Reliable Castors for Sale in Melbourne – All Types Available

- Written by Daily Bulletin

When you need to move something heavy like a trolley, chair, or toolbox, you probably don’t think twice about the wheels underneath. But those little wheels, called castors, do all the hard work. They make life easier in homes, offices, hospitals, and warehouses by helping things roll smoothly.

If you're looking for castors in Melbourne, there are many types to choose from depending on what you need. From heavy industrial trolleys to light office chairs, castors come in many shapes, sizes, and materials. Castor Master offers one of the most complete selections of castors in Melbourne, with durable and reliable options for all types of industries.

What Are Castors and Why Do They Matter?

Castors are small wheels attached to the bottom of things like chairs, tables, or carts. They let you move heavy stuff without breaking your back. Think about a shopping cart at the supermarket – those wheels are castors, making it easy to push your groceries around. In Melbourne, businesses and homes use castors for all sorts of things, from office chairs to hospital beds and even big machines in warehouses.

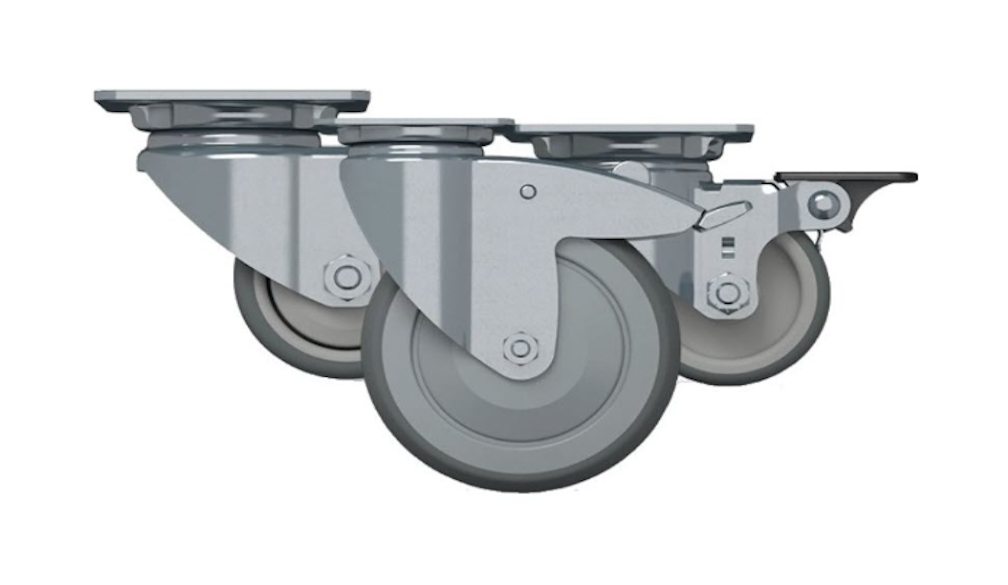

Castors come in different types, like swivel castors that spin in any direction or fixed castors that only roll straight. Some have brakes to lock them in place, which is great for safety. Choosing the right castor depends on what you’re moving, how heavy it is, and where it’s going. That’s why finding quality castors in Melbourne is so important – they need to be tough and work well for a long time.

Types of Castors

At CastorMaster, we have a huge range of castors for every job. Here’s a quick look at some popular types you can find in Melbourne:

1. Swivel Castors

Swivel castors are super flexible because they can turn 360 degrees. They’re perfect for things like office chairs or trolleys that need to move in tight spaces. For example, if you’re pushing a cart through a busy Melbourne café, swivel castors make it easy to dodge tables and chairs.

2. Fixed Castors

Fixed castors only move in one direction – forward or backward. They’re great for things that need to stay on a straight path, like heavy equipment in a factory. If you’re moving big boxes in a Melbourne warehouse, fixed castors keep everything steady.

3. Heavy-Duty Castors

Need to move something really heavy, like a big machine? Heavy-duty castors are built to handle tons of weight. They’re used in places like construction sites or manufacturing plants around Melbourne. These castors are made from strong materials like steel to last a long time.

4. Furniture Castors

Furniture castors are smaller and often used on things like sofas, beds, or cabinets. They’re great for home projects or small businesses in Melbourne, like a boutique shop that needs to rearrange displays easily.

5. Medical Castors

Hospitals and clinics in Melbourne use special castors for beds, stretchers, and medical carts. These are designed to be quiet, smooth, and easy to clean, keeping patients safe and comfortable.

No matter what you need, CastorMaster has the right castors in Melbourne for you. Visit CastorMaster to check out our full range!

Why Choose Castors from CastorMaster in Melbourne?

Melbourne is a busy city with lots of businesses, homes, and industries that need reliable castors. Here’s why CastorMaster is the go-to place for castors in Melbourne:

- Top Quality: Our castors are made from strong materials like steel, rubber, and polyurethane. They’re built to last, even with heavy use.

- Huge Variety: From tiny furniture castors to giant industrial ones, we have every type you could need.

- Local Expertise: We know Melbourne’s needs, whether it’s for a small shop in Fitzroy or a big factory in Dandenong.

- Great Prices: You don’t have to spend a fortune to get quality castors. We offer affordable options for everyone.

- Fast Delivery: Need castors quickly? We deliver fast across Melbourne, so you can get moving sooner.

How to Choose the Right Castors in Melbourne

Picking the right castors can feel tricky, but it’s easier when you know what to look for. Here are some tips to help you choose the best castors in Melbourne:

1. Check the Weight

How heavy is the thing you’re moving? Every caster has a weight limit, called its load capacity. For example, a small chair might need castors that hold 50 kilograms, while a heavy machine might need ones that can handle 500 kilograms. Always choose castors that can support more weight than you need, just to be safe.

2. Think About the Floor

What kind of floor do you have? Hardwood floors in a Melbourne home need soft castors, like rubber or polyurethane, to avoid scratches. For rough concrete floors in a warehouse, go for tougher materials like steel or nylon.

3. Swivel or Fixed?

Do you need to turn corners easily, or just move in a straight line? Swivel castors are great for flexibility, while fixed castors are better for stability. Some jobs might need a mix of both!

4. Brakes or No Brakes?

If you want your item to stay put, get castors with brakes. This is super important for things like hospital beds or office chairs, so they don’t roll away by accident.

5. Ask for Help

Not sure what to pick? The team at CastorMaster is here to help. We know all about castors and can recommend the best ones for your needs in Melbourne.

Where to Use Castors in Melbourne

Castors are used all over Melbourne, from homes to huge businesses. Here are some examples:

- Homes: Move furniture like beds, desks, or cabinets easily. Perfect for rearranging your room in a Melbourne apartment.

- Offices: Roll chairs and desks around in places like Southbank’s office buildings.

- Warehouses: Move heavy boxes and equipment in industrial areas like Port Melbourne.

- Shops: Rearrange displays in retail stores in Chadstone or Melbourne Central.

- Hospitals: Keep medical equipment moving smoothly in hospitals like the Royal Melbourne Hospital.

No matter where you are in Melbourne, castors make life easier. Check out CastorMaster for the best options.

Why Quality Castors Save You Money

You might think all castors are the same, but cheap ones can break quickly. That means spending more money to replace them and maybe even damaging your floors or equipment. High-quality castors from CastorMaster are built to last, saving you money in the long run. Plus, they make moving things safer and easier, which is a big win!