Escrow.com launches in Australia

- Written by Leon Spencer

Escrow.com, the world’s most secure payment system for cars, boats, aeroplanes, domains or anything of value, launches in Australia, introducing Australian Dollar capability for online escrow payments

Escrow.com, the leading provider of secure online payments and online transaction management for consumers and businesses on the Internet, has launched Australian Dollar capability to its escrow service, offering a safe and secure sale for local both buyers and sellers transacting big-ticket items.

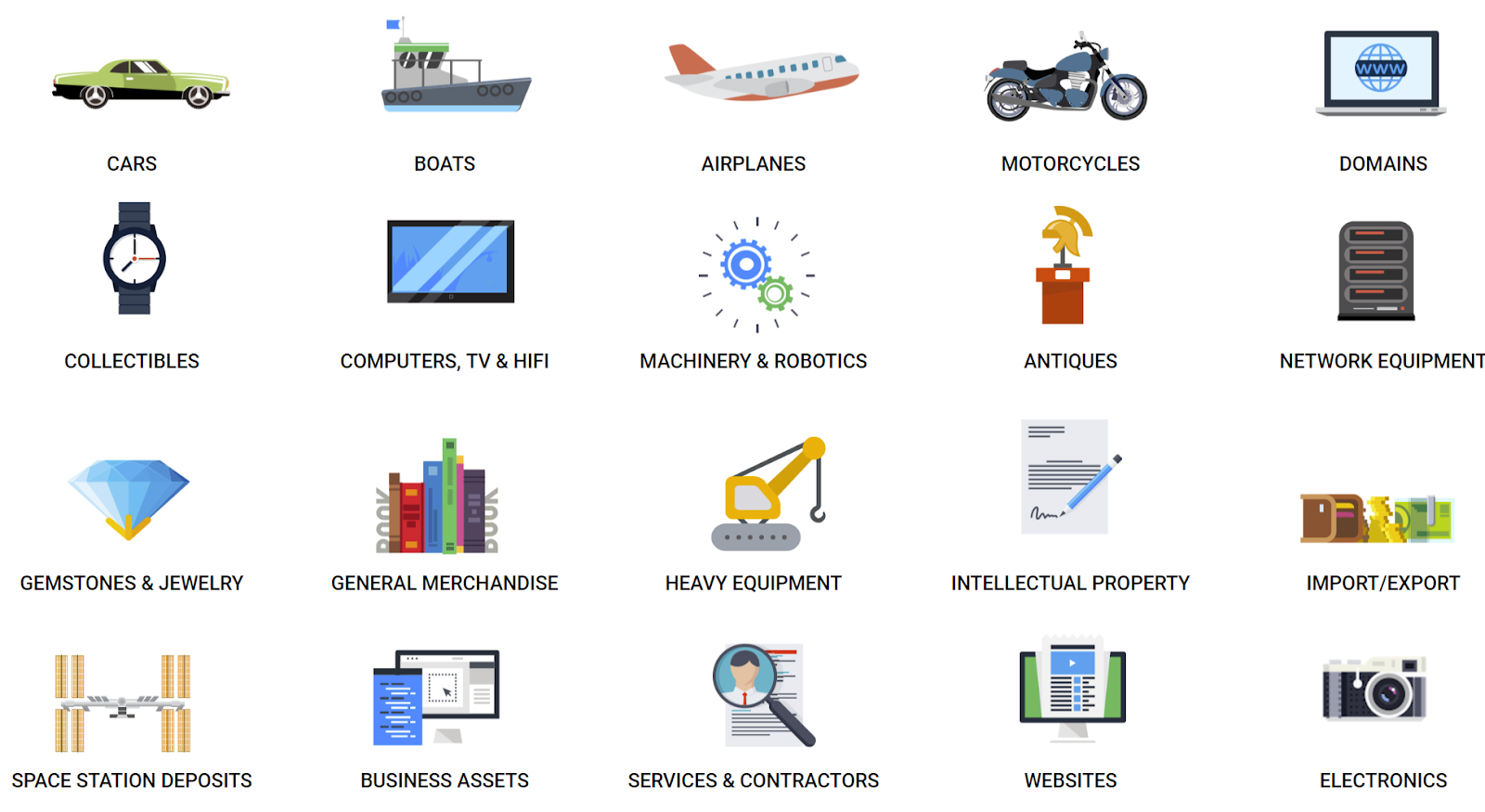

Escrow.com can be used for secure transactions involving any item of value, including domain names, vehicles, machinery, aircraft, space station hotel deposits or anything that a business or an individual might want to buy or sell safely online.

Escrow.com, which has safely processed over US$3.5 billion in transactions with its secure escrow service, acts as a trusted third-party that collects, holds and only disburses funds when both a buyer and a seller are satisfied with a transaction. It is ideal for transaction sizes from $100 to $10,000,000 or more.

Now, for the first time, merchants and online marketplaces in Australia have the ability to tap into the security and power of Escrow.com, ensuring safe transactions for buyers and no chargebacks, ever, for sellers.

“Escrow.com has already made a name for itself in other markets, delivering unprecedented safety and security for online transactions, thanks to the escrow process, which sees funds kept in trust until all involved parties are satisfied with the deal,” said Escrow.com General Manager Jackson Elsegood. “With the launch of Australian Dollar capability, buyers and sellers in Australia can now make the most of what this escrow process has to offer.”

Escrow.com’s Australian Dollar launch comes just weeks after the launch of Escrow Offer, the easiest way to introduce the power of price negotiation into online platforms. This followed the release of Escrow Pay, which lets businesses integrate the protection provided by the powerful Escrow.com API directly into their websites, mobile apps and online marketplaces.

About Escrow.com

Escrow.com is the leading provider of secure online payments and online transaction management for consumers and businesses on the Internet, having safely processed over US$3.5 billion in transactions. Founded by Fidelity in 1999, Escrow.com reduces the risk of fraud by acting as a trusted third party that collects, holds and disburses funds according to buyer and seller instructions.

Escrow.com is also the winner of the 2017 BBB Torch Award for Ethics for Silicon Valley, San Francisco and the Bay Area, an award presented to a business that goes above and beyond in their business dealings with customers, other businesses and the community.

Escrow.com is a subsidiary of eleven-time Webby Award winning Freelancer.com, the world’s largest freelancing and crowdsourcing marketplace by number of users and jobs posted. Freelancer Limited is listed on the Australian Securities Exchange under the ticker ASX:FLN