nasdaq listed brokerage moomoo announced that CHESS-sponsored trades will be available on its platform starting from 8th April, as a reinforcement of its commitment to improving the trading experience and investor protection for Australian clients. Moomoo now offers seamless access to the CHESS-sponsored Australian Securities Exchange (ASX) shares with trading fees as little as AUD $3 per trade.

The Clearing House Electronic Subregister System (CHESS) is a computer system utilised by the ASX to keep records of shareholdings and manage the settlement of share transactions. Trading through a CHESS-sponsored broker like moomoo enables investors to own and access the ASX shares directly, which also provides greater flexibility for investors to switch between brokers while keeping their holdings unaffected.

In conjunction with the existing security measures that moomoo has already put in place, including holding client funds with HSBC Bank Australia to fully segregate from moomoo's own fund, and insuring clients' US assets by SIPC for up to $500,000 in securities and $250,000 in uninvested cash, the CHESS-sponsored model also added an extra layer of security for client assets.

Starting from 8th April, CHESS sponsorship will automatically apply to all new moomoo trading accounts in Australia, and all new clients will be assigned a unique Holder Identification Number (HIN), which simplifies the process of buying, selling and transferring ASX stocks.

With a HIN, investors can manage their share portfolios across different brokers more efficiently. The streamlined transfer process also allows for easier switching between brokers, significantly reducing paperwork and administrative hassles.

By consolidating their holdings under the same HIN, moomoo users in Australia gain the advantage of leveraging more competitive prices and diverse product offerings on the platform. Moomoo will also enable its current clients to switch to CHESS-sponsored accounts upon request.

Trade with a value-first broker

Moomoo currently provides Australian investors with a comprehensive range of investment options, granting them one-stop access to over 22,000 shares and ETFs across Australia, US and Hong Kong markets, which helps investors build a diversified portfolio to better capture investment opportunities worldwide.

As a value-first broker in Australia, moomoo stands out for its highly competitive rates and fees. By offering Aussies incredible low trading fees, moomoo charges a flat fee of only USD $0.99 per trade* for trading US stocks and ETFs, and as low as AUD $3** per trade for trading Australian stocks and ETFs. This commitment to affordability positions moomoo as an ideal choice for all investors seeking exceptional value-for-money brokerage services.

To cater to the diverse needs of investors across all trading levels, moomoo empowers Australian users with free access to a wide array of professional-level features. These include a comprehensive suite of over 100 technical indicators and a variety of patented charting tools, enabling investors to make informed decisions based on advanced market analysis.

Additionally, moomoo's exclusive AI-powered capabilities, such as trend projection, indicator sentiment, and candlestick pattern recognition, provide users with valuable insights into their investment strategies. Moomoo also offers users access to round-the-clock global news and reports from reputable sources like Bloomberg and Dow Jones, which ensures investors can stay ahead of the market trends to make timely and well-informed decisions.

In addition to accessing Level 2 quotes for US stocks for free, global users can enjoy an exclusive free trial of Nasdaq TotalView, a standard data feed that displays the full order book depth on Nasdaq between 1st May and 31st July. New users can sign up for the TotalView free trial here.

To support beginners in their investment journey, moomoo offers over 740 free investment courses that can be customized to meet individual learning needs. The moomoo community, which brings together over 21 million global investors, serves as a platform to facilitate the exchange of ideas and experiences.

In Australia, moomoo has awarded as the Best Investment Platform for Beginners for the second consecutive years by financial wellness platforms WeMoney, and named Online Broker Rising Star Gold Winner by Money Magazine. These accolades reflect moomoo's commitment to revolutionizing the trading landscape and empowering investors of all levels.

*Other pass-through fees and FX costs are not included.**Moomoo may charge $3 per trade or 0.03% of the transaction value, whichever is greater.

About moomoo

Based in Sydney, NSW, Australia, Futu Securities (Australia) Ltd is an indirect and wholly owned subsidiary of Futu Holdings Ltd, an advanced technology company transforming the investing experience by offering a fully digitized brokerage and wealth management platform. Futu Holdings Ltd was ranked second in Fortune magazine's Fortune 100 list in 2022.

Moomoo's mission is to provide all investors with an intuitive and powerful investing platform, built with proprietary technology. We leverage our deep technological R&D capabilities and future-focused operating model to constantly improve our clients' experience and drive industry-wide innovation.

Securities services available on the moomoo App are offered by but not limited to the following brokerage firms: Futu Securities (Australia) Ltd regulated by the Australian Securities and Investments Commission (ASIC); Moomoo Financial Inc. regulated by the U.S. Securities and Exchange Commission (SEC), Moomoo Financial Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS), and Futu Securities International (Hong Kong) Ltd. regulated by the Securities and Futures Commission of Hong Kong (SFC).

Moomoo Financial Inc. is a member of the U.S. Securities Investor Protection Corporation (SIPC). The SIPC provides limited protection over an investor's U.S. securities and cash when a member brokerage firm is to be liquidated. SIPC does not protect against losses due to market volatility.

Authors: PR Newswire Asia - Daily Bulletin Au RSS

Read more https://www.prnasia.com/story/archive/4382919_AE82919_0